The US equity markets are considered the best and offer investors the best chance of achieving a steady return in the long term. The wide variety of company types presents opportunities for both speculative traders and long-term investors. There’s something for everyone.

While some stocks may have a one-day surge that traders capitalise on, there are also thousands of ‘slow-burners’ for buy-and-hold strategies. The good news is that you don’t have to be based in the US to trade the opportunities on offer. Thanks to the financial sector being a global market, clients worldwide, from the UK to Australia, can buy the best US stocks.

The Best US Stocks to Buy in the UK

- Amazon

- Apple

- Proctor & Gamble

- Stitch Fix

- Johnson & Johnson

- Microsoft

- Advanced Micro Devices

- Apache Corp

- Chevron

- Endeavour Silver Corp.

- Tesla

- United Natural Foods, Inc.

- JPMorgan

- US Bancorp

The Best Overall US Stocks

Amazon (NASDAQ: AMZN)

E-commerce and technology powerhouse Amazon managed to capitalise on the changing habits of businesses and consumers.

Its flagship retail business has thrived, and during the most recently measured survey period, which ended in March 2019, it was said that the average Amazon Prime member spends $1.4k per year.

Following the pandemic, there is no doubt that the company acquired many more consistent users.

The firm’s incredible cash generation has allowed it to diversify into other sectors. It has a streaming site Twitch, and its cloud offering, Amazon Web Services (AWS), which has so far been extremely successful.

Apple (NASDAQ: AAPL)

The US economy is still home to the biggest and brightest names, and you won’t find a tech brand as powerful as Apple (AAPL) anywhere else in the world.

The firm’s loyal customer base means the iPhone maker effectively has a licence to print money. The company has staggering cash reserves.

Therefore, Apple is an opportunity to tap into a growth market by buying into a business that is incredibly strong financially.

Proctor & Gamble (NYSE: PG)

Blue-chip firms like Proctor & Gamble (PG) are traditionally targeted by those looking for an investment offering a more stable risk return.

Despite economic uncertainty, PG’s stock price remains stable due to the fact it is a well-run company with an impressive track record.

Positioned in a more defensive sector, it offers investors an unlikely blend of security and market-beating share price performance.

The Best US Penny Stocks

US penny stocks typically trade at $5 per share or less. To trade the below names requires selecting a broker such as IG, which supports trading in a larger than average number of markets.

Stitch Fix (NASDAQ: SFIX)

Stitch Fix is an online personal styling service in the US and UK. The company has recently faced some challenges which have weighed on its valuation and pushed it into penny stock territory, but many analysts still see potential in the stock.

There have been some more promising signs since then, but investors are still cautious. However, Stitch Fix has a unique e-commerce platform and a solid balance sheet, which could help push it higher over the medium to long term.

It is important to remember that investing in penny stocks is a high-risk-return venture. Not only is the likelihood of a business failing higher, but trading costs can also be a drag on performance.

Best US Dividend Stocks

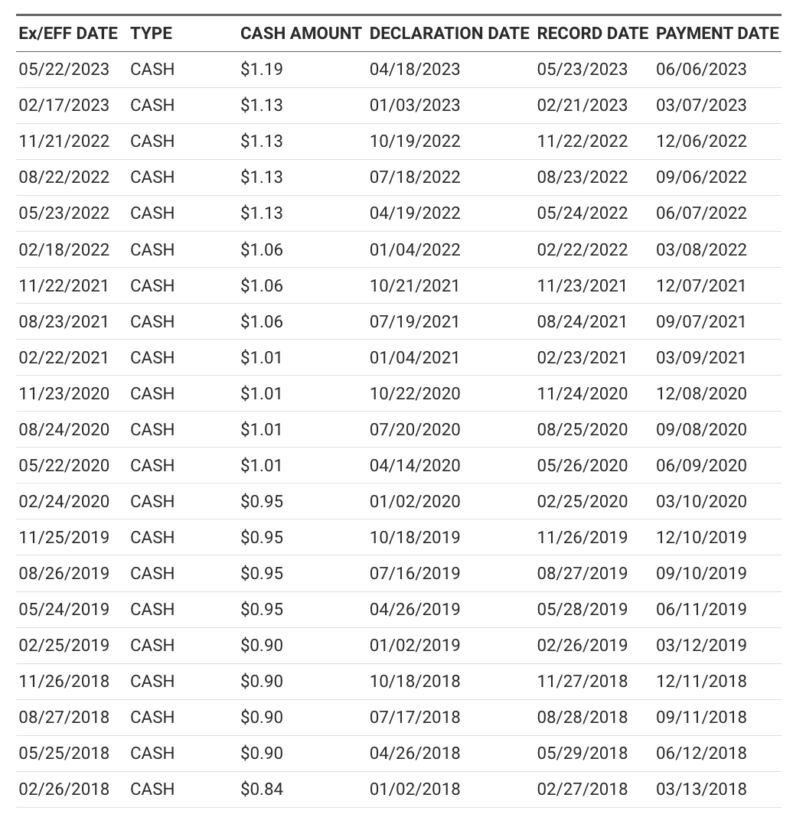

Johnson & Johnson (NYSE: JNJ)

The US healthcare giant JNJ has a strong history of dividends that have continuously grown over a number of years. According to Dividend.com, JNJ’s dividend has increased consecutively for 62 years.

The company offers a big chunk of security due to the sector in which it operates. Healthcare was a big winner during the pandemic, and while it has died down since, Johnson & Johnson always offers investors a solid return through its dividend payment policy.

The Best US Tech Stocks

There’s no avoiding the fact that because of the COVID-19 pandemic, US tech stocks are a market that has to be considered. The good news for investors is that they can choose from off-the-radar start-ups to established market giants.

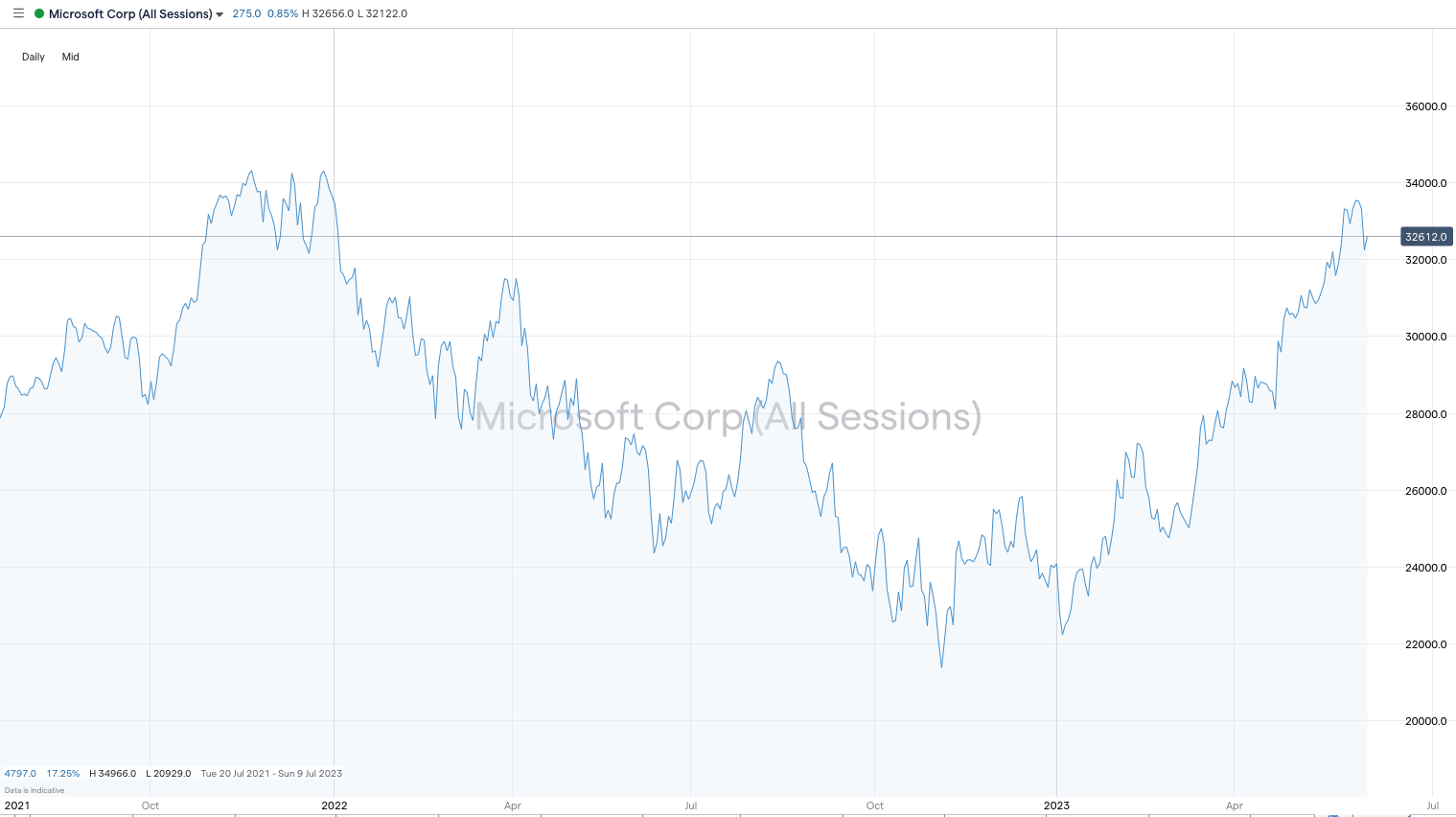

Microsoft (NASDAQ: MSFT)

Software giant Microsoft MSFT revolutionised desktop computing, but since pioneering that development, it has undergone a low-key transformation into cloud computing and is now benefitting from the surge in artificial intelligence (AI).

If Johnson & Johnson is a dividend stock with a growth kicker, then MSFT is a growth stock with a surprising yield.

Advanced Micro Devices (NASDAQ: AMD)

Semiconductor chip maker (AMD) is another company that could benefit from the rapid rise of AI. The hardware the firm makes for electronic devices, such as the Ryzen 5000 PC chips, is regarded as high-quality and generally superior to its rival, Intel.

As more leisure and work-time is spent online, processing speed is becoming a key metric and one in which users are increasingly willing to invest.

All these high-profile US stocks can be found at eToro, Admiral Markets or IG.

Best US Oil Stocks

Apache Corp (NASDAQ: APA)

Oil firm Apache Corp tends to generate considerable interest from Hedge Funds looking for long-term plays. APA seems well-positioned and has benefitted from the rise in the price of crude and a return to somewhat economic normality.

Chevron (NYSE: CVX)

Oil giant Chevron (CVX) is one of the 15 largest companies in the world, so it has more critical mass than Apache. It pays has a strong dividend history and has a healthy/low debt balance sheet, which puts it in an excellent position to restructure and build a position in the booking renewable energy market.

Best US Commodity Stocks

Endeavour Silver Corp. (NYSE: EXK)

Silver has traditionally acted as a hedge against inflation and is also widely used in industry, so the price responds well to an uptick in economic activity. Buying shares in silver miners provides equity investors with a chance to get exposure to the commodity markets using an instrument they are more familiar with.

Best US Growth Stocks

Tesla, Inc (NASDAQ: TSLA)

There aren’t many stocks that divide investor opinion as much as Tesla (TSLA). Yes, the company has faced some challenges in more recent times, but it is still one to consider.

Tesla isn’t just about electric cars. It’s an incubator for a lot of outlandish ‘next-big-thing’ ideas, and one of them might just pay off. That goes some way to explaining the stock price, but the Tesla market is dominated by speculators rather than investors, so caution is advised.

United Natural Foods, Inc. (NYSE: UNFI)

While it catches the zeitgeist of ethical investing (UNFI), the company has run into some challenges recently.

While UNFI operates in a growth sector, it isn’t a small, vulnerable start-up. The UNFI shares should probably be a name for a buy-and-hold value investor’s shortlist. Despite the more recent downturn, there could be a reversal due, as the firm is a leading distributor of healthy foods — in a gold rush, sell shovels.

Best US Bank Stocks

JPMorgan (NYSE: JPM)

Despite the more recent banking uncertainty, banking stocks gained some popularity following the rise in interest rates. The increase in economic activity and surge in inflation — which resulted in rates increasing— was good for the sector and JPM, which is our pick of the bunch.

Its long-established management team has kept its seats at the top table by investing heavily in IT infrastructure. The bank has built an excellent reputation in the booming FinTech sector.

US Bancorp (NYSE: USB)

The personal banking market is relatively commoditised, with minimal differences between rival firms. There is also little to lose from changing banks. This makes USB’s decision to offer a more ethical approach a potential game-changer. If you’ve got to choose a bank and there’s not much in it, then using one that makes you feel good is an easy option to take.

In 2020, US Bancorp was named one of the World’s Most Ethical Companies by the Ethisphere Institute — a global leader in defining and advancing the standards of ethical businesses. This is a long-term approach as EI has recognised the bank for the last six years in a row. The bank was impacted by the sector’s uncertainty following the collapse of SVB, but it is still a stock to consider.

Which is the Best UK Broker for US Stocks?

eToro

One of the most user-friendly sites in the sector, eToro must be doing something right as the number of traders using the platform has risen significantly in the last few years.

The registration process is incredibly straightforward, and clients can trade their own ideas or copy those of other traders.

IG

With more than 17,000 markets on offer, IG is a great platform for those looking to trade in smaller US stocks and not just the big names. IG provides an in-depth breakdown of every US company it covers so you can build a detailed picture of stock price prospects. It also offers markets in options, meaning you have more available strategy choices.

UK-domiciled clients can also take advantage of the tax breaks associated with spread-betting. The markets traded, and functionality is identical to CFD accounts; it’s just that any profits are treated differently.

Admiral Markets

A tried-and-trusted operator, Admiral Markets specialises in providing research and analysis tools designed to help clients spot trade entry and exit points. Trading Central, Zero to Hero, and the in-house podcasts are all trade-specific programmes that help beginners get a feel of how and when to pull the trigger on a trading opportunity.

How to Buy US Stocks in the UK

UK citizens who use an FCA-regulated broker such as eToro, IG or Admiral Markets can trade US markets knowing they come under the official UK regulator's protective umbrella. The FCA’s rules and regulations mean clients are protected in various ways when they take positions in US stocks.

The brokers' trading platforms make buying the best US stocks exceptionally straightforward. It’s merely a case of completing an online registration form, wiring funds into your broker account, going to your target market, and clicking ‘buy’.

The process is broken down into easy-to-follow steps in this article.

RELATED: