Northrop Grumman’s stock (NYSE: NOC) is 31.35% higher on a 1 year basis ahead of this morning’s earnings, with bulls eyeing a further move to highs.

$94.6B

23.8

$6.46

$10.71B

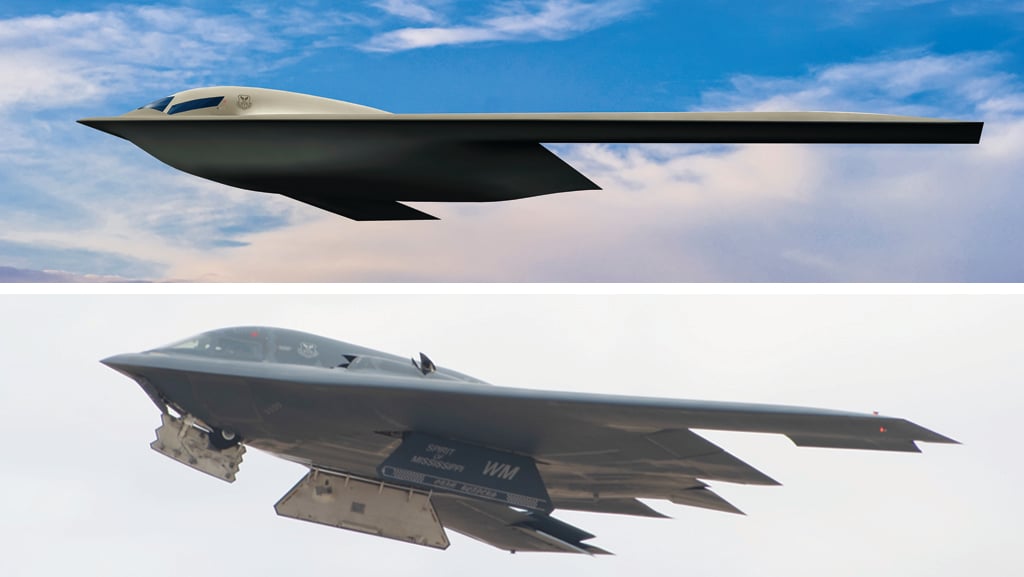

Fourth-quarter results will provide clarity on B-21 program execution following the first-quarter loss provision reset

Northrop Grumman reports fourth-quarter and full-year 2025 results on January 27 before market open. The quarter closes a fiscal year defined by the B-21 LRIP loss provision that forced a $2.74 per share EPS reset in Q1, followed by consecutive margin-recovery beats in Q2 and Q3. Consensus sits at $6.46 EPS on $10.71B revenue, both tracking above the implied company guidance midpoint of roughly $6.75 EPS and $11.5B sales embedded in the October raised full-year outlook.

The setup creates asymmetric risk: execution that merely meets the raised FY25 guide ($25.65–$26.05 EPS; $41.7–$41.9B sales) may disappoint a market that has priced in 38% stock appreciation over the past year and now demands confirmation that the B-21 issue remains ring-fenced while the rest of the portfolio sustains margin momentum.

The estimate narrative shifted twice in 2025. Management’s initial FY25 outlook framed at $28.05 EPS midpoint collapsed to $25.15 after the April B-21 disclosure, then rebuilt incrementally to $25.85 by October as Defense Systems and Mission Systems execution offset Aeronautics headwinds.

Consensus Estimates

| Metric | Consensus Est. | Range | Implied Guidance | YoY Change |

|---|---|---|---|---|

| EPS (Adjusted) | $6.46 | $6.30 – $6.67 | ~$6.75 | -7.8% |

| Revenue | $10.71B | $10.65B – $10.88B | ~$11.5B | +7.2% |

| FY25 EPS | $26.07 | $25.72 – $26.47 | $25.65 – $26.05 | -7.4% |

| FY25 Revenue | $41.86B | N/A | $41.7B – $41.9B | +5.1% |

Analysts Covering: 18 (EPS), 17 (Revenue)

Estimate Revisions (30d): 5 up / 0 down

The consensus EPS estimate of $6.46 sits 4% below the implied company guidance of roughly $6.75 derived from the October raised full-year range, creating a setup where a “beat” requires clearing both the Street number and management’s embedded Q4 assumption. Revenue consensus at $10.71B tracks 7% below the $11.5B implied guide, a gap consistent with the pattern of conservative Street positioning following three consecutive revenue misses.

Management Guidance and Commentary

“We are raising our 2025 sales and segment operating margin rate guidance to reflect our strong performance through the first three quarters of the year and our expectations for the fourth quarter.”

Management’s October 21 guidance raise to $25.65–$26.05 EPS (midpoint $25.85) and $41.7–$41.9B sales (midpoint $41.8B) followed a Q3 EPS beat of $7.67 versus $6.44 expected, but paired the profit increase with a revenue range cut from the prior $42.05–$42.25B. The combination signaled that margin capture across Mission Systems and Defense Systems was overcompensating for top-line timing friction in Space Systems and Aeronautics.

Mission Systems segment margin resilience has offset program timing headwinds across the portfolio

“Sales decreased primarily due to lower volume on restricted space programs and NGI, partially offset by higher volume on GBSD and other programs.”

The Q3 commentary explicitly quantified the Space Systems headwind that drove the revenue guide cut, attributing the shortfall to restricted-program wind-down rather than demand softness. This framing matters because it positions the revenue compression as a known, finite drag rather than a structural execution issue.

Analyst Price Targets & Ratings

Wall Street maintains a positive outlook with 82% of analysts rating shares a Buy or Strong Buy. The modest 2.9% upside to the $680.44 consensus target reflects the stock’s recent 38% appreciation and suggests much of the recovery narrative is already priced in.

Sector & Peer Comparison

| Company | Ticker | Market Cap | P/E | Fwd P/E | Profit Margin |

|---|---|---|---|---|---|

|

Northrop Grumman

⭐ Focus |

NOC | $94.6B | 23.8 | 22.9 | 9.8% |

|

Lockheed Martin

|

LMT | $135.2B | 19.4 | 18.2 | 11.2% |

|

RTX Corporation

|

RTX | $162.8B | 28.6 | 21.4 | 7.9% |

|

General Dynamics

|

GD | $78.4B | 21.2 | 19.8 | 10.1% |

|

L3Harris Technologies

|

LHX | $46.9B | 24.1 | 20.3 | 11.4% |

|

Boeing

|

BA | $108.3B | N/A | N/A | -8.3% |

Northrop trades at a 23.8 trailing P/E and 22.9 forward P/E, representing a 23% premium to Lockheed Martin’s 19.4 trailing multiple. The premium reflects investor willingness to pay for B-21 program exclusivity, but the 9.8% profit margin lags Lockheed’s 11.2%, creating a valuation-versus-profitability tension that requires margin expansion to justify.

Earnings Track Record

| Quarter | EPS Actual | EPS Est. | Result | Surprise % |

|---|---|---|---|---|

| Q3 2025 | $7.67 | $6.46 | Beat | +18.7% |

| Q2 2025 | $8.15 | $6.80 | Beat | +19.9% |

| Q1 2025 | $3.32 | $6.26 | Miss | -47.0% |

| Q4 2024 | $6.39 | $6.35 | Beat | +0.6% |

| Q3 2024 | $7.00 | $6.07 | Beat | +15.3% |

| Q2 2024 | $6.36 | $5.93 | Beat | +7.3% |

| Q1 2024 | $6.32 | $5.78 | Beat | +9.3% |

| Q4 2023 | $6.27 | $5.80 | Beat | +8.1% |

Northrop has beaten EPS estimates in 15 of the past 18 quarters, an 83.3% success rate with an average surprise of 4.5%. The Q1 2025 miss stands as the only earnings shortfall in the past three years, and the 47% magnitude reflects the $2.74 per share B-21 provision rather than operational underperformance.

Post-Earnings Price Movement History

| Date | Surprise | EPS vs Est. | Next Day Move | Price Change |

|---|---|---|---|---|

| Q3 2025 | +18.7% | $7.67 vs $6.46 | +1.9% | $494.00 to $503.53 |

| Q2 2025 | +19.9% | $8.15 vs $6.80 | +1.9% | $494.00 to $503.53 |

| Q1 2025 | -47.0% | $3.32 vs $6.26 | +0.2% | $512.19 to $513.10 |

| Q4 2024 | +0.6% | $6.39 vs $6.35 | +1.9% | $574.57 to $585.66 |

| Q3 2024 | +15.3% | $7.00 vs $6.07 | +3.2% | $526.79 to $543.88 |

Post-earnings reactions have been muted despite large beats, with guidance tone driving sustained moves

Northrop’s average next-day move of 1.6% following earnings sits well below the 3–5% range typical of large-cap defense peers. The pattern shows the market consistently looks through headline results to focus on guidance, with the Q3 2024 reaction illustrating this dynamic: a 15.3% EPS beat drove a 3.2% gain because management raised full-year guidance.

Expected Move & Implied Volatility

24.3%

62%

21.8%

The options market is pricing a 3.2% move in either direction, approximately double Northrop’s 1.6% historical average post-earnings reaction. The elevated implied volatility of 24.3% versus 21.8% historical volatility suggests traders are pricing incremental risk beyond normal earnings variance, likely tied to potential B-21 cost pressures or 2026 guidance significance.

Expert Predictions & What to Watch

Key Outlook: Guidance Will Drive the Trade

The setup favors a result that meets or modestly exceeds the raised October guidance while avoiding incremental program charges. The 83% historical beat rate and consecutive 19% surprises establish execution momentum, but the pattern of revenue misses and the stock’s 38% year-to-date gain create asymmetric risk.

Key Metrics to Watch

The Q4 revenue figure carries disproportionate weight because it determines whether Northrop can avoid a fourth consecutive revenue miss while staying inside the narrowed full-year range. A result of $10.5B or higher would place FY25 sales at $41.9B, the top end of guidance, demonstrating that program timing issues are resolving rather than persisting.

Aeronautics segment margin is the clearest read on B-21 execution post the Q1 provision. The segment delivered 8.2% operating margin in Q3, below the 9–10% range typical of stable production programs. A Q4 margin at or above 9.5% would signal that LRIP cost overruns are behind the company and production learning curves are taking hold.

FY26 guidance will be parsed for three elements: revenue growth rate, EPS growth rate, and the implied margin trajectory. Revenue growth of 4% or higher ($43.5B+) would demonstrate that GBSD, B-21, and other new programs are offsetting restricted-space wind-down at a pace that supports the long-term thesis.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- XTB UK regulated by the FCA – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY