As Wells Fargo & Company (NYSE: WFC) gears up to announce its second-quarter 2025 earnings before the market opens tomorrow, the company's stock price is threatening to challenge highs.

Wells Fargo's stock is currently trading at $83.12 per share, a gain of 0.72% through the morning session, and 44% up on year. The question now is whether the bullish sentiment can translate into sustained growth following the earnings release.

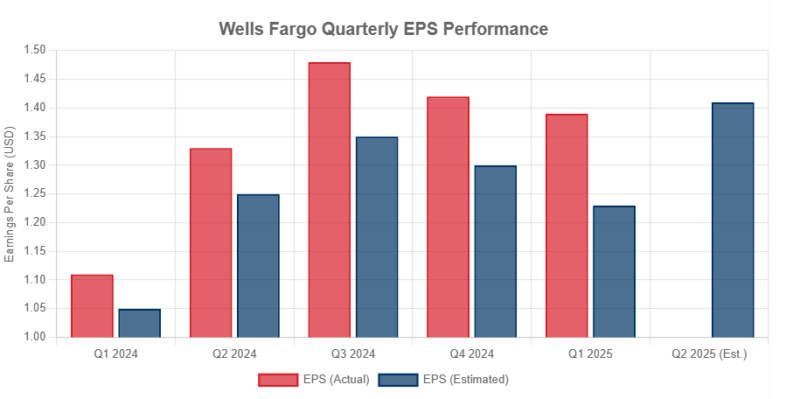

Wells Fargo's recent performance has been a mixed bag, highlighting both strengths and areas of concern. In the first quarter of 2025, the bank reported an earnings per share (EPS) of $1.39, handily outperforming analysts' expectations of $1.23. This beat, however, was somewhat overshadowed by revenue that fell short of projections, coming in at $20.15 billion compared to the anticipated $20.75 billion. A notable decline in net interest income, a critical component of bank profitability, by 6% year-over-year to $11.50 billion, raised concerns.

This decline suggests that Wells Fargo may be facing challenges in maximizing profits from its lending activities, potentially due to a flattening yield curve or increased competition. On the other hand, noninterest income saw a slight increase to $8.65 billion, indicating some diversification in revenue streams. The market reaction immediately following the Q1 earnings release was a 1% dip in stock price, a sign that investors are carefully scrutinizing the underlying factors driving the bank's performance.

Analysts are projecting a more optimistic picture for the second quarter. The consensus EPS estimate stands at $1.41, representing a 6% increase from the same period last year. Revenue is also expected to improve, reaching $20.73 billion, a modest 0.2% year-over-year growth. The upward revision of the consensus EPS estimate by 0.53% over the past 30 days suggests growing confidence among analysts regarding Wells Fargo's potential. This optimism could be fueled by expectations of improved performance in certain business segments or the anticipation of benefits from recent strategic initiatives.

One significant development that could positively impact Wells Fargo's future performance is the lifting of the $1.95 trillion asset cap by the Federal Reserve in June 2025. This cap, imposed in 2018 following the infamous fake account scandal, severely restricted the bank's ability to grow its asset base. With the removal of this restriction, Wells Fargo now has the freedom to pursue growth opportunities, expand its lending activities, and potentially increase its market share. This newfound flexibility could translate into higher revenue and earnings in the coming quarters.

However, challenges remain. The analyst target price for WFC is $82.72, which is marginally below the current trading. This indicates that, on average, analysts believe the stock is currently priced to perfection. Furthermore, the competitive landscape in the financial services industry is becoming increasingly intense, with both traditional banks and fintech companies vying for market share. Wells Fargo will need to demonstrate its ability to innovate and adapt to changing customer preferences in order to maintain its competitive edge.

The upcoming earnings report will provide crucial insights into how Wells Fargo is navigating these challenges and capitalizing on its opportunities. Investors will be particularly interested in the bank's net interest margin, loan growth, expense management, and any updates on its strategic initiatives. The earnings call, scheduled for July 15th at 10:00 a.m. Eastern Time, will offer further details and perspectives from the company's management team.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY