Markets are gearing up for one of their busiest weeks of the year, with more than 150 companies on the S&P 500 reporting this week, on top of a spate of important data, and the all important FOMC meeting.

Fresh off the weekend's news of an EU/U.S trade deal, markets are moving higher in the pre-market, with the SPY up 0.3%, and the QQQ's up more than 0.5% leading into the new week.

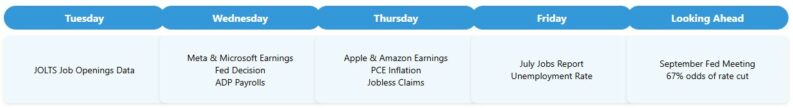

It will be hard to escape earnings news this week, with four of the Mag 7 set to report, on Wednesday and Thursday, after market close. With Meta, Microsoft, Apple, and Amazon, all coming to the table, markets will be looking for a continuation in Capex, akin to Alphabet last week, and looking for any news relating to AI.

Management's commentary regarding AI spending and the returns on those investments could prove to be more important than the financials themselves.

Outside of tech, there will be plenty of other names to keep tabs on as the week progresses, with almost 1/3rd of the S&P 500 releasing financials. You can expect various previews here in the days to come on specific companies, with the expectations for Boeing already up.

Federal Reserve Meeting and Interest Rate Outlook

This week, the Federal Reserve will conclude its two-day policy meeting. Despite what President Trump may have said after his meeting at the Fed last week, the central bank is widely expected to hold interest rates steady in the current target range of 4.25% to 4.5%.

However, markets will be closely scrutinizing the Fed's statement and press conference for any indications of a potential rate cut at the September meeting. While current odds for a July cut are minimal, the probability of a September cut currently sits at 67%.

Economic Data in Focus: PCE Inflation and Jobs Report

The market will also be closely monitoring key economic data releases this week.

On Thursday, the June Personal Consumption Expenditures (PCE) price index, the Fed's preferred measure of inflation, will be released.

Economists expect the PCE to rise to 2.4% year-over-year, up from 2.3%, and to 0.31% on a monthly basis, from 0.14%.

The July jobs report, due on Friday, is expected to show a slowdown in job growth, with economists anticipating 115,000 jobs added, down from 147,000 in June, and a slight increase in the unemployment rate to 4.2% from 4.1%.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY