With the August 1, 2025 deadline fast approaching, the United States and the European Union are engaged in intense negotiations to secure a trade agreement, aiming to avoid the imposition of substantial tariffs that could disrupt transatlantic commerce.

Failure to reach an accord could trigger a trade war, sending shockwaves through markets.

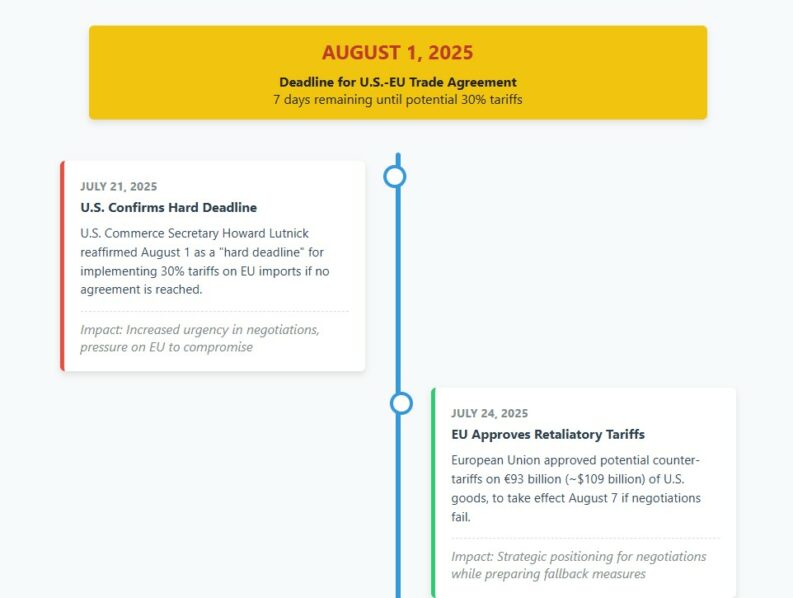

However, the pressure is mounting as both sides prepare for the possibility of failed negotiations. President Trump has threatened to impose 30% tariffs on most EU exports if an agreement is not reached by the deadline with comments today indicating that he puts the chances at “50/50”.

The EU, in turn, has approved potential counter-tariffs on €93 billion (~$109 billion) of U.S. goods, slated to take effect on August 7 if the U.S. proceeds with its tariff plan. This strategic move serves as a deterrent, designed to encourage the U.S. to reach a mutually acceptable agreement.

Brussels is reportedly willing to accept an agreement that may favor the U.S. to avoid severe tariffs according to recent reports. This willingness to compromise underscores the EU’s desire to avoid a trade war that would negatively impact its economy.

Meanwhile, the European Central Bank (ECB) has adopted a cautious approach, maintaining its benchmark interest rate at 2%. ECB President Christine Lagarde cited the uncertainty surrounding the trade negotiations as a key factor in the decision, signaling a “wait-and-watch” stance.

Lagarde noted that inflation remains steady at 2%, aligning with the ECB's medium-term target. She suggested that a successful trade agreement could provide a boost to the economic outlook, reducing the need for further monetary easing.

U.S. Commerce Secretary Howard Lutnick has reiterated the firmness of the August 1 deadline, emphasizing that tariffs will be implemented as scheduled if no agreement is reached. “That's a hard deadline, so on August 1, the new tariff rates will come in,” Lutnick affirmed, underscoring the urgency for both parties to finalize negotiations promptly.

Despite progress in trade talks, disagreements persist over the EU's digital regulations, including the Digital Markets Act and the Digital Services Act. The U.S. has sought discussions on the implementation of these regulations and requested exemptions for U.S. companies.

However, European Commission's technology chief, Henna Virkkunen, has emphasized the importance of these regulations for ensuring trustworthy technologies, indicating the EU's reluctance to compromise on these issues.

The outcome of these negotiations is poised to have far-reaching implications for global trade dynamics, economic policies, and market performances. Investors and policymakers alike are closely monitoring developments, as the clock ticks down to the August 1 deadline.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY