HubSpot (NYSE: HUBS) saw its price target nudged down by Jefferies Financial Group to $650 from $700 following its Q2 2025 earnings release, yet the firm maintained its “Buy” rating, signalling continued confidence in the company's growth prospects.

The analyst cited HubSpot's robust fundamentals, positive management tone, and better-than-expected guidance as key factors underpinning their bullish stance.

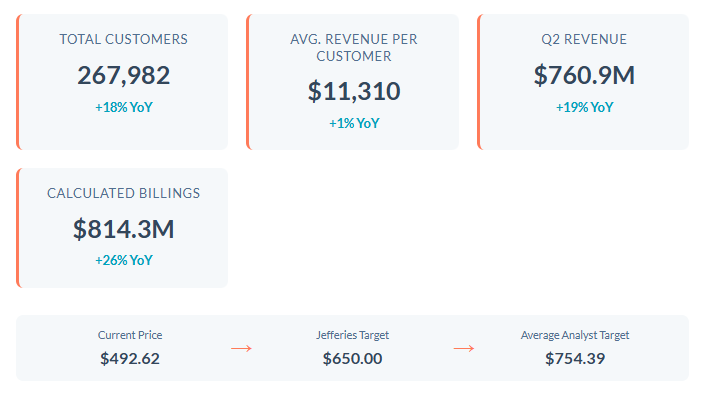

HubSpot's stock has moved 5.96% higher in the pre-market to $522, with Jefferies' revised target indicating a perceived upside of more than 20% from here.

Stellar Q2 Results and Optimistic Outlook

HubSpot's Q2 2025 results showcased significant growth. Total revenue reached $760.9 million, a 19% increase year-over-year, exceeding analysts' expectations of $740.1 million. The company's customer base expanded to 267,982, an 18% jump from the previous year.

Calculated billings also saw a healthy surge, reaching $814.3 million, up 26% as-reported and 20% in constant currency.

The company also provided an optimistic outlook, projecting FY25 EPS between $9.47 and $9.53, surpassing the consensus estimate of $9.36. Q3 EPS is projected between $2.56 and $2.58, also above the consensus of $2.54.

“Q2 was another solid quarter of continued revenue growth and customer expansion,” stated Yamini Rangan, CEO of HubSpot. “Our strategy is to be the leading AI-first customer platform for scaling companies, and I'm excited by the progress we're making. Customer Agent and Prospecting Agent are delivering results for customers, and our embedded AI features are helping go-to-market teams work smarter and faster. We're innovating rapidly, reimagining our product and our company to be AI-first, and relentlessly focused on delivering customer value. Heading into Q3, we're strongly positioned to deliver durable, long-term growth.”

Jefferies' analyst highlighted that management's commentary on the role of inbound marketing within an AI-driven landscape should alleviate investor anxieties concerning HubSpot's long-term sustainability and competitive edge.

The company's proactive integration of AI into its platform, exemplified by tools like the Customer Agent, which autonomously handles support tickets, demonstrates a commitment to innovation and efficiency.

A word of caution is needed, as despite the positive outlook, the stock's current price had been in state of freefall this year leading in, with a 29% decline YTD. There could also be further analyst shifts as the recent results are digested and modelled out.

Looking ahead, HubSpot's ability to successfully execute its AI-first strategy, maintain its growth trajectory, and effectively compete in the evolving CRM market will likely prove critical in shaping up where the stock goes from here.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY