NIO's stock price (NYSE: NIO) has had a 2025 of two halves so far, reversing 33% over the past four months, having started the year with more than 15% in gains.

The Chinese EV maker now finds itself with a market cap 23.5% below where it began the year, and more than 90% off the highs of 2021.

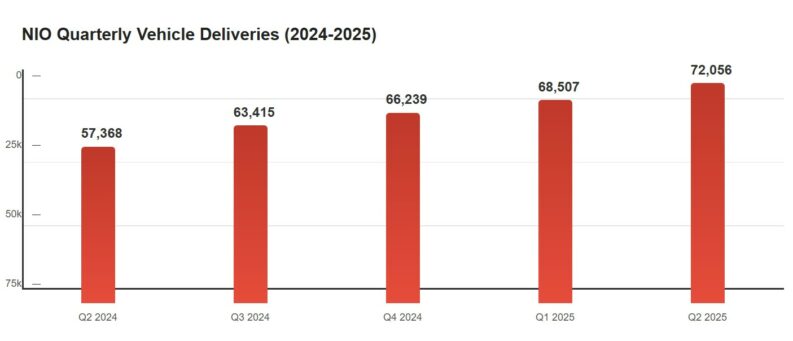

The NIO bulls will point to recent delivery numbers as a sign of improving operations, although persistent financial challenges and cautious analyst sentiment continue to weigh on the stock.

The company's recent performance has been a mixed bag. NIO reported a 17.5% year-over-year increase in June deliveries, shipping 24,925 vehicles. Second-quarter deliveries totalled 72,056, a 25.6% increase compared to the same period last year, bringing total cumulative deliveries to 785,714.

These figures suggest that NIO is successfully ramping up production and meeting consumer demand, particularly as it diversifies its product portfolio.

NIO's strategic expansion into new market segments is evident with the introduction of two new brands: Onvo and Firefly. Onvo, aimed at the mass market, launched its first model, the L60, in May 2024, positioning it as a direct competitor to the Tesla Model Y. The L60 emphasizes low energy consumption and extended range, appealing to a broader customer base. Deliveries began in September 2024. Firefly, on the other hand, targets the small, high-end EV market.

The first Firefly model, a subcompact hatchback, was unveiled in April 2025, with deliveries commencing shortly after. NIO plans to expand Firefly’s reach to 16 new markets across five continents by the end of 2025. These new brands, along with the flagship ET9 sedan launched in December 2024, demonstrate NIO's commitment to innovation and market diversification. The ET9 boasts impressive specifications, including a dual-motor all-wheel-drive system and a 100 kWh swappable battery.

However, these positive developments are overshadowed by persistent financial concerns, with the firm unprofitable, with negative earnings and significant cash burn. The company's need to raise capital is evident in its March 2025 announcement of an upsized HK$4,030.13 million offering of class A ordinary shares.

Analysts remain cautious about NIO's prospects, citing tariff-driven volatility and broader challenges in the Chinese EV sector. The consensus of $4.73 reflects considerable upside potential from the current level, although operations will need to progress smoothly in order for the company to realise this.

The local market is growing increasingly competitive, and NIO will need to hit it's marks. One of the keys to NIO's future success lies in its ability to translate delivery growth into sustainable profitability.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY