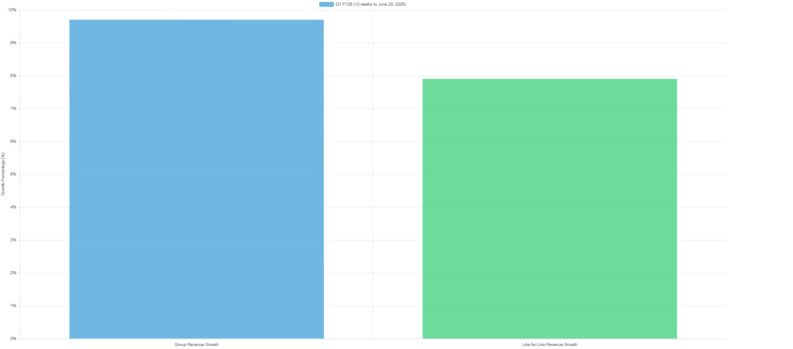

Shares in Cranswick (LON:CWK), the UK-based food producer, are maintaining a steady course following a trading update for the first quarter of the financial year ending March 2026. The company reported a 9.7% increase in group revenue for the 13 weeks to June 28, 2025, showcasing strong performance across all product categories.

Like-for-like revenue climbed by a healthy 7.9%, fuelled by volume growth resulting from new business wins, tighter alignment with key retail partners, and the continued appeal of premium, added-value products resonating with consumers seeking natural protein options.

The positive results are underpinned by several key factors. The acquisition of Blakemans, a sausage manufacturer serving the foodservice industry, completed on May 16, is already contributing positively and in line with expectations.

Furthermore, export revenue experienced significant growth, benefiting from increased volumes and higher pricing following the reinstatement of the Norfolk fresh pork site's China export license in December 2024. This access to the Chinese market, a crucial outlet for pork products, provides a boost to Cranswick's revenue stream.

Poultry revenue is also proving to be a significant growth driver, spurred by the onboarding of new premium retail business at the Cooked and Prepared Poultry sites.

The pet products division continues upwards, with revenue well ahead of the previous year, reflecting the successful ongoing rollout of business with Pets at Home.

With eyes on the future, Cranswick is aggressively pursuing capital expenditure projects to enhance capacity, expand capabilities, and improve operating efficiencies across its extensive network of 23 production facilities and pig and poultry farming operations.

CEO Adam Couch emphasized this proactive approach, stating, “We have made a strong start to the year, delivering volume-led revenue growth across all product categories. We continue to invest at pace across our asset base to drive strong returns.”

Despite the positive financial performance, Cranswick faces challenges.

Ethical considerations surrounding animal welfare have surfaced, with undercover filming at a Red Tractor-certified pig farm operated by the company revealing instances of animal cruelty in May. Although the company has taken steps to strengthen its animal welfare compliance practices, these allegations have the potential to negatively impact consumer perception and brand reputation.

Some UK supermarkets temporarily suspended supplies from the implicated farm, highlighting the sensitivity of this issue. Addressing these concerns and demonstrating a commitment to high animal welfare standards is crucial for maintaining consumer trust and securing long-term sustainability.

The latest trading update highlights a company that is continuing to demonstrate strong growth across a number of areas, and with an analyst update last week hiking the price target to 6,200p, there could be scope for further improvement from here, despite markets being relatively unmoved by today's update.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY