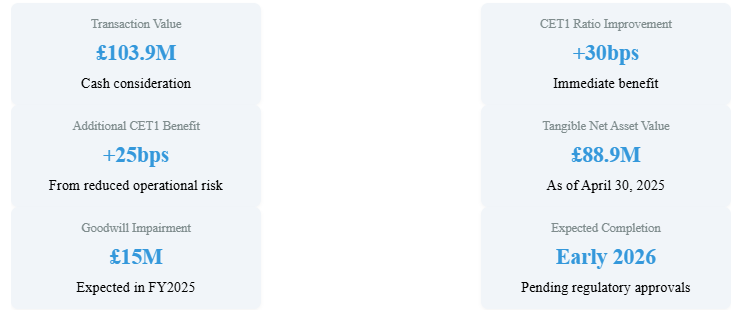

Close Brothers shares (LON:CBG) have jumped 10% in the morning session, as the firm announced the sale of its execution services and securities arm, Winterflood Securities, to Marex Group plc in a £103.9 million all-cash deal.

The transaction, expected to close in early 2026 pending regulatory approvals from the FCA and FINRA, marks a significant step in Close Brothers' ongoing strategy to streamline its operations and concentrate on its core specialist lending business.

The divestiture follows the sale of Close Brothers Asset Management (CBAM) earlier this year, underscoring a clear directional shift for the financial services group. Markets have reacted well to the pivot, with the Close Brothers' share price almost doubling (+93%) since the start of the year.

From a financial perspective, the transaction is expected to provide an immediate boost to Close Brothers' Common Equity Tier 1 (CET1) capital ratio. The group anticipates a roughly 30 basis point increase, lifting the ratio from 14.0% to approximately 14.3%, based on financials as of April 30, 2025.

The injection of capital also provides Close Brothers with increased financial flexibility to pursue growth opportunities within its core lending activities.

The sale will necessitate a goodwill impairment loss on disposal of approximately £15 million, which is expected to be recognized upon the classification of Winterflood as ‘held for sale' and ‘discontinued operations' in the group's Full-Year 2025 financial statements. However, the company anticipates no further loss on disposal upon completion of the transaction in the Full-Year 2026 financial statements.

For Marex Group, the acquisition of Winterflood represents a strategic expansion of its equity market-making capabilities. Marex CEO Ian Lowitt emphasized the transformative potential of integrating Winterflood's technology and client relationships, envisioning a leading franchise that can leverage economies of scale and introduce new products and services to a broader client base.

Completion is contingent upon securing regulatory approvals from both the FCA in the UK and FINRA in the United States, given Winterflood's operations in both jurisdictions, with a break fee payable by Marex should FCA approval not be forthcoming, providing some protection for Close Brothers.

Ultimately, the sale of Winterflood represents a pivotal moment for Close Brothers Group. By simplifying its portfolio and focusing on its core strengths, the company looks to enhance operational efficiency and drive sustainable growth. Markets like the move.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY