AstraZeneca (LON:AZN) has unveiled plans to inject $50 billion into its U.S. operations by 2030, signaling a major commitment to manufacturing and research within the American market. The move aims to propel the pharmaceutical giant towards its ambitious $80 billion revenue target, with the U.S. expected to contribute 50% of this total.

The firm's landmark $50 billion investment in the United States aims to bolster domestic manufacturing capabilities and strengthen R&D infrastructure across multiple states, supporting the company's revenue growth ambitions and creating thousands of highly skilled jobs.

At the heart of this investment is a proposed multi-billion dollar drug substance manufacturing facility in Virginia. This will be AstraZeneca's most substantial single investment in a facility to date. The plant will focus on producing treatments for chronic diseases, including innovative therapies for weight management and metabolic disorders.

The Virginia facility will produce drug substances for AstraZeneca's innovative weight management and metabolic portfolio, including oral GLP-1, baxdrostat, oral PCSK9, and combination small molecule products. This state-of-the-art center will produce small molecules, peptides, and oligonucleotides.

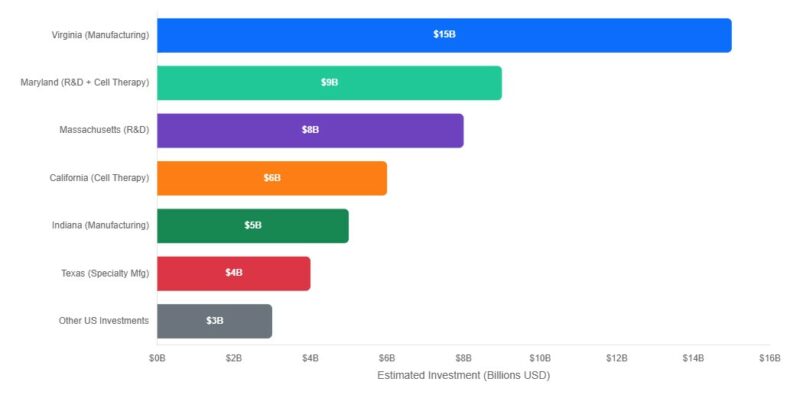

The $50 billion will also fund expansion across AstraZeneca's U.S. footprint. This includes R&D facilities in Maryland and Massachusetts, cell therapy manufacturing in Maryland and California, and continuous manufacturing expansion in Indiana and Texas, plus new clinical trial sites.

“Today's announcement underpins our belief in America's innovation in biopharmaceuticals and our commitment to the millions of patients who need our medicines in America and globally.”

Pascal Soriot, AstraZeneca CEOU.S. Secretary of Commerce Howard Lutnick lauded the investment as a step towards reducing reliance on foreign pharmaceutical supplies. Governor Glenn Youngkin of Virginia echoed this sentiment, highlighting the creation of high-skilled jobs and the strengthening of the domestic supply chain.

While the market is largely flat on AstraZeneca's massive U.S. investment, a devil's advocate perspective suggests potential pitfalls. The sheer scale of the investment could strain resources and divert focus from other critical areas. Moreover, relying heavily on the U.S. market exposes AstraZeneca to specific political and economic risks, including potential drug pricing reforms and changes in healthcare policy.

AstraZeneca's next earnings report, scheduled for July 29, will provide crucial insights into the company's financial performance and the early impact of its strategic initiatives. Analysts project earnings per share (EPS) of $1.11 for the upcoming quarter, representing a 7.77% increase from the same period last year.

The AZN share price has been largely unmoved by the news, with the latest price of 10,238p on the LSE almost exactly where it closed off Monday's session.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY