The Walt Disney Company (NYSE: DIS) is poised to release its fiscal third-quarter earnings before the market opens tomorrow, with the stock price toying with $120 for much of the past couple of months.

Analysts are looking for earnings per share (EPS) of $1.44, an improvement on the $1.39 last year. Revenue is projected at $23.76 billion, up 2.61% from $23.16 billion a year ago, reflecting modest growth in sales.

The analyst community is largely optimistic about Disney's prospects. UBS recently boosted its price target for the stock to $138 from $120, reiterating a “Buy” rating. Their rationale centers on strong demand at Disney's theme parks and improving profitability in the direct-to-consumer (DTC) segment.

JPMorgan Chase echoes this sentiment, raising its price target to $138 from $130, citing anticipated operating income gains within the DTC segment, fueled by both increased volume and strategic pricing adjustments. The overall consensus among 28 analysts points to a “Strong Buy” rating, with an average price target of $132.32, implying further upside potential from current trading levels.

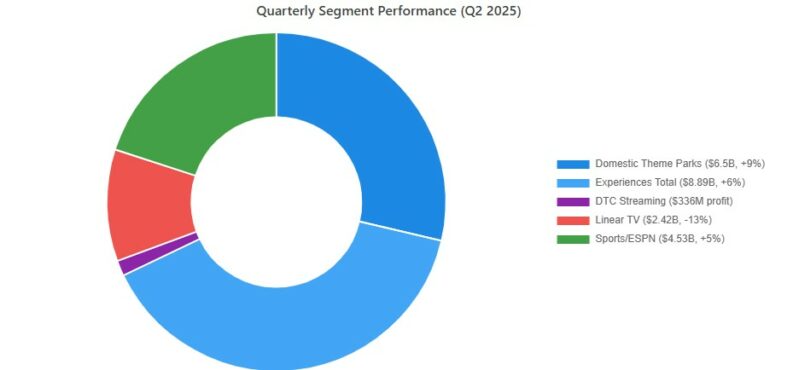

Looking at the most recent quarter for clues, Disney's direct-to-consumer (DTC) segment, particularly its streaming services like Disney+, Hulu, and ESPN+, remains a key area of focus. In the second quarter of fiscal 2025, the DTC segment reported an operating income of $336 million, a substantial increase from $47 million in the same period last year.

This impressive growth has been attributed to strategic price hikes and increased advertising revenues. The company's efforts to crack down on password sharing by introducing an extra-member fee are also expected to contribute to revenue growth by converting shared users into paying subscribers.

The Experiences segment, which includes theme parks, resorts, and cruise lines, has consistently been a strong performer for Disney. In the second quarter, revenue for this segment rose 6% to $8.89 billion, with domestic theme parks experiencing a 9% increase to $6.5 billion.

This growth was driven by higher guest spending and increased cruise line business, bolstered by the launch of the new Disney Treasure cruise ship. Analysts anticipate this positive trend to continue, further fueling the company's overall earnings growth.

Disney's media networks segment is facing a more complex landscape. While the linear television segment has experienced challenges, with revenue declining by 13% to $2.42 billion, the sports segment, primarily ESPN, has shown resilience, with a 5% revenue increase to $4.53 billion. This growth was driven by higher advertising revenues from additional college football playoff games and NFL broadcasts.

In the run-up to earnings, projected EPS figures have diverged – 6 seeing upward revisions, while 2 have moved down. With the stock having added 35% in the past 12 months, there has been plenty of the old magic at Disney for bulls to look to, yet tomorrow's print will have added expectations.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY