The United Kingdom and India officially signed a historic Free Trade Agreement (FTA) today, a move anticipated to reshape trade dynamics and unlock significant economic opportunities for both nations. The agreement aims to boost annual bilateral trade by $34 billion and double trade to $120 billion by 2030.

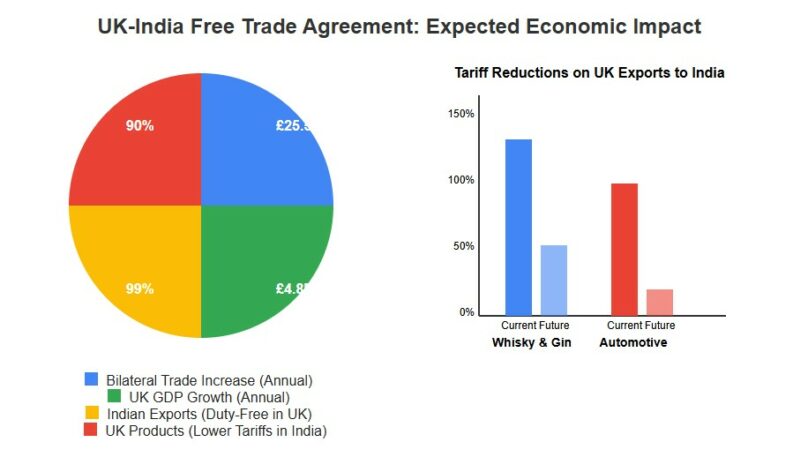

The FTA's core provisions include substantial tariff reductions. India will reduce tariffs on 90% of British goods, with 85% becoming fully tariff-free within a decade. Notably, duties on whisky and gin will be halved from 150% to 75%, eventually decreasing to 40% over ten years. Automotive tariffs will also see a significant reduction from over 100% to 10% under a quota system.

Conversely, the UK will eliminate tariffs on 99% of Indian exports, including textiles, food products, and jewellery. This is expected to provide Indian businesses with easier access to the UK market. The UK GDP is projected to increase by £4.8 billion annually because of the deal.

“This landmark agreement will create thousands of British jobs and unlock new opportunities for businesses in both countries,” stated UK Prime Minister Keir Starmer. Indian Prime Minister Narendra Modi hailed the agreement as “historic,” highlighting its role in catalyzing trade, investment, and innovation.

Companies in India’s leather, textiles, chemicals, and software sectors are expected to see export volume and revenue growth. British firms in alcohol, automotive, and consumer goods are forecast to benefit from increased market access and reduced import duties, potentially leading to positive revisions in earnings estimates.

The FTA is projected to create more than 2,200 new UK jobs through expanded Indian investment, with nearly £6 billion in new investment and export deals expected in Britain over the next year. UK import duties are expected to fall by £400 million immediately, with a further reduction to £900 million over 10 years.

Several sectors stand to gain significantly. The Indian textile and apparel industry, including manufacturers like Arvind Limited, Raymond Ltd, and Trident Group, are poised to benefit from the elimination of UK import duties. Similarly, the pharmaceutical sector is expected to see a boost in exports to the UK, benefiting companies such as Sun Pharmaceutical Industries, Dr. Reddy's Laboratories, Cipla Ltd, and Lupin Limited.

However, not all sectors are equally enthusiastic. British carmakers expressed disappointment with the deal, citing limited immediate benefits due to phased tariff reductions and restrictive annual quotas. The agreement stipulates a gradual reduction in tariffs for UK petrol and diesel cars to 10% by 2031, with initial quotas starting at 20,000 cars subject to tariffs of 30-50%.

Despite this, the FTSE 100 closed out the day at a new high of 9,138.37, with a gain of 0.85% on the day.

Indian equity benchmarks experienced a slight dip on the day, with the Nifty 50 falling 0.17% and the BSE Sensex dropping 0.2%. Indian markets were closed before the deal was inked, with the impact more likely to be seen in Friday's session.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY