Samsung Electronics shares (KRX:005930) fell back 1.65% today, as chip headwinds outweigh growth seen in other segments. In what has been a rollercoaster 12 months for holders of the stock, the extent of the decline in DS will have been hard to see.

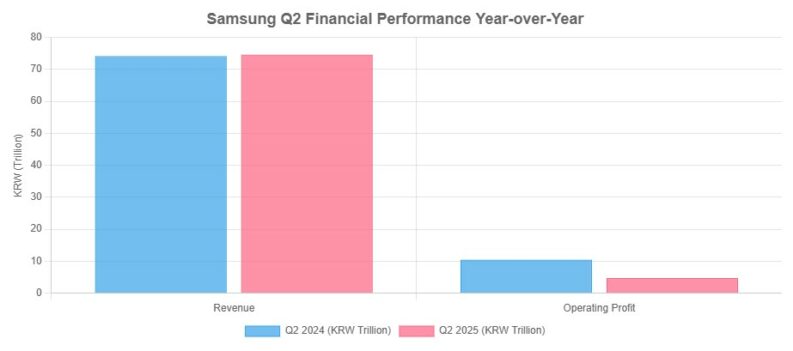

The company reported Q2 revenue of KRW 74.6 trillion, up slightly on the KRW 74.1 trillion a year earlier, yet more importantly, operating profit plunged to KRW 4.7 trillion, a 55% year-over-year drop.

The primary drag on performance was the Device Solutions (DS) Division, which includes the semiconductor business. Operating profit in this division fell 94% year-on-year to KRW 400 billion, marking its lowest level in six quarters.

Delays in certifying HBM3E 12-layer chips with major clients like NVIDIA hindered the company’s ability to benefit from soaring AI-related demand, whilst new U.S. regulations restricting advanced AI chip exports to China further pressured semiconductor sales, resulting in inventory write-downs and reduced profitability.

Despite chip sector headwinds, Samsung’s Mobile eXperience (MX) Division showed some resilience. Both revenue and operating profit grew year-on-year, with robust sales in the Galaxy S25 series, Galaxy A series, and tablets. The division maintained double-digit profitability, even as Q2 shipments dipped compared to Q1.

The company highlighted the U.S.-South Korea trade agreement (imposing a 15% tariff on South Korean imports) as a positive, and one which reduces business uncertainty with the $16.5 billion chip supply deal with Tesla expected to boost the contract chipmaking business and future orders.

Potential Upside: Bull Case

- HBM3E and DDR5 Sales: Addressing server demand by expanding HBM3E sales and high-density DDR5 products.

- NAND Inventory Reduction: Significant reduction in NAND inventory via server SSD sales expansion, as delayed datacenter projects resume.

- Mobile Experience Growth: Growth in both revenue and operating profit YoY, driven by strong S25, A series, and tablet sales.

- Second Half Focus: Emphasis on flagship foldables/S25, AI on A series, and new form-factor devices.

- Trade Agreements: New U.S.-South Korea trade deal reduces business uncertainty.

- Tesla Deal: $16.5 billion chip supply agreement with Tesla is expected to bolster contract chipmaking business and future orders.

Potential Downside: Bear Case

- Semiconductor Weakness: Ongoing delays in HBM3E certification and U.S. export restrictions to China could continue to weigh on chip revenues.

- Inventory Pressures: Further inventory value adjustments may impact future profitability.

- Overbought Stock: With an RSI over 76, the stock may be vulnerable to a correction after recent gains.

- Global Trade Risks: New tariffs and regulatory shifts could present unforeseen challenges.

- Competition: Intense competition in both the chip and smartphone markets could limit margin improvement.

Samsung's share price, whilst on a recent 21% run in the month leading in, remains firmly below where it was this time last year. Sentiment has clearly improved in the name since the turn of the year, yet down 14.9% on the 1 year, whilst locally listed peers such as SK Hynix have added 40% reveals the extent of the challenge that awaits.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY