Microsoft's stock price (NASDAQ:MSFT) has been flirting with highs leading into today's earnings, with the intraday high of $517.62 in yesterday's session less than $1 below the ATH.

With earnings due after today's close, followed by a conference call at 5:30 pm ET, all eyes will be on the tech giant for clues about the it's outlook in key areas. particularly its cloud computing arm, Azure, and its burgeoning artificial intelligence initiatives.

The street is expecting the firm to print an EPS of $3.38, up strongly from the $2.95 in the same period last year, on revenue of $73.84 billion, itself a 14.08% growth rate. The real story lies beneath the surface.

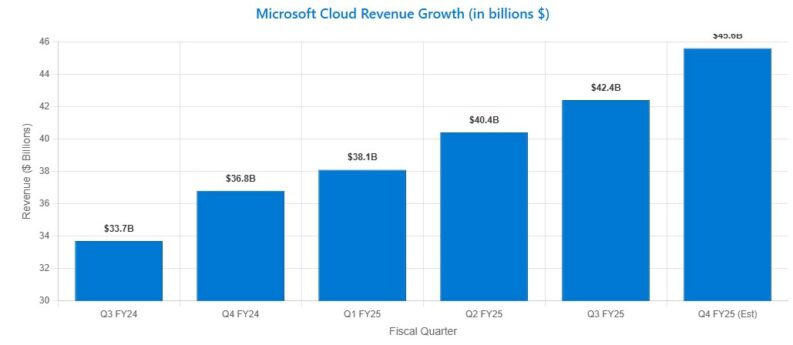

The prior quarter saw Microsoft exceeding expectations, with CEO Satya Nadella emphasizing the pivotal role of cloud and AI in driving business transformation. CFO Amy Hood highlighted the impressive 20% (22% in constant currency) growth in Microsoft Cloud revenue, reaching $42.4 billion. These figures have fueled optimism, but the looming question is whether Microsoft can sustain this momentum.

Azure's performance will undoubtedly be a central theme.

Analysts are projecting growth in the mid-30% range in constant currency, with AI services becoming an increasingly significant contributor.

The degree to which Microsoft is effectively monetizing its AI investments, including the adoption rates of Microsoft 365 Copilot and other AI-powered products, will also be under the microscope. Concrete data points that validate the company's vision of AI as a major revenue driver and long-term competitive advantage could well set up a further bull run.

Microsoft's aggressive push into AI necessitates substantial capital expenditure, primarily focused on building out its AI infrastructure. The projected $80 billion investment for fiscal year 2025 has already impacted cloud gross margins.

Markets will be keen to hear management's commentary on future capital spending plans, with the rate of spending likely to have significant implications for the company's near-term and long-term financial outlook.

An increased rate of spending was actually seen as a positive for Alphabet during their own earnings, with the expectations that returns will come in time, and the commitment to the firm in it's attempts to dominate AI being seen as a future growth indicator.

The recent announcement of layoffs affecting approximately 9,000 employees, representing ~4% of Microsoft’s global workforce, has raised some eyebrows. While the company frames these cuts as part of an ongoing effort to optimize its organizational structure and improve efficiency, the move underscores the competitive pressures and the need to adapt to a rapidly changing technological landscape.

Nadella himself acknowledged the emotional toll of these decisions. The conference call will likely address how these workforce reductions will impact Microsoft's strategic priorities and its ability to execute its long-term vision.

Looking to the street, Stifel analysts raised their price target on Microsoft leading in, to $550 from $500, reiterating a Buy rating.

The firm anticipates that Microsoft's Azure cloud platform will outperform expectations, potentially adding 100-200 basis points of upside to the company's year-over-year constant currency growth guidance of 34-35%.

This projection is based on healthy results from peers like Google Cloud and ServiceNow, coupled with “strong checks” indicating an acceleration in enterprise spending.

The analyst firm expects Azure growth to remain robust, projecting rates in the mid-30% range in the coming quarters. This positive outlook aligns with recent target hikes from other firms, such as Jefferies, who also increased their price target to $550, citing Microsoft's strong third-quarter performance and consistent demand signals.

Raymond James have also revised upwards, pushing their price target from $490 to $570, also expecting Azure to land at the top end of guidance.

While the consensus outlook is largely positive, the devil will be in the details, and more importantly the outlook and commentary. Analysts have revised EPS estimates leading in, with 4 upwards revisions in the last 30 days, and 2 moving down. Expectations for the next year are improving however, with 8 upwards revisions, and only 3 to the downside.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY