Amazon's stock (NASDAQ: AMZN) is seeing renewed optimism, fueled by projections of a significant boost in free cash flow linked to the recently enacted “One Big Beautiful Bill.” This marks a turnaround in what has been a hugely volatile year for AMZN.

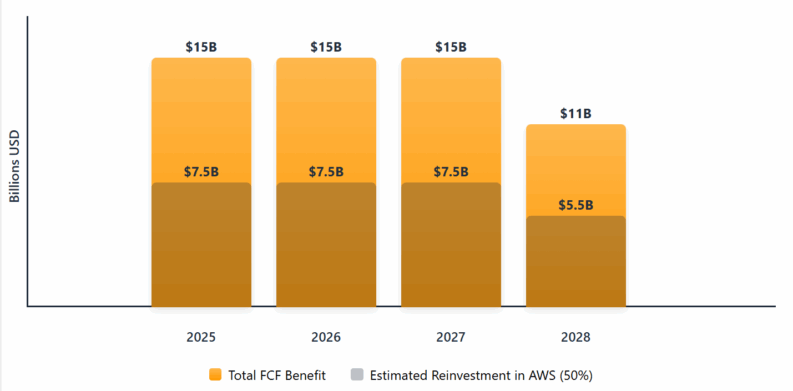

Morgan Stanley analysts estimate that Amazon stands to be the largest beneficiary of this legislation, potentially unlocking $15 billion in annual free cash flow between 2025 and 2027, followed by $11 billion in 2028.

The investment bank believes that a substantial portion of this windfall will be strategically reinvested into Amazon Web Services (AWS). This capital injection could accelerate automation initiatives, leading to substantial cost savings and further solidifying AWS's market leadership.

Morgan Stanley reiterated its “Overweight” rating on Amazon, reaffirming it's price target of $300. The firm cites manageable tariffs, strong AI tailwinds, and continued momentum in AWS as key drivers for this positive outlook. The $300 target represents a potential upside of nearly 30% from the current trading price.

“We believe most of the benefit will be reinvested in Amazon Web Services, but say that even investing 50% of the annual cash flow can drive a much faster path to billions of annual automation savings,” Morgan Stanley analysts noted in their research report.

The stock’s recent performance reflects a recovery from earlier in the year. While AMZN was down 24% year-to-date as of mid-April, it has since rebounded to sit 5.88% higher YTD . This resurgence is largely attributed to easing tariff concerns and robust growth in AI and cloud services, particularly within AWS.

Elsewhere on the day, UBS have raised their price target on AMZN to $271 from $249, seeing Amazon as being ‘most-coiled' from those they cover.

Earnings are expected to show steady growth in this week's report, with a $1.32 consensus $0.06 higher than the same period Y/Y.

Revenue is expected to come in at a growth rate of 9.5%, with $162.02billion expected on the quarter. There have been 8 upside revisions to EPS estimates in the past month leading in, with the street clearly expecting bigger things from Amazon as the days go by.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY