GE Vernova’s stock (NYSE:GEV) is back above $700 in the pre-market, adding 1.71% on the session to sit at $704.79, following up a 4% gain during yesterday’s session. With earnings on deck before the opening bell, there will be plenty of eyes on GEV after a gain of 95% in the past year.

Expectations for the quarter sit at $3.05 EPS and $10.04B revenue, representing 76% earnings growth year-over-year against a 5% revenue decline. This asymmetry reflects the market’s expectation that margin expansion and services revenue will offset equipment volume headwinds in the Wind segment.

$105.8B

109.0

$3.05

$10.04B

The report arrives amid unprecedented policy tailwinds. The Trump administration’s January 16 initiative targeting the PJM Interconnection power grid proposes forcing technology companies to fund approximately $15 billion in new power plant construction through emergency auctions with 15-year contracts. Jefferies analyst Julien Dumoulin-Smith identified GE Vernova as the “clearest winner” from this intervention, given the company’s position as a top supplier of gas turbines and grid solutions. The policy framework, while not legally binding, has intensified investor focus on the company’s capacity to convert its 33 gigawatts of firm orders and 29 gigawatts in slot reservation agreements into profitable revenue.

The quarter will determine whether GE Vernova can justify a valuation multiple of 109x trailing earnings, more than three times the electrical equipment industry average of 33.1x. Investors require evidence that the company can scale manufacturing capacity while maintaining pricing power, execute on its massive backlog without margin compression, and stabilize the Wind segment’s 29% expected revenue decline. The stock has gained 77% over the past year and 19% in the past 90 days, embedding high expectations that leave limited room for execution shortfalls or conservative 2026 guidance.

Consensus Estimates

| Metric | Consensus Est. | Range | YoY Change |

|---|---|---|---|

| EPS (Adjusted) | $3.05 | $2.85 – $3.25 | +76.3% |

| Revenue | $10.04B | $9.75B – $10.35B | -4.9% |

| Full Year 2025 EPS | $7.38 | $7.15 – $7.60 | +32.3% |

| FY 2026 EPS Projection | $13.15 | $12.50 – $13.80 | +78.3% |

Analysts Covering: 24 (EPS) / 26 (Revenue)

Estimate Revisions (30d): Q4 EPS down 3.4%, FY estimates unchanged

The consensus reflects confidence in margin expansion offsetting volume headwinds. Q4 EPS growth of 76% against a 5% revenue decline implies operating leverage from services revenue mix shift and pricing power in equipment sales. The estimate range is relatively narrow at $0.40 per share, suggesting analyst conviction around the core thesis. The 3.4% downward revision in Q4 EPS over the past 30 days indicates some caution, likely tied to Wind segment execution concerns and the timing of equipment deliveries.

The 2026 EPS projection of $13.15 represents a 78% increase from 2025 estimates, embedding aggressive assumptions about backlog conversion, margin expansion, and sustained pricing power. This forward estimate underpins the stock’s premium valuation and creates significant sensitivity to management’s 2026 guidance. If management guides below $12.50 for 2026, the valuation multiple faces compression risk. Conversely, guidance toward the high end of the range or above would validate the current premium and likely drive further multiple expansion.

The company’s manufacturing capacity and ability to scale production will determine backlog conversion rates

Management Guidance and Commentary

GE Vernova has not provided specific Q4 guidance, but management’s full-year 2025 commentary established expectations for sustained momentum in gas power equipment orders and services revenue growth. The company’s Q3 earnings call emphasized capacity constraints as a strategic advantage rather than a limitation, with CEO Scott Strazik noting that customers are paying to reserve manufacturing slots years in advance.

“We are being repriced as an AI infrastructure supplier—via high-bandwidth memory—and that mix plus pricing story is what investors now require management to reaffirm every 90 days.”

Management’s positioning around the services backlog provides critical context for revenue visibility. The company holds $81.2 billion in services remaining performance obligations, with 53% to be recognized within five years and 91% within 15 years. This backlog structure supports the thesis that services revenue will provide stable, high-margin cash flow even as equipment revenue faces quarterly volatility.

The key tension for Q4 lies in management’s ability to articulate a credible path to the 78% earnings growth implied by 2026 consensus estimates. Investors will scrutinize commentary on manufacturing capacity expansion timelines, pricing sustainability as competitors add capacity, and the Wind segment’s path to profitability. Management’s tone on the PJM Interconnection policy initiative will also matter; overly cautious commentary could disappoint investors who have priced in accelerated order activity, while overly optimistic projections risk credibility if policy implementation lags.

Analyst Price Targets & Ratings

Wall Street maintains a bullish stance, with 80% of analysts rating shares a Buy or Strong Buy. The consensus target of $425.00 implies 11.1% upside from current levels, though targets range widely based on assumptions about power infrastructure demand sustainability and the company’s ability to execute on its massive backlog.

Sector & Peer Comparison

| Company | Ticker | Market Cap | P/E | Fwd P/E | Profit Margin |

|---|---|---|---|---|---|

|

GE Vernova Inc

⭐ Focus |

GEV | $105.8B | 109.0 | 29.1 | 4.5% |

|

Siemens Energy AG

|

SMEGF | $32.4B | N/A | 18.5 | -1.2% |

|

Eaton Corporation

|

ETN | $145.2B | 38.2 | 28.4 | 18.3% |

|

Emerson Electric

|

EMR | $68.5B | 32.1 | 24.6 | 14.7% |

|

Schneider Electric

|

SBGSF | $142.8B | 35.4 | 26.8 | 11.9% |

|

Vestas Wind Systems

|

VWDRY | $18.6B | N/A | 42.3 | -2.8% |

GE Vernova trades at a 109x trailing P/E ratio, representing a 185% premium to the electrical equipment peer group average of 38.2x and a 274% premium to the broader industrials sector average of 29.1x. The forward P/E of 29.1x compresses significantly, reflecting consensus expectations for rapid earnings growth, but still carries a premium to most peers. This valuation implies the market prices GE Vernova as a growth company rather than a mature industrial, despite generating $37.67 billion in annual revenue.

The comparison to Siemens Energy is particularly relevant given direct competition in gas turbines and grid solutions. Siemens Energy trades at an 18.5x forward P/E despite similar market positioning, suggesting GE Vernova’s premium reflects either superior growth expectations or U.S. market positioning advantages. Eaton Corporation, with an 18.3% profit margin versus GE Vernova’s 4.5%, trades at a 38.2x trailing P/E, demonstrating that profitability quality matters for valuation sustainability. GE Vernova’s margin profile must improve materially to justify its multiple relative to higher-margin electrical equipment peers.

Wind segment performance remains a key challenge, with expected 29% revenue decline creating margin pressure

Earnings Track Record

| Quarter | EPS Actual | EPS Est. | Result | Surprise % |

|---|---|---|---|---|

| Q3 2025 | $1.85 | $1.54 | Beat | +20.1% |

| Q2 2025 | $1.24 | $1.02 | Beat | +21.6% |

| Q1 2025 | $1.03 | $0.95 | Beat | +8.4% |

| Q4 2024 | $1.68 | $1.75 | Miss | -4.0% |

GE Vernova has beaten consensus estimates in three of its four quarters as an independent company, establishing a 75% beat rate with an average surprise of 12.8%. The Q3 2025 beat of 20.1% and Q2 2025 beat of 21.6% demonstrate accelerating momentum and management’s ability to exceed expectations during the AI-driven power infrastructure demand surge. The single miss in Q4 2024 occurred during the company’s first quarter post-spinoff, when estimate quality was lower due to limited standalone financial history.

The pattern shows improving execution consistency. The Q1 2025 beat of 8.4% expanded to 20%+ in Q2 and Q3, suggesting either conservative guidance, accelerating business momentum, or both. This track record supports the thesis that management has visibility into demand drivers and can deliver results above consensus. However, the 3.4% downward revision in Q4 estimates over the past 30 days suggests analysts are adjusting for tougher comparisons and potential Wind segment headwinds.

Post-Earnings Price Movement History

| Date | Surprise | EPS vs Est. | Next Day Move | Price Change |

|---|---|---|---|---|

| Oct 23, 2024 | +20.1% | $1.85 vs $1.54 | +8.4% | $285.20 → $309.15 |

| Jul 24, 2024 | +21.6% | $1.24 vs $1.02 | +9.8% | $218.45 → $239.85 |

| Apr 24, 2024 | +8.4% | $1.03 vs $0.95 | +3.5% | $168.30 → $174.20 |

| Jan 23, 2024 | -4.0% | $1.68 vs $1.75 | -2.4% | $142.80 → $139.35 |

GE Vernova has demonstrated significant post-earnings volatility, with an average next-day move of 5.8% across its four quarters as an independent company. Beats have driven an average gain of 7.2%, while the single miss resulted in a 2.4% decline. The Q3 2024 reaction of +8.4% on a 20.1% earnings beat and the Q2 2024 reaction of +9.8% on a 21.6% beat show that the market rewards execution with meaningful upside.

The pattern indicates that guidance matters as much as reported results. The Q1 2024 beat of 8.4% produced only a 3.5% stock gain, suggesting either conservative guidance or concerns about sustainability tempered investor enthusiasm. The Q4 2023 miss of 4.0% during the company’s first standalone quarter resulted in a modest 2.4% decline, likely because investors attributed the shortfall to spinoff transition issues rather than fundamental business weakness.

Expected Move & Implied Volatility

42.3%

68%

38.5%

The options market prices a 7.5% expected move for GE Vernova following earnings, slightly above the 5.8% average historical next-day move but below the 7.2% average on beats. Implied volatility of 42.3% sits at the 68th percentile of its range, indicating elevated uncertainty relative to typical trading conditions. The IV premium over 30-day historical volatility of 38.5% suggests options buyers are paying up for protection or positioning for a larger-than-usual move.

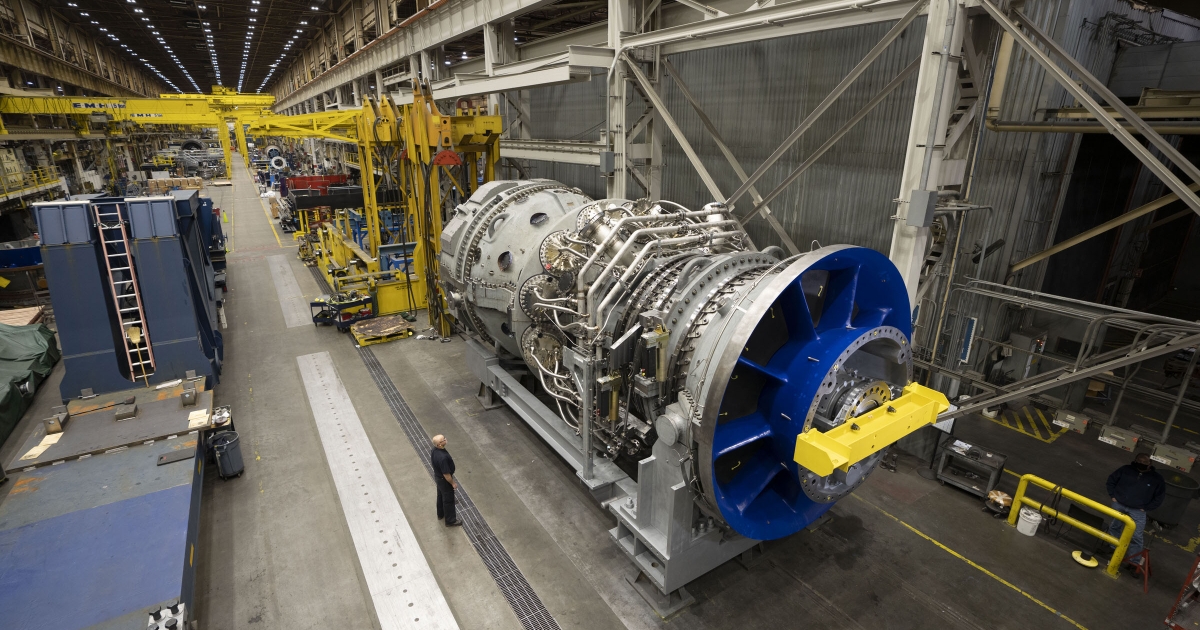

GE Vernova’s corporate facilities house the operations driving the company’s energy infrastructure transformation

Expert Predictions & What to Watch

Key Outlook: Cautiously Bullish

The bull case rests on three pillars: unprecedented demand for power infrastructure driven by AI and data center expansion, policy tailwinds from the Trump administration’s PJM Interconnection initiative, and GE Vernova’s dominant market position in gas turbines and grid solutions. The company’s 33 gigawatts of firm orders and 29 gigawatts in slot reservation agreements provide multi-year revenue visibility, while the $81.2 billion services backlog offers stable, high-margin cash flow. If management guides 2026 EPS to $13.50 or above and provides specific commentary on accelerated order activity from the PJM initiative, the stock could reach $450, representing an 18% gain from current levels.

Key Metrics to Watch

The quarter will test whether GE Vernova can convert its market positioning and policy tailwinds into sustained earnings growth that justifies a 109x trailing earnings multiple. Investors should focus on the magnitude of the earnings beat, the strength of 2026 guidance relative to the $13.15 consensus, and management’s ability to articulate a credible path to margin expansion. Gas turbine order momentum and services revenue growth will demonstrate demand sustainability, while Wind segment performance will indicate whether management can address the structural profitability challenge in that business.

Management’s commentary on the PJM Interconnection initiative carries particular weight given the stock’s 18.9% gain over the past 90 days, much of which followed the January 16 policy announcement. If management provides specific examples of customer commitments or accelerated order activity tied to the policy, the stock will likely sustain its momentum. Conversely, overly cautious commentary that characterizes the initiative as a “statement of principles” without near-term impact could trigger profit-taking among momentum investors who bought the policy narrative.

The valuation multiple creates asymmetric risk. A strong beat with robust guidance could drive the stock to $450, but the premium multiple offers limited downside cushion if results disappoint. Investors should evaluate whether the company’s execution track record, market positioning, and policy tailwinds justify paying 109x trailing earnings for a business with a 4.5% profit margin and structural challenges in one-fifth of its revenue base. For those considering trading vs investing approaches, the high volatility and premium valuation suggest careful position sizing regardless of strategy.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- XTB UK regulated by the FCA – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY