Cadence Design Systems stock (NASDAQ: CDNS) has been given a boost leading into today's earnings results, as Baird move CDNS to Outperform, and hike the price target to $380 (from $340). The firm like the setup here, and expect further growth to come through the second half.

The company is set to report Q2 2025 results after market close today, with markets expecting solid double digit growth from Cadence.

Analysts are projecting a solid quarter, with consensus revenue estimate standing at $1.25 billion, an 18% year-over-year growth rate. Earnings per share (EPS) are also expected to grow strongly, reaching $1.56, up from $1.28 in the same quarter Y/Y.

These figures align closely with the company's performance in the first quarter of 2025, where Cadence reported revenue of $1.25 billion.

The positive outlook for Cadence is supported by several factors. The company's solutions are critical for designing advanced semiconductors, systems, and electronic devices, positioning it to benefit from the ongoing demand for innovation in areas such as artificial intelligence, 5G, and automotive electronics.

Cadence's performance in recent quarters has boosted the bulls leading in, with the stock having added 28.23% over the past 12 month, and trading near all-time-highs.

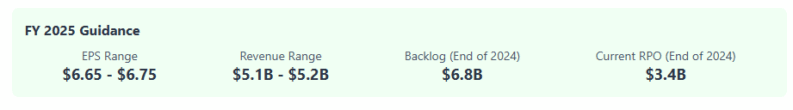

Having beat in Q1 2025, with an EPS of $1.57 exceeding the consensus estimate of $1.49, momentum has been building. Furthermore, the company ended 2024 with a record backlog of $6.8 billion and a record current remaining performance obligations (CRPO) of $3.4 billion, indicating strong future revenue visibility.

For the full fiscal year 2025, Cadence has provided earnings guidance of $6.65 to $6.75 per share and revenue guidance between $5.1 billion and $5.2 billion.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY