IBM's stock (NYSE:IBM) is trading sharply lower today, down 8.1% and falling below $260, after its Q2 earnings report disappointed the street. While overall revenue and adjusted EPS exceeded expectations, weakness in the software segment has spooked investors.

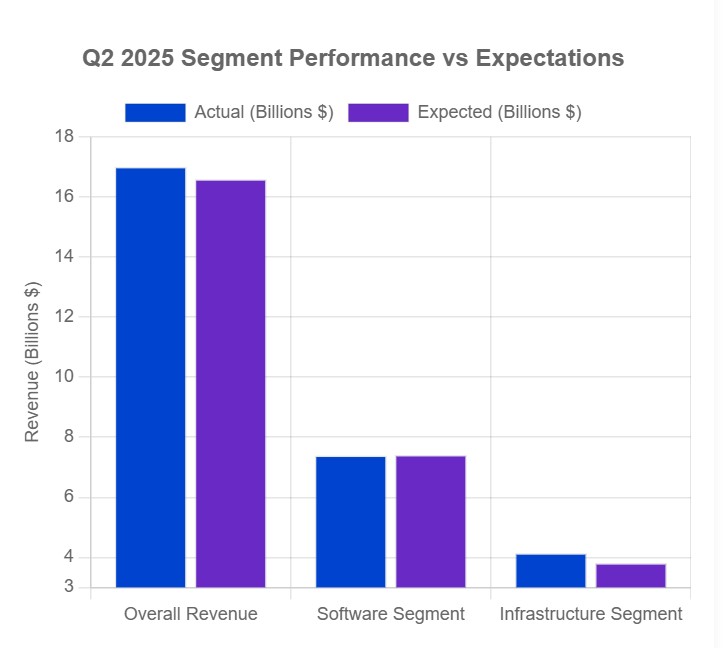

IBM's Q2 revenue reached $16.98 billion, a 7.7% year-over-year increase. Adjusted EPS came in at $2.80, surpassing consensus estimates. However, software revenue of $7.39 billion fell short of projections, raising concerns about the segment's growth trajectory.

Bank of America (BofA) responded to the earnings release by lowering its price target on IBM to $310 from $320, while maintaining a Buy rating. The firm cited a “mixed quarter” in which stronger-than-expected infrastructure results offset organic software deceleration.

According to BofA's analyst note, the outperformance of the infrastructure business, while positive, may limit near-term valuation due to its cyclical nature. The analyst believes that IBM’s software performance needs to improve in the second half of the year to justify a higher valuation. The analyst added that this has “turned into a show me story on software” in the second half, but remains bullish on the overall company trajectory.

IBM's Q2 performance highlighted the strength of its Infrastructure segment, which includes AI-enhanced mainframes. Revenue from this segment reached $4.14 billion, exceeding projections of $3.81 billion. However, the software segment's slight miss, attributed to clients reallocating investments toward AI-specialized mainframes, tempered investor enthusiasm.

CEO Arvind Krishna stated that IBM's AI-related business bookings have risen to $7.5 billion, up $1.5 billion from the previous quarter. The company also raised its full-year free cash flow outlook to over $13.5 billion, signaling confidence in its strategic direction.

Despite the long-term optimism surrounding AI and hybrid cloud solutions, the market's immediate reaction reflects concerns about IBM's ability to maintain growth in its core software business. The company's performance in the second half of 2025 will be crucial in determining whether it can regain investor confidence and justify its current valuation.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY