Wix.com stock (NASDAQ: WIX) is down 6.67% over the past week of trading, with pressure on the firm intensifying since the start of the year. The website development platform, finds itself down 31% since the start of the year, although analysts continue to see upside, complicating the picture somewhat.

Today's observation by Barclays analyst Trevor Young, issued via a research note, show that the firm's weekly pricing tracking has identified price increases for Wix's two and three-year subscription plans. It's unclear whether these price hikes represent a temporary test or a permanent strategic shift.

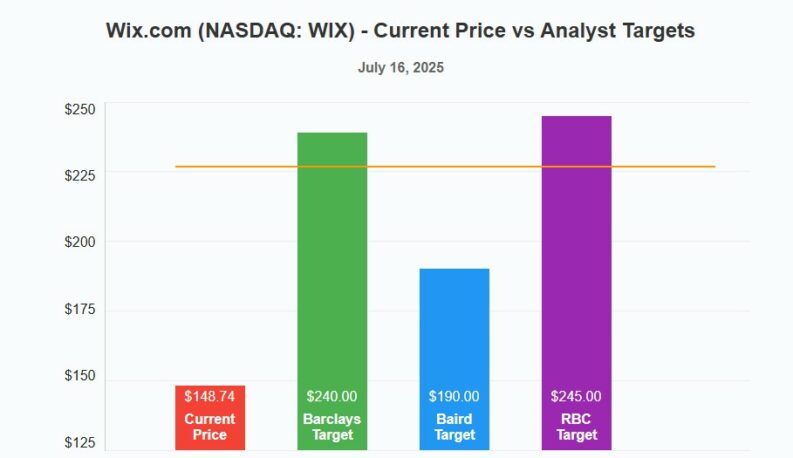

However, Young posits that if these price increases stick, Wix's bookings could experience a significant acceleration in the second half of 2025. Barclays maintains an Overweight rating on the stock with a price target of $240, signalling substantial upside potential of more than 60% from current levels.

This bullish outlook contrasts with the stock's recent performance and broader technical analysis. A deeper dive into technical indicators reveals a “strong sell” rating across daily, weekly, and monthly timeframes. This suggests persistent downward pressure with the stock continuing to trade below its key moving averages, reinforcing bearish momentum.

Despite these headwinds, several analysts express optimism about Wix's long-term prospects. Analyst estimates for Wix's future price range from a low of $189 to a high of $250.

In May, Baird analyst Vikram Kesavabhotla upgraded Wix from Neutral to Outperform, setting a price target of $190. This upgrade was driven by confidence in Wix's product offerings and a belief that the stock's year-to-date decline presented an attractive entry point for investors.

In June, Wix acquired Hour One, a generative AI media creation company. This acquisition signals a strategic focus on leveraging AI to enhance its platform and attract new users. Barclays views this acquisition as part of a broader strategy of targeted mergers and acquisitions to bolster product capabilities.

The core debate surrounding Wix centers on its ability to translate strategic initiatives into sustained revenue growth and profitability. The potential impact of the recent price increases is a key factor to watch. If these increases are successfully implemented and accepted by customers, they could provide a significant boost to Wix's bookings and financial performance in the second half of 2025. However, there is also the risk that these higher prices could deter new customers or lead existing customers to switch to competing platforms.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY