Meta Platforms' stock (NASDAQ: META) has been given a vote of confidence, with a significant analyst upgrade over the weekend, which alongside ambitious AI investments has seen the price add 0.6% in early pre-market trading.

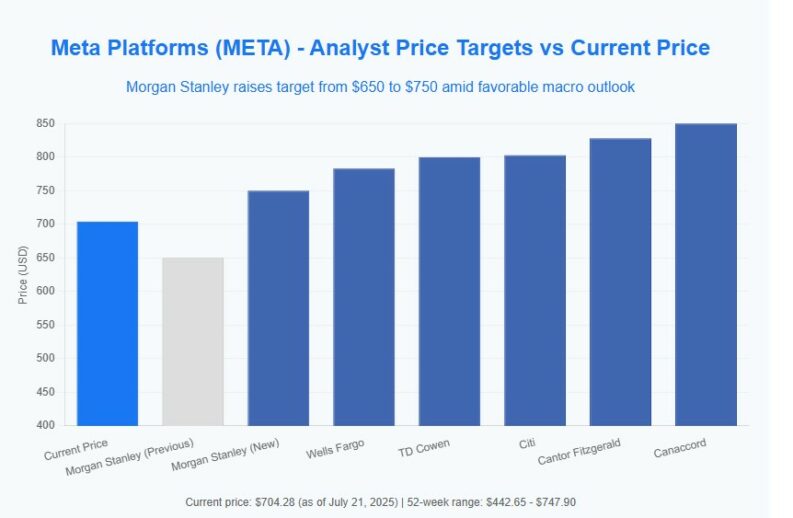

Morgan Stanley's recent decision to raise its price target to $750, from a previous $650, underscores the bullish sentiment surrounding the tech giant, driven by expectations of a more favorable macroeconomic environment and easing trade tensions with China.

Morgan Stanley's upgrade is part of a broader trend of positive analyst revisions. Firms like Wells Fargo ($783), TD Cowen ($800), Citi ($803), Cantor Fitzgerald ($828), and Canaccord ($850) have all issued Overweight or Buy ratings with price targets exceeding the current trading price.

The average price target of $729.37 indicates that the street continues to expect further upside in the stock, despite an impressive 44% gain over the past 12 months. Morgan Stanley's decision to roll its valuation methodologies to mid-year 2026 highlights the long-term perspective on Meta's growth potential. They also increased estimates across the internet space to reflect a more favorable macro backdrop and lower China tariffs.

However, the firm tempers its enthusiasm slightly, noting a near-term preference for Alphabet (GOOGL) due to valuation considerations. This suggests that while Morgan Stanley believes both companies are poised to benefit from accelerating revenue growth, Alphabet currently offers a more attractive entry point for investors.

One of the most significant developments impacting Meta's future is CEO Mark Zuckerberg's ambitious plan to invest “hundreds of billions of dollars” in building massive AI data centers. These centers, including the Prometheus and Hyperion projects, are designed to develop superintelligence, a long-term bet on the transformative power of artificial intelligence.

The scale of these investments is staggering, with each AI titan cluster covering an area comparable to a significant portion of Manhattan. While this move signals Meta's commitment to leading the AI revolution, it also raises questions about capital allocation and the potential impact on near-term profitability.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY