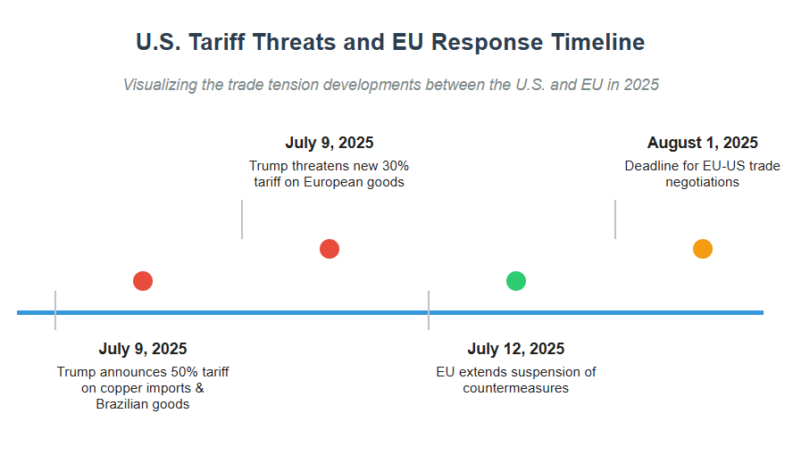

In a move designed to avert an immediate transatlantic trade war, European Commission President Ursula von der Leyen has announced the EU will extend the suspension of its trade countermeasures against the United States until August 1, 2025.

This decision comes in response to President Donald Trump's recent threat to impose a sweeping 30% tariff on European goods, a move that has rattled global markets and prompted the EU to seek further negotiations. The extension represents a delicate balancing act, signalling the EU's desire for a negotiated solution while simultaneously preparing for potential retaliatory measures should discussions fail.

Von der Leyen emphasised the EU's continued commitment to finding common ground with the U.S., stating that the bloc remains ready “to continue working towards an agreement by Aug 1.” However, she also underscored the EU's resolve to protect its interests, asserting that it is prepared to take “all necessary steps to safeguard EU interests, including the adoption of proportionate countermeasures if required.” This dual approach highlights the precarious nature of the current trade relationship and the high stakes involved.

The EU's strategy involves not only extending the olive branch of negotiation but also actively preparing for a scenario where talks break down. Von der Leyen revealed that the EU has developed a second potential list of countermeasures, demonstrating its readiness to respond swiftly and decisively to any U.S. tariffs. Furthermore, the EU is actively seeking to diversify its trade relationships, as evidenced by a recently concluded free trade agreement with Indonesia, a move aimed at reducing its reliance on the U.S. market.

President Trump's tariff announcements have had a cascading effect on global trade relations. His recent imposition of a 50% tariff on copper imports and Brazilian goods, justified on national security grounds and aimed at bolstering the U.S. copper industry, has fueled fears of a broader trade conflict.

Similar high tariffs have been levied on imports from 21 other countries, including key trading partners such as South Korea and Japan, further escalating tensions and raising concerns about the future of global trade.

In response, the EU is actively lobbying for early U.S. tariff relief and a “stand-still clause” to prevent the imposition of any new tariffs during ongoing negotiations. Bernd Lange, head of the European Parliament’s trade committee, has emphasised the EU's efforts to secure immediate tariff reductions upon the signing of a framework agreement. However, the U.S. has yet to agree to these demands, creating a significant obstacle to progress.

However, the underlying uncertainty surrounding trade policies continues to pose a significant risk. Economists caution that the full impact of the tariffs may not be immediately apparent and could materialise in the coming months as inventories are depleted.

The administration's lack of clarity on its trade policies further contributes to this uncertainty, potentially undermining investor confidence and broader economic stability. Sectors reliant on transatlantic trade, such as autos (BMW, Volkswagen), aerospace (Airbus, Boeing), and luxury goods, remain particularly vulnerable to any escalation in trade hostilities.

The EU's decision to extend the suspension of trade countermeasures against the U.S. represents a calculated effort to de-escalate tensions , match the U.S position, and pursue a negotiated solution. While markets have, thus far, exhibited a degree of stability, the clock is ticking, and the future of transatlantic trade hangs in the balance.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY