Meta Platforms (META) delivered a stunning second quarter, exceeding analyst expectations on both earnings and revenue, sending shares soaring in after-hours trading. The results underscored the company's robust financial health and effective monetization strategies.

Meta's stock price has surged to a new overnight high, adding 11% in early pre-market trading, reaching $775.10, having closing the day below $700 at $695.21.

The company reported Q2 EPS of $7.14, absolutely crushing the estimate of $5.90. Revenue for the quarter reached $47.52 billion, also a significant upside beat on expectations of $44.84 billion.

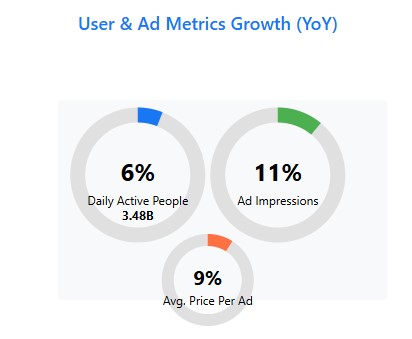

Meta's strong performance was driven by a combination of factors, including continued growth in user engagement and a rebound in advertising revenue. Family daily active people (DAP) averaged 3.48 billion in June, a 6% year-over-year increase.

Ad impressions across Meta's Family of Apps increased by 11% year-over-year, while the average price per ad rose by 9%. These figures demonstrate the continued demand for advertising on Meta's platforms and the company's ability to monetize its user base effectively.

Looking ahead, Meta expects third-quarter revenue to be in the range of $47.5 billion to $50.5 billion. This guidance includes an approximately 1% tailwind from foreign currency exchange rates.

However, the company cautioned that year-over-year revenue growth in the fourth quarter is expected to be slower than in the third quarter, due to a tougher comparison against a period of stronger growth in the fourth quarter of 2024.

Meta CEO Mark Zuckerberg highlighted the company's commitment to artificial intelligence, stating, “We've had a strong quarter both in terms of our business and community. I'm excited to build personal superintelligence for everyone in the world.”

The company has been investing heavily in AI infrastructure and talent, including a significant investment in AI firm Scale AI. These investments are aimed at enhancing Meta's AI capabilities and driving future growth.

The market's initial reaction to Meta's earnings was overwhelmingly positive, with the stock surging immediately on the print. Analysts at several firms have reiterated their positive ratings on the stock, citing the company's strong fundamentals and growth potential.

Analyst price targets for META average around $760, with some bullish forecasts reaching as high as $918. However, we can expect shifts in the days ahead as the street adjusts to the new outlook.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY