Barclays has released a comprehensive update on its price targets for a wide array of mid-cap banks, signalling a generally optimistic outlook for the sector as the second quarter earnings season approaches.

The revisions, affecting institutions across the United States, reflect Barclays' belief that current valuations largely fail to appreciate the improving operating and regulatory environment these banks are navigating. While the majority of price targets were raised, a few received more cautious ratings, offering a nuanced perspective on the diverse landscape of mid-cap banking.

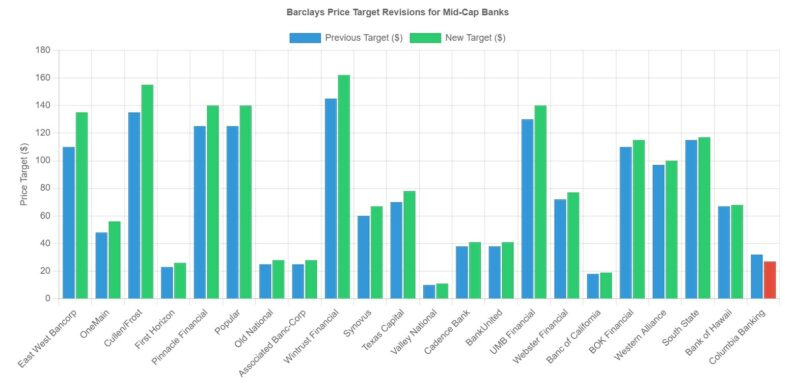

Each of the previous and current targets can be found on the chart below.

Barclays believes valuations in the mid-cap banking group still largely underappreciate an improving operating and regulatory backdrop. Most banks received higher price targets with Overweight ratings dominating the coverage. Only Columbia Banking System saw a price target reduction. East West Bancorp had the largest percentage increase in price target (+22.7%).

One of the most notable adjustments was for Wintrust Financial (WTFC), with Barclays increasing its price target from $145 to $162 while maintaining an Overweight rating. This significant upward revision underscores Barclays' confidence in Wintrust's ability to capitalize on favorable market conditions and deliver strong financial performance. The Overweight rating suggests that Barclays expects Wintrust to outperform its peers in the sector.

Other institutions receiving increased price targets and Overweight ratings include Webster Financial (WBS), UMB Financial (UMBF), Synovus (SNV), South State (SSB), Popular (BPOP), Pinnacle Financial (PNFP), Old National Bancorp (ONB), First Horizon (FHN), East West Bancorp (EWBC), and Cadence Bank (CADE).

These revisions collectively paint a picture of a sector poised for growth, driven by a confluence of factors such as easing regulatory burdens, rising interest rates (benefiting net interest margins), and a strengthening economy.

Not all mid-cap banks received such glowing endorsements. Valley National (VLY) and Texas Capital (TCBI) saw their price targets modestly increased, but retained Underweight ratings.

This suggests that while Barclays acknowledges some positive developments within these institutions, concerns remain regarding their long-term prospects or potential headwinds they may face.

Columbia Banking (COLB) was the only bank to have its price target lowered, seeing the previous level of $32 trimmed to $27, accompanied by a maintained Equal Weight rating, indicating a less optimistic outlook compared to its peers.

Cullen/Frost (CFR) and OneMain (OMF) also received Equal Weight ratings, signalling a neutral stance from Barclays, suggesting that these banks are expected to perform in line with the broader market.

The rationale behind Barclays' bullish sentiment centers on the notion that the market has yet to fully recognize the positive impact of the evolving regulatory landscape on mid-cap banks. Years of stringent regulations following the 2008 financial crisis are gradually being eased, providing these institutions with greater flexibility in their operations and capital management.

This, coupled with a generally improving economic outlook, is expected to fuel loan growth, boost profitability, and ultimately drive shareholder value.

The upcoming second quarter earnings season, kicking off next week, could be crucial in validating Barclays' optimistic outlook. Markets will be closely scrutinizing key metrics such as net interest margin, loan growth, asset quality, and expense management to assess whether mid-cap banks are indeed capitalizing on the favorable operating environment. Any significant deviations from expectations could trigger swift market reactions, underscoring the inherent risks associated with investing in this sector.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY