Canadian National Railway's stock (NYSE:CNI) has pulled back 10% since the start of July, setting up a bearish beginning to H2. It could be set to get worse, with persistent economic uncertainty and trade volatility forcing the company to trim its financial outlook.

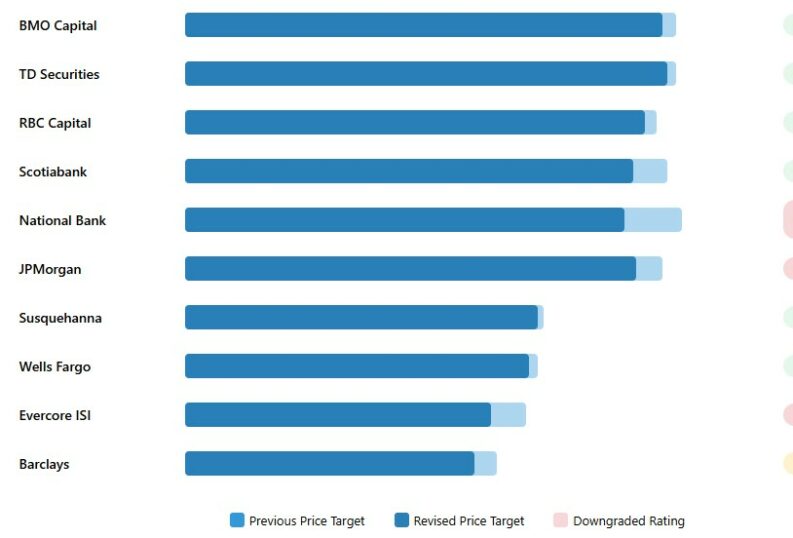

The revised guidance has prompted a flurry of downgrades and price target reductions from the street, and analysts move lower.

- CN Rail has revised its FY25 EPS growth outlook from 10-15% to mid-high single digits due to economic uncertainty and trade/tariff volatility.

- All 10 major analyst firms have cut their price targets, with an average reduction of approximately 5%.

- 3 firms downgraded their ratings: National Bank (Outperform → Sector Perform), JPMorgan (Overweight → Neutral), and Evercore ISI (Outperform → In Line).

- Largest price target cuts: National Bank (-C$20), Evercore ISI (-$11), and Scotiabank (-C$12).

- Despite the downgrades, 6 of 10 firms maintain positive ratings (Outperform/Buy/Positive/Overweight).

- CN Rail has withdrawn its 2024-2026 financial outlook due to continued macroeconomic uncertainty.

CNI announced it now expects adjusted diluted EPS growth in the mid-to-high single-digit range for 2025, a significant departure from its earlier projection of 10% to 15%. This revision is primarily attributed to economic uncertainty and persistent trade and tariff volatility impacting key economic sectors.

Adding to investor unease, CN has withdrawn its 2024-2026 financial outlook entirely, citing the continued high level of macroeconomic uncertainty and evolving trade policies. Despite the lowered expectations, CN plans to continue its capital program, investing approximately C$3.4 billion, net of customer reimbursements.

The revised outlook has sent analysts scrambling to adjust their price targets. BMO Capital analyst Fadi Chamoun lowered the firm's price target on CN to C$163 from C$168 but maintains an Outperform rating. Similarly, Scotiabank analyst Konark Gupta reduced the price target to C$153 from C$165, while also keeping an Outperform rating.

Susquehanna lowered its price target to $120 from $122, maintaining a Positive rating. The firm noted that weaker grain and merchandise revenue contributed to an operating miss in Q2, although lower fuel pricing partially offset the impact. RBC Capital reduced its price target to $157 from $161, retaining an Outperform rating, and viewed the recent change in the CCO role as neutral to favorable given the view on the incoming CCO Janet Drysdale.

Wells Fargo analyst lowered the firm's price target on CN to $117 from $120, maintaining an Overweight rating, noting that estimates need to reset lower due to a weaker volume and profit outlook for the second half of 2025. The firm expressed concerns that the revised guidance may still be optimistic.

Evercore ISI analyst Jonathan Chappell downgraded CN to In Line from Outperform, slashing the price target from $116 to $105. The firm cited softer-than-expected volumes and concerns that limited margin expansion would hamper earnings upside. The analyst also pointed out that CN's share buybacks are well below annual expectations, further hitting earnings.

Barclays analyst Brandon Oglenski lowered the firm's price target on CN to $99 from $106, maintaining an Equal Weight rating. The analyst indicated that withdrawn 2026 targets, reduced 2025 earnings estimates, and slightly weaker-than-expected Q2 results would likely weigh on the shares.

JPMorgan downgraded CN to Neutral from Overweight, with a price target of C$154, down from C$163. The firm cited that its upgrade thesis did not play out. The “sudden departure” of the chief commercial officer after 15 months on the job raises questions around CN's commercial strategy. JPMorgan sees downside risk to estimates if the company's volumes do not recover as quickly as management forecasts given the lingering impact from tariffs.

National Bank analyst Cameron Doerksen downgraded CN to Sector Perform from Outperform, lowering the price target from C$170 to C$150. TD Securities analyst Cherilyn Radbourne lowered the firm's price target on CN to C$165 from C$168 but maintained a Buy rating.

Despite the prevailing pessimism, it's crucial to recognize that economic forecasts are inherently uncertain. A positive shift in trade relations or a stronger-than-expected economic recovery could quickly alter CN's trajectory. Those with a long-term perspective and a tolerance for risk may find value at these levels.

Ultimately, the long-term outlook for CN will depend on its ability to adapt to a dynamic and uncertain economic environment. While the near-term challenges are undeniable, the company's inherent strengths and strategic investments provide a foundation for future success.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY