The Johannesburg Stock Exchange is the largest in South Africa and Africa overall, featuring more than 66,500 shares that can be traded.

The actual process involved with buying shares in South Africa is simple once you get started but there are some steps you have to take before you can press the ‘buy’ button or make your first investment. We will guide you through the process of how to buy shares in South Africa, and all you will need to do before you can get access to the markets.

What are Shares?

A share is a percentage of ownership that an investor buys when they purchase the shares of a given company. Companies in South Africa issue shares to raise capital from investors.

Owners of shares are referred to as shareholders and ownership is determined by the percentage or number of shares that a person holds, providing them with voting rights and dividends, depending on the type of shares that they hold.

How to Buy Shares in South Africa

Buying stocks listed on the Johannesburg Stock Exchange (JSE) requires using a broker. It’s impossible to buy directly from the exchange, but it is possible to find a broker who will do that for you.

The good news is that the buzz of excitement about South African stocks means a range of reputable brokers provide ways to access the market. Technological breakthroughs mean that big-name online platforms offer execution only services and user-friendly functionality.

Ultimately the act of buying South African shares comes down to a click of a mouse or a tap on a screen, as trading can be done from handheld as well as desktop devices. Before getting to that stage, there are some ‘onboarding’ processes to work through and insider tips relating to client safety to consider. You will want to know about risk, portfolio management, position sizing, have an investment strategy, and understand what your tax liabilities may be. Once you are comfortable with the basics, you can move on.

It is also essential to factor in the two principal risks, which, while unavoidable, can be managed.

Market Risk

Market risk is the chance that your South Africa stock purchase might be a bad choice. This is, unfortunately, an inherent part of investing. Good brokers offer tools to help manage this risk and help clients tilt the risk-return equation in their favour.

Operational Risk

There is a lot more scope for individuals to manage their accounts in a way that helps them avoid scams or making newbie errors. One way to get to grips with the process is to set up a Demo account. They are free to use and take moments to set up. Once done, it’s possible to practise risk-free trading using virtual funds to establish which broker would best suit your needs.

Once you have assessed the entry risks, you can buy shares in South Africa by following the three steps below. The first two are preliminary steps to getting the right platform and stocks, step three is the actual process of buying and selling South African shares.

Step 1: Find suitable shares to buy

It is not advised that shares be selected at random. It requires in-depth research to determine which JSE shares are the best investment option at the given time that you wish to enter the stock market.

You cannot buy shares directly from the JSE and it must be done through a well-regulated stockbroker or through your bank, who will buy the shares on your behalf.

However, before you explore these options, the important thing to do is to gain adequate knowledge of the stock market and the process involved with trading shares on the JSE.

Education

You can learn more about share investment by:

- Reading books, guidelines, and tutorials.

- Watching various YouTube videos that give a visual explanation.

- Consulting with a Professional and gaining investment advice to direct your investment decisions.

- Attending webinars, seminars, and other forms of lessons and courses.

- Taking a detailed look at our investing educational area here on Asktraders.

Share Selection

To determine which shares would suit your profile, you need to understand your risk appetite and what you are willing to risk in comparison with your budget. There are many penny stocks on the JSE that sell for R1, and less, which may look like a good starting point while you are learning how the stock market works. There are a lot more risks with penny stocks than you will find with blue chips, so do not less the price of the stock dictate your plan.

However, if you want to start building a portfolio of shares, you will need to invest a minimum of R5,000 to make an investment worth your while, and to cover a couple of companies minimum.

The next step involves exploring your options on the JSE by researching the performance of the companies that are listed.

When deciding, pay attention to the P/E ratio, Earnings per share (EPS), Price to sales ratio, and the dividend yield of the company. These figures give you an idea of that real value of the company, and allows you to benefit from the capital growth of the company when it performs well.

Step 2: Find a Stock Broker, Trading Platform, or App

As previously mentioned, you will need the services of a stockbroker to facilitate your trades in the JSE. Many reputable brokers in South Africa have corresponding regulations with the Financial Sector Conduct Authority (FSCA), which is the market regulator in the country, previously FSB.

Fortunately, financial authorities such as the FSCA make it their duty to regulate the financial markets. The FSCA, previously known as the Financial Services Board (FSB), aims to ensure the fair and efficient operation of financial markets. The licenses of approval it provides for high-quality firms can only be attained by the broker completing a range of costly and time-consuming tasks. These include providing reports on the health of the company and client care protocols.

Regulation importance for safety and security of funds

South African investors are not obligated to use an FSCA regulated broker, if an alternative trusted platform is available that provides a broader selection for example. Some international brokers operate under licence from other regulators, and a seal of approval from a Tier-1 regulator such as those listed below will confirm the broker is legitimate.

- The Financial Services Conduct Authority of South Africa (FSCA)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The U.S. Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

Different brokers will have different specialities and offers. Therefore, you need to determine what your unique trading needs and objectives are so that you can choose a stockbroker that can help you achieve this.

Regulatory protection is essential, but if two brokers offer the same degree of security, choosing between them will come down to other factors. The trading dashboards provided by online brokers have a different ‘feel’ from each other. The quality of the mobile phone App platform might also be important, and then there are the T&Cs. Competition between brokers has driven down the cost of trading, but it’s worth checking the small print to ensure you’re not giving money away unnecessarily.

Other criteria to consider

Some considerations when you choose a broker include the following:

- Regulation

- The type of trading accounts

- The provision of a demo or paper trading account to practice trading

- The trading platform offered

- The number of shares offered

- The trade execution speed and liquidity of the broker

- The deposit and withdrawal methods

- The costs and fees (trading and non-trading)

- The customer support offered

- Educational resources and research tools

Once you have chosen a stockbroker and you have registered a demo account with them, create a diversified portfolio of shares that you want to purchase.

Diversification is a very important strategy that ensures that your risks are spread across several industries. If one underperforms, it can be offset by the others that perform well.

Once you feel comfortable with your trading strategy and you have more knowledge of the markets, you can register a live trading account with your broker to start purchasing shares with real money.

Step 3: How to buy stocks – the process of executing orders

The steps to buy stocks include opening and funding an account from which to buy, open an order ticket (plus set your position size), set your stops and take profits, then press ‘buy’. After this, it is a case of monitoring your account, and repetition if you wish to buy or sell anything more.

3.1 – Open and Fund an Account

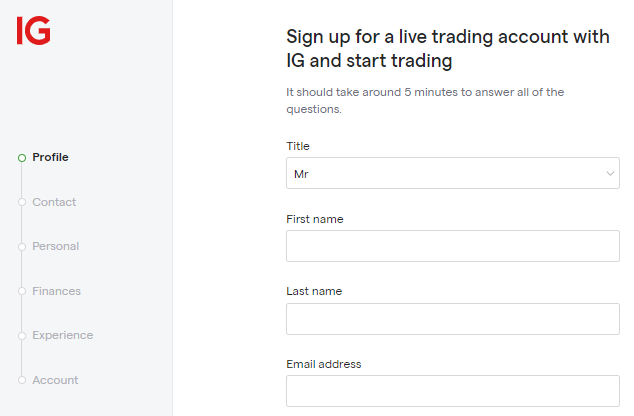

To upgrade your Demo account to a Live Trading account or to set up a Live account from scratch requires providing the broker with some personal information. The broker will then be able to identify you and ensure that you, and only you, have access to the account.

Source: IG

Opening an Account

Onboarding is completed online; regulated brokers use a relatively generic template. After submitting personal details and verifying your I.D., there may be a series of questions relating to your trading experience and investment aims. The questions are asked so that a broker can comply with Know Your Client (KYC) rules and apply an appropriate amount of client protection. The whole process can be completed using a laptop, PC, tablet, or mobile handset and takes minutes to do. Once finished, you’re ready to wire funds to your account.

Funding your account

If, after some final checks, you’re sure your broker is safe, then it’s time to wire funds to your new account. The process is in many ways like any other online purchase or banking transaction. Good brokers allow clients to fund using various payment methods, with bank transfer, credit card and debit cards being popular. However, ePayment service providers are increasingly gaining market share. It is worth checking the T&Cs on your account as you may find using one payment method is faster and cheaper than another. Once the funds hit your account, you’re ready to trade.

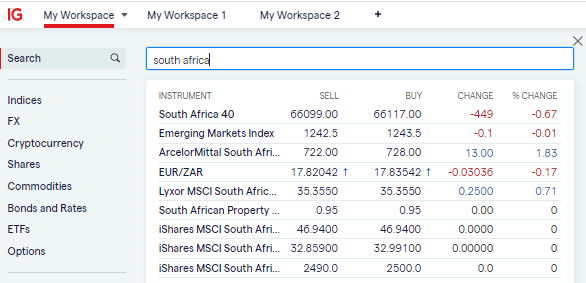

3.2 – Open an Order Ticket and Set Your Position Size

If you already know what South African stock to buy, then you can navigate the trading dashboard at your broker to locate that market. If you’re still considering your options, it’s possible to run a search on stocks by country or use some of the free research brokers offer on firms and their stocks. The platforms provide tools based on technical analysis, charting and fundamental analysis to help their clients spot good investment ideas.

Source: IG

Most of the hard work has been done at this stage, and the actual act of putting on a trade is incredibly simple. All that is needed is to populate some data fields and click or tap ‘buy’. As trading is as much about managing risk as it is about banking profits, some additional risk-management features are worth considering. These can help you limit not only your downside but also enhance returns.

3.3 – Set Your Stops & Limits

Online trading platforms give clients complete control of trade management, and you can access your positions at any stage of their life to adjust your strategy. For example, Stop Loss instructions and Take Profit orders are instructions built into the system that will automatically sell some or all of your position if price reaches a certain point. That means you can get on with your day job rather than watch the markets while at the same time benefiting from knowing that you’ll automatically bail out of a position if things go against you.

Take Profit orders work similarly to stop losses but close out your position if price moves the way you want it to go. They lock in profits by selling some or part of your position and turn unrealised profits into realised gains.

An Alternative Approach to Stop Loss Use

Stop losses are often recommended for beginners and are popular with traders following short-term strategies. Practising using them in a Demo account is recommended, and it’s also worth remaining open-minded about alternative forms of risk management.

Buy-and-hold investors prepared to wait a long time for a position to come good often don’t apply stop-losses. That is because using stops would leave them open to being stopped out if there is a flash crash. The argument that long-term investors sometimes use is that short-term bumps in the road ought not to jeopardise your long-term confidence in a position. That doesn’t mean risk can’t still be managed, and trading in a smaller size makes it more likely that any ‘noise’ can be ridden out. That way, you can stay in a trade and protect your account.

Effective portfolio management is an excellent skill to learn. It involves using diversification of assets, having a clear strategy including target entry and exit points, and taking the emotion out of trading.

A final order type to consider is the Limit Order, which can help introduce an element of discipline into trading. These allow you to state the price you want to enter into a position. There’s no guarantee that the price will reach your target level, but if it does, you’ll optimise your entry price rather than overpay due to impatience.

3.4 – Make Your Purchase

The process of buying South African stocks is very straightforward. The functionality of modern online broker sites is designed to make things easy, and complete beginners can set up and book their first trade within minutes. It requires simply clicking or tapping the button marked ‘buy’.

The added protection offered by stop losses, take profits, and limit orders are nice to have features but might not fit in with all types of trading strategy; however, there is one check all investors should run after they have traded.

After executing a trade, it’s a good idea to immediately visit the Portfolio section of your account to double-check you bought what you intended to buy. Even the pros make ‘fat finger’ errors and buy instead of sell, and as prices can move very quickly, any errors need rectifying before they prove costly.

3.5 – Monitor Periodically Your P/L

The Portfolio section of the site is also where you’ll be able to monitor your trade’s performance over time. You’ll be able to watch the P&L (profit and loss) on the position fluctuate in line with market prices. You as a client of these platforms have complete control over trade management and can add to positions by buying more, or when the time is right, sell some, or all, of the position and convert the proceeds to cash.

Buying or selling South African stocks doesn’t have to take over all your free time. You can use price alerts to let the broker keep you up to date with events and following the adage of using only amounts of money you can afford to lose can take some of the emotion out of the process. That way, you can focus on your day job, but at the same time hope to gain from your investment.

Why buy stocks in South Africa?

Many of the reasons why now might be a good time to buy stocks in South Africa revolve around mining, minerals and commodities. South African stocks have historically been targeted by investors looking to gain exposure to that sector. There are other reasons why now might be a good time to invest in South African stocks.

The continent of Africa is seen as one of the most exciting growth markets in the world. Investing in emerging markets can be risky, and South Africa’s relative stability means it is seen by many as the safest way to gain exposure to the Africa growth story. South Africa has also recently become a member of The African Continental Free Trade Area, meaning it has access to a market of one billion people and a combined GDP of $2.6tn.

The country’s financial markets are managed by a well-regarded regulator, the Financial Services Conduct Authority FSCA, which applies internationally recognised standards of investment practice. A country’s banking sector plays an essential part in supporting growth, and South African banks have a solid and long-running reputation for being prudent and consistent. The country also has a modern infrastructure system and is home to Africa’s largest airport and logistics network.

The solid foundations for business operations add up to South Africa having the largest number of multinational firm headquarters on the continent. Firms looking to access expansion opportunities across the continent are choosing South Africa as a base, and local and international investors are following suit.

South Africa and the Commodities Super-Cycle

The abundance of South Africa’s natural resources makes it one of the world’s largest raw materials suppliers. It produces more than 10% of the world’s gold, holds more than half of the world’s supply of chromium and has one of the biggest diamond trades in the world. The list of natural resources found in the country is extensive and includes iron ore, copper, platinum, silver, manganese, titanium, and uranium.

Peculiarities of the mining industry mean that mining stocks are likely to see their prices rally hard following even a slight uptick in demand for their products. The long period needed to bring new mines into production means that big players like Anglo American, BHP Billiton, Rio Tinto, Kumba Iron Ore Ltd and Sibanye-Stillwater are limited to the extent to which they can increase supply to meet increased demand.

Following the fundamental laws of economics, prices in commodities then rise and sometimes spiral as manufacturers scramble to ensure they have enough supply. Exploration, testing and setting up new mines are time-consuming activities, and it can take decades for a new supply to become available. If demand remains the same, then a commodities super-cycle, which can last for years, is formed.

Having their resources increase in value is obviously a positive move for South African mining stocks. However, there is a quirky accounting feature, which means the rise in the value of the stocks can be far greater than the rise in the price of the minerals themselves.

Taking the gold market as an example, if a firm breaks even when the price of gold is $1,200 per ounce, and the market price is $1,800, then a 10% increase in the price of gold would result in the firm’s profit margin increasing by 30% not 10%. [(19800-12000) / (18000-12000)]. That can cause small changes in commodity prices leading to South African mining stock prices experiencing exponential gains.

Indices and Exchange-Traded Funds (ETFs)

When you purchase shares, you take your investment into your own hands. If you are a complete beginner who is not comfortable with this notion, there are other options to buy shares while having professionals manage your portfolio.

This can be done by buying a stock market index or Exchange-Traded Funds (ETFs), which are baskets containing different shares from different stock exchanges.

Interest from domestic and international investors is based mainly on the potential of South Africa’s relatively young population and the country’s world-beating mineral reserves. In an ideal world, a commodities super-cycle could act as a catalyst for widespread economic growth. Periods of sustained bull-runs in mining and mineral stocks have a record of lasting for years.