The Federal Reserve, at the conclusion of its meeting, opted to hold steady the benchmark federal funds rate within a range of 4.25% to 4.5%, marking a continuation of its pause initiated at the start of the year. This decision, while widely anticipated, underscores the central bank’s delicate balancing act as it navigates an increasingly complex economic landscape fraught with inflationary pressures, geopolitical uncertainties, and signs of slowing growth.

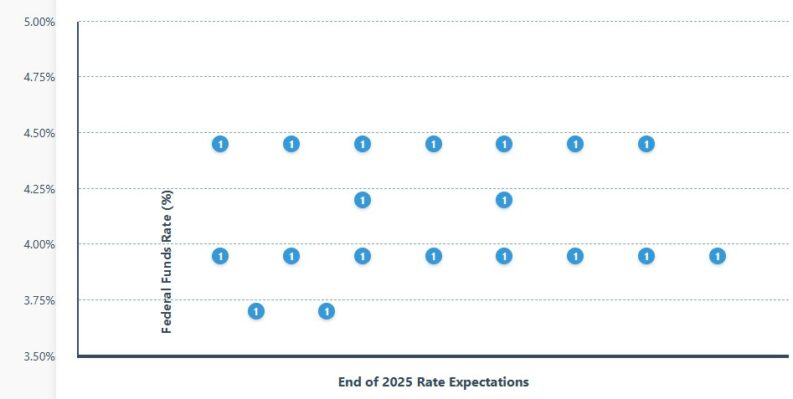

Committee Divided: The FOMC is notably split on the path forward, with 7 members expecting no rate cuts in 2025, while 12 members anticipate at least one cut.

Median Projection: The median forecast still shows two 25 basis point cuts by year-end (to 3.75%-4.00%), though with less conviction than in previous meetings.

Hawkish Shift: Compared to March’s projections, more officials now favor keeping rates steady through 2025, reflecting concerns about persistent inflation, particularly related to recently implemented tariffs.

Economic Context: The Fed also revised down GDP growth to 1.4% (from 1.7%) and raised inflation projections to 3% for 2025, indicating stagflation concerns.

The meeting’s outcome, dissected through the lens of the infamous “dot plot,” reveals a deeply divided committee grappling with the optimal path forward.

The decision to maintain the status quo reflects a cautious approach, particularly in light of recently announced tariffs and ongoing geopolitical tensions, specifically the escalating crisis in the Middle East. These factors, according to Chair Jerome Powell, pose significant upside risks to inflation, potentially complicating the Fed’s efforts to achieve its 2% target.

Despite a softer-than-expected core inflation reading for May, Powell cautioned that the inflationary impact of tariffs could materialize over the summer, adding another layer of uncertainty to the economic outlook. The updated economic projections released alongside the policy decision paint a less optimistic picture than previously envisioned.

The Fed revised downwards its GDP growth forecast for 2025, citing weaker economic activity, while simultaneously raising its inflation forecast. The median projection for Personal Consumption Expenditures (PCE) inflation now stands at 3.0%, a notable increase from the 2.7% projected in March.

This combination of slower growth and higher inflation has fueled concerns about a potential stagflationary environment. Adding to the unease, the unemployment rate is projected to rise, consistent with expectations of a slowing economy and tighter financial conditions.

| Rate Expectation for End-2025 | Number of FOMC Members | Percentage of Committee |

|---|---|---|

| 4.25% – 4.50% (No change) | 7 | 36.8% |

| 4.00% – 4.25% (1 cut) | 2 | 10.5% |

| 3.75% – 4.00% (2 cuts) | 8 | 42.1% |

| 3.50% – 3.75% (3 cuts) | 2 | 10.5% |

However, it is the “dot plot”, a visual representation of individual FOMC members’ expectations for future interest rates, that truly illuminates the internal divisions within the Fed.

The Dot Plot

While the median forecast still anticipates two quarter-point rate cuts (totaling 50 basis points) by the end of 2025, a significant contingent of policymakers now believes that no rate cuts will be necessary. Of the 19 FOMC participants, seven expect rates to remain unchanged at 4.25%-4.5% for the remainder of the year, while eight anticipate two rate cuts to 3.75%-4.0%. The remaining four are split, with two projecting rates at 4.0%-4.25% and two at 3.5%-3.75%.

This wide dispersion of views underscores the lack of a clear consensus on the appropriate policy path, highlighting the challenges facing the Fed in formulating a unified monetary policy response. Policymakers expect only one rate cut in 2026 and 2027, indicating a very gradual normalization process.

The market reaction to the FOMC’s announcements was muted, reflecting the prevailing uncertainty. The S&P 500 ended the day nearly flat, giving back earlier gains following Powell’s comments on inflation and tariffs. Fed funds futures, meanwhile, indicate a roughly 65% chance of a rate cut by September, with two cuts priced in by year-end. This suggests that while markets are still anticipating some easing of monetary policy, they are also acknowledging the possibility that the Fed may remain on hold for longer than previously expected.

Looking ahead, the Fed faces a delicate balancing act. On one hand, it must remain vigilant in its fight against inflation, particularly in light of potential upside risks from tariffs and geopolitical tensions. On the other hand, it must also be mindful of the potential for slower growth and rising unemployment. The committee’s decisions will be data-dependent, reacting to the evolving economic environment.

The TJX Companies, Inc. continues to exhibit financial resilience and strategic growth, positioning itself well for future opportunities while navigating the inherent challenges of international expansion and market dynamics.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY