Apple Inc. (NASDAQ:AAPL) finds itself with markets increasingly focused on the company's long-term innovation pipeline rather than immediate product cycle upgrades. With Apple's stock price having fallen 13.36% this year, whilst broader markets have been on the rise, sentiment has turned on AAPL for now leading into tomorrow's earnings.

Those able, or willing, to look through near term slowing could be rewarded according to some analysts.

While the upcoming iPhone 17 release this fall is anticipated to offer only incremental improvements, the market's attention has already shifted to the potential game-changer slated for September 2026: Apple's inaugural foldable iPhone, expected to debut as part of the iPhone 18 line-up.

JPMorgan, in a recent research note, underscored this evolving perspective, maintaining an “Overweight” rating on Apple while acknowledging the muted expectations for the iPhone 17.

The firm's analysis highlights the transformative potential of the foldable iPhone, projecting it to unlock a substantial $65 billion market opportunity for Apple and drive high-single-digit earnings accretion in the medium term.

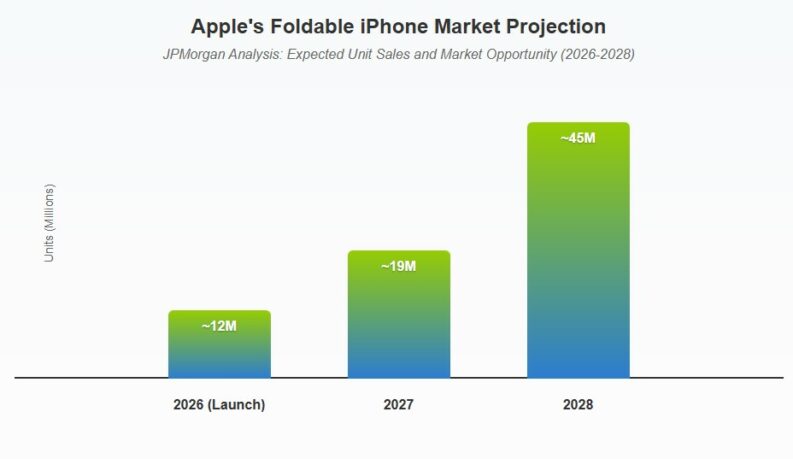

The foldable smartphone market is poised for exponential growth, with JPMorgan forecasting volumes to surge from 19 million units in 2025.

Apple's entry into this space, with an anticipated price point of $1,999 for its foldable iPhone, positions the company to capture a significant share of the premium segment.

Projections indicate that foldable iPhone shipments could reach the low-teens million units in fiscal year 2027, accelerating to the mid-40s million by fiscal year 2028.

The design of the foldable iPhone is expected to resemble a book-style format, akin to Samsung's Galaxy Z Fold series. Rumors suggest that the device will feature a 7.8-inch internal display when unfolded, along with a 5.5-inch external screen for use in its folded state.

A key differentiator for Apple will be its ambition to eliminate the visible crease that plagues many existing foldable devices, enhancing the user experience and justifying the premium price tag.

Production timelines appear to be on track, with analyst Ming-Chi Kuo reporting that the foldable iPhone has entered the New Product Introduction (NPI) phase at Foxconn.

This suggests that Apple is moving towards mass production, with the device expected to be finalized by mid-2026 and production slated for late 2026, aligning with the anticipated September 2026 launch.

However, Apple's path forward is not without its challenges. Recent reports suggest that near-term growth prospects are considered the weakest among Big Tech peers, largely due to trade war and tariff concerns. The company faces tough pricing decisions in a competitive market, and any missteps could impact its ability to achieve the ambitious growth targets associated with the foldable iPhone.

Bull Case:

- Significant Market Opportunity: Foldable iPhone could unlock a $65B market opportunity.

- Earnings Accretion: High-single-digit earnings accretion in the medium term.

- Strong Demand: Potential for mid-40s million unit sales by fiscal 2028.

- Premium Design: Elimination of visible crease could differentiate Apple from competitors.

Bear Case:

- iPhone 17 Weakness: Limited upgrades expected this fall.

- Trade and Tariff Concerns: Near-term growth prospects considered weak due to macroeconomic factors.

- Pricing Risks: High price point of $1,999 could limit adoption.

- Competition: Established players like Samsung already dominate the foldable market.

Despite these uncertainties, the potential of the foldable iPhone to revitalize Apple's growth trajectory is undeniable. By entering the foldable market with a premium device that addresses key user concerns, Apple could solidify its position as a leader in innovation and drive significant shareholder value.

Whilst the market will be looking to earnings tomorrow as a near term catalyst, the product focus has clearly shifted to 2026, and Apple's ability to deliver on the promise of the foldable iPhone will be critical in shaping its future success.

Analysts are looking for an EPS of $1.43 on the quarter, a mild improvement on the $1.40 delivered in the same period last year. Revenue growth is expected to be just under 4% (3.93), with a figure of $89.15billion on the quarter.

Revisions have largely been to the upside from the street leading in, with 6 upwards moves on EPS in the month, and only the one trimming.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY