Robinhood's stock price (NASDAQ: HOOD) is on the move today, up 2.9%, as the $100 level continues to provide support leading into earnings. The company is set to report its second-quarter results after today's closing bell, with the company's stock one of the leading momentum names over the past year.

With HOOD gaining 170% since the turn of the year, and 420% over the past 12 months, the stock has built a strong following of bulls.

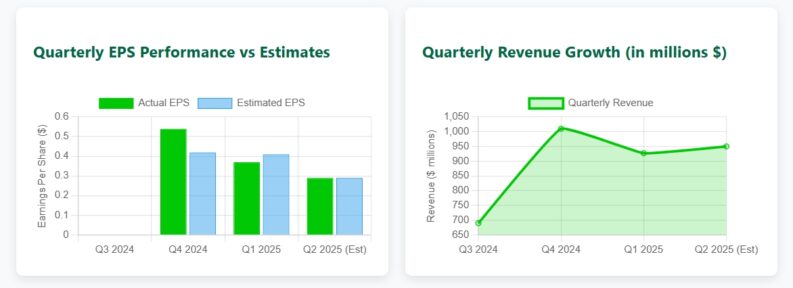

Analysts are projecting an earnings per share (EPS) of $0.35, a steady jump of close to 20% from the $0.30 reported in the same quarter last year, yet a slowing from the $0.44 in the most recent period. Robinhood has a history of exceeding expectations, having surpassed EPS estimates in each of the last four quarters.

Revenue is expected to have grown even more substantially, with a 33.92% growth rate bringing the number to $913.33million on the quarter.

The pressure is on for Robinhood to deliver. The company's Q1 results, while showing a 50% year-over-year revenue increase to $927 million, did see them miss EPS estimates by $0.04, reporting $0.37 against an expected $0.41. This mixed performance underscores the need for a strong Q2 to maintain market confidence.

Recent analyst upgrades, fueled by Robinhood's expansion into new products and international markets, have contributed to the stock's impressive year-to-date performance.

Morgan Stanley analysts have pointed out that Robinhood is uniquely positioned to capitalize on increased retail engagement, particularly among younger traders, and a more favorable regulatory landscape for cryptocurrencies. With the broader market also experiencing increased retail participation, the tailwinds appear to be in Robinhood's favor.

However, these high expectations create a precarious situation. Any sign of slowing growth, missed revenue targets, or disappointing user engagement metrics could trigger a significant sell-off. Markets will be scrutinizing not just the EPS but also key performance indicators (KPIs) such as monthly active users (MAUs), average revenue per user (ARPU), and total assets under custody (AUC).

Revisions in the month leading into earnings have been positive, with 4 moving EPS expectations to the upside, and none going the other way.

Expectations are high, and the stock has a strong following. But can Robinhood beat the street again?

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY