Despite Netflix's stock (NFLX) dipping by 5.10% following Q2 2025 earnings release, multiple analysts have raised their price targets, reflecting continued confidence in the company's long-term growth trajectory.

While the firm delivered a strong second quarter, beating the street on both revenue and EPS, markets reacted negatively, sending the stock down 5.1% to end the week. This dip came despite several firms, including Baird, raising their price targets, signalling a divergence between short-term market sentiment and long-term analyst outlook.

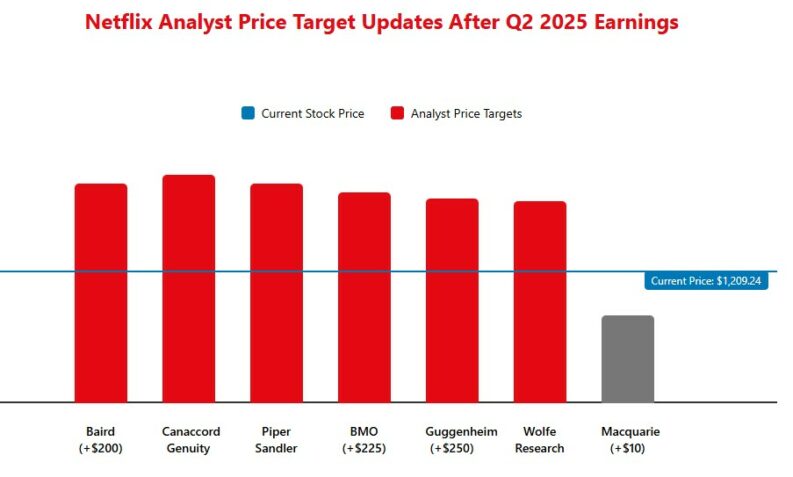

Baird’s upgrade is particularly noteworthy. The firm increased its price target from $1,300 to $1,500, maintaining an “Outperform” rating. This bullish stance is rooted in an updated model following the Q2 results, suggesting Baird sees underlying strength in Netflix’s business that the market is currently overlooking.

Other firms echo this sentiment, with Guggenheim setting a $1,400 target (up from $1,150), Piper Sandler at $1,500 (from $1,400), and Wolfe Research at $1,390 (from $1,340).

The Q2 numbers themselves show solid growth, even if much of this was expected. Netflix reported an EPS of $7.19, up 47% YoY. Revenue reached $11.08 billion, up 16% from the same period last year.

These results led to many analysts raising their price targets, indicating confidence in Netflix's long-term growth trajectory. Jefferies raised to $1,500 from $1,400, maintaining a “Buy” rating and highlighting Netflix's solid performance, including a 17% year-over-year revenue growth on a foreign exchange-neutral basis.

Canaccord reiterated its “Buy” rating with a price target of $1,525, as all geographic regions achieved double-digit year-over-year foreign exchange-neutral growth.

While the company beat estimates, some analysts believe the “good” results weren't enough to justify the stock's premium valuation. The decline in free cash flow margin from 25.2% to 20.4% quarter-over-quarter may also be contributing to investor apprehension.

The revenue forecast also came in a bit lighter than the street wanted, with this potentially being driven by a weaker U.S. dollar.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY