The buzz about the financial markets has led to a surge in retail investors in the Philippines setting up trading accounts with online brokers. Adding to the excitement, stockbrokers in the Philippines are offering traders and investors some exceptional deals.

No one can guarantee prices will move your way, but choosing to use one of the best stock brokers in the Philippines is the first step. This review will help you do that, and set yourself up with the best chance of success.

The Best Stock Brokers in the Philippines

#1FXGT

What We Liked:

What We Liked:

- Leverage of up to 1:1000

- Hassle-free account opening

- Spreads as tight as zero pips

- Impressive industry awards

#2Tickmill

- Some of the lowest-priced trading in the industry.

- Award-winning 24/5 customer service — ideal for beginners.

- Great research tools with an emphasis on spotting trading opportunities.

- Easy to navigate website — ideal for beginners.

- Free demo account with no time-limit.

- Low minimum opening account balance of just $25.

- Great promotional offers such as the $30 welcome account offer where the broker gives you real cash to trade with

Tickmill is an ideal option for beginners who want to get set up quickly and start trading in small sizes. The minimum account opening balance is only $25 and few brokers offer an entry-level this low. Tickmill’s approach is to be congratulated as small-scale trading is highly recommended, at least until you get a better understanding of the markets.

There are a lot of other reasons to register for a Tickmill account. The broker has a global presence, is regulated by tier-one authorities, provides its clients with a free demo account and the world’s most popular trading platform.

Once you take the step up to real trading, even in small size, you’ll find Tickmill combines super-fast trading with some of the most competitive pricing in the sector.

It’s no surprise that Tickmill has won a host of industry awards, which include International Business Magazine’s Best CFD Broker Asia, the Online Personal Wealth Awards’ Most Reliable Broker, the Forex Awards’ Most Transparent Broker and CFI.co Awards Best Forex Execution Broker. It is the real deal and if you’re looking for a great place to start trading, then head here to try it out.

Broker Fees

Tickmill offers three different trading accounts, which means most traders can find a good fit. The spreads for the Pro and VIP accounts begin at 0.0 pips and confirm Tickmill’s reputation for being super aggressive on prices — after all, it’s very hard to beat zero.

Those who trade using the VIP account will find commission as low as $1 per lot per side, which is considered among the lowest in the sector.

Trading Limit

Maximum leverage settings are in line with regulatory restrictions but are variable so you can scale your risk up and down according to market conditions. Margin terms extend from 1:1 and go as high as 1:500 for major forex pairs.

Features

- Trading infrastructure, including ECN and VPS services, ensures clients get the access to the best liquidity pools in the market.

- User-friendly entry-level accounts but enough add-ons to allow beginners to scale up to more advanced strategies.

Regulation

The Tickmill group of companies are regulated in some of the world’s most reputable financial jurisdictions.

Tickmill Asia Ltd is authorised and regulated by the Labuan Financial Services Authority under licence number: MB/18/0028.

Platform

Another way Tickmill hits the target is in offering its clients access to one of the best trading platforms on the market — the tried and tested MetaTrader4 platform. It comes with 30 built-in indicators and the option to bolt on dozens more custom indicators, which can be easily downloaded online. MT4 can be installed on Mac, Windows, Android and iOS devices. It is also available in a WebTrader format, which means trading with Tickmill can fit in with your other day-to-day commitments.

The Expert Advisors (EA) service is a great way to start using algorithmic models to engage in automated trading. The forex markets are particularly well suited to automated trading and it offers a hands-off way to gain exposure to the financial markets.

Other features which make Tickmill really stand-out include the additional services designed to help clients spot trade. These additional services include AutoChartist, Myfxbook, and Pelican trading.

Customer Support

In the unlikely event that you do need to contact the multi-lingual Tickmill customer service, they are available via telephone and email.

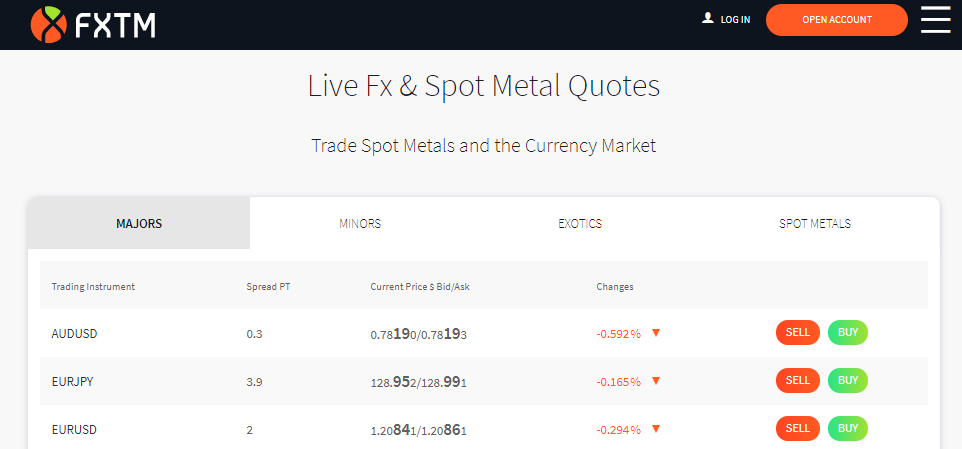

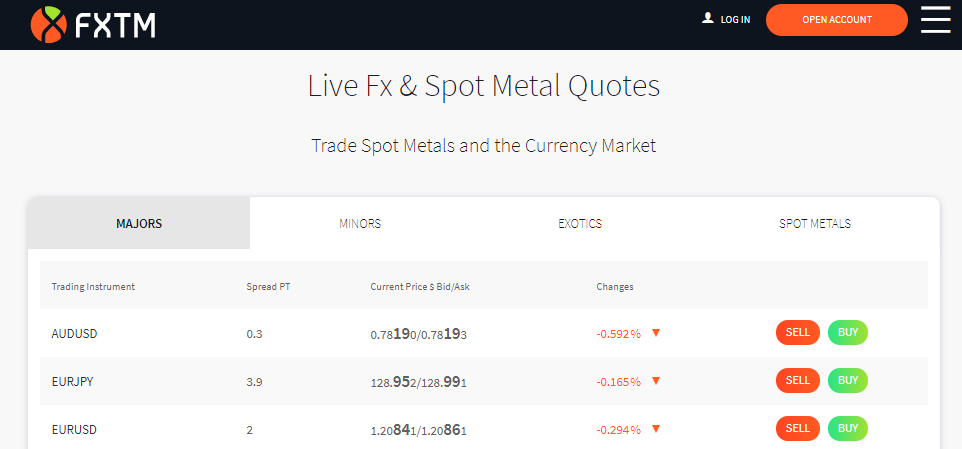

#3FXTM

- Strong and stable. More than 2 million clients across the world.

- Innovative Cent account allows clients to trade in small size — $10 minimum opening balance.

- Great trade execution thanks to VPS hosting.

- Winner of the World Finance, Best Trading Experience award, 2020.

- Market-leading mobile apps, perfect for those who want to trade on the move.

- 24-hour customer support available in 18 different languages.

- Islamic Account for Shariah-compliant trading.

- Free demo account.

- Specialist tools to help you spot trades — including FXTM Pivot Point Strategy and Trading Signals.

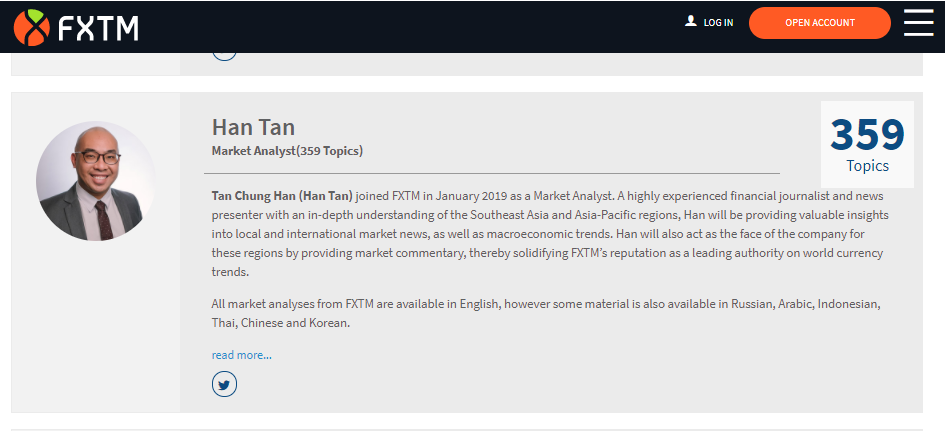

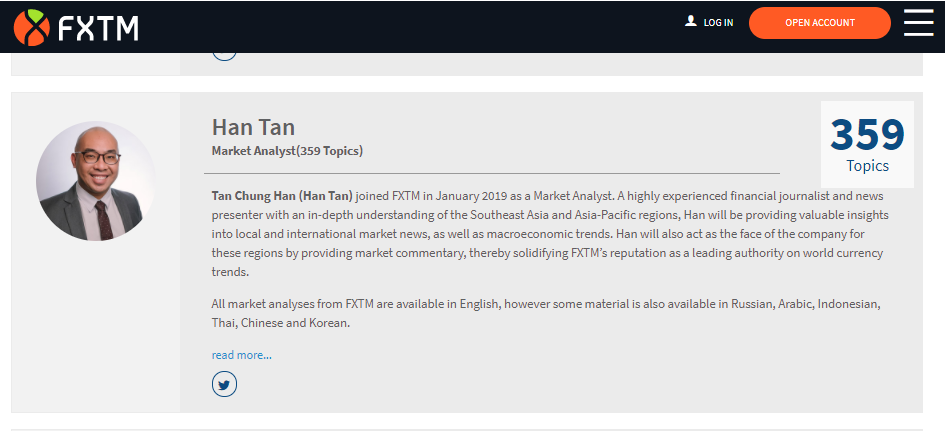

FXTM is a market-leading online trading platform, which is designed to give traders just what they need. It is packed full of neat and innovative features specifically designed to make trading easy. The broker continues to pick industry awards and new clients, thanks to it providing this approach. It gives traders everything they need and nothing that they don’t.

FXTM is different, in a good way. A lot of the features are unique to FXTM and visiting the platform to try out its services is highly recommended.

Some of the great features found at FXTM really ought to be industry standard. The Cent account, for example, is ideal for beginners as it has a low minimum deposit of $10. This is perfect for traders taking the step up from trading in a demo account and into real trading as there are subtle differences between the two. Offering this approach helps new clients develop the skills to be successful, but without burning through their cash pile on the way.

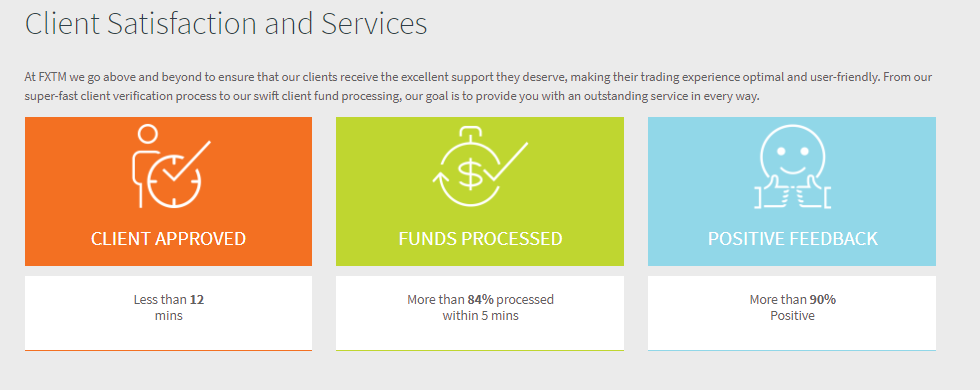

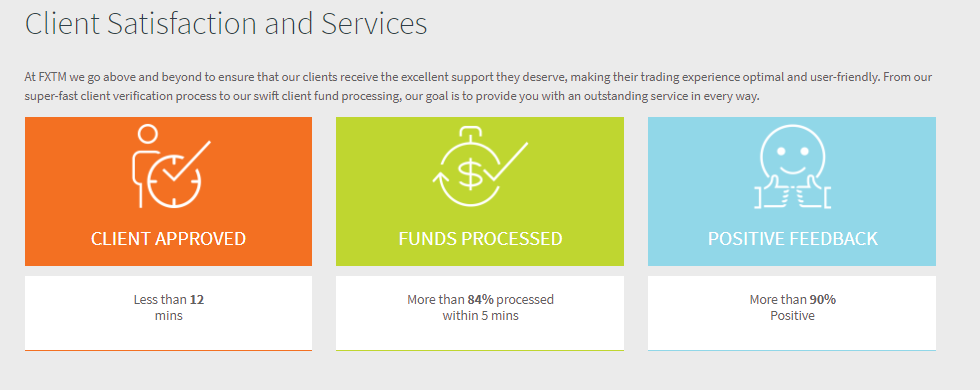

The firm also stands out in terms of transparency of reporting. It shares important information about the operational efficiency of the site with its users. At first, this might appear to be overkill, but it is to be rewarded as it demonstrates it knows that brokers need to ensure they deliver a first-rate service. It also oozes confidence, confirming the broker is obviously comfortable that it is doing a good job.

Broker Fees

FXTM offers three types of account types, Standard, Shares and Cent. This means clients can find the account that’s right for them. The T&Cs vary across the accounts but, in all instances, are very competitive.

- EURUSD as low as 0.1pips

- EURUSDStandard spread: 1.9 pips

- EURUSD Average RAW spread:Standard spread 0.6 pips

- GBPUSD Average RAW spread:Standard spread 0.5 pips

- Commissions USD:$2

Trading Limit

Leverage terms can be adjusted on a trade-by-trade basis. The maximum margin terms for FXTM clients that have accounts covered by the Mauritius regulator FSC is 1:300.

- FCTM provides access to a range of asset groups: 120 currency pairs + 36 commodities + 58 indices + 7 cryptocurrencies + 77 ETFs and 4 bonds

- The minimum initial deposit requirement at FXTM is $10 for the Cent account and $100 for the Standard, Stock and FXTM copy trading accounts.

- Maximum number of orders: 100

Features

- A trusted broker with a passion for client-focused innovation.

- The Cent account is a great introduction level account, which is ideal for beginners.

Regulation

Exinity Limited is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License bearing license number C113012295.

Platform

FXTM offers its clients the world’s most popular retail trading platform, MetaTrader MT4. In addition, the broker also offers its clients the sister platform MT5, which is equally impressive but slightly different in nature. Both are available in desktop, WebTrader and mobile app format so that clients can keep in touch with the markets 24/7.

MT4 has a user-friendly functionality but is packed full of powerful software tools that take trading up to another level. The graphics are razor-sharp and indicators and oscillator tools are ideal for spotting trade entry points. It’s easy to learn how they work and the MT4 online community has a friendly vibe and is a great place for beginners to seek out the ideas of other more experienced traders.

The MetaTrader5 platform has more indicators and time-frame settings and offers a slightly different way of doing things. But in truth, both platforms complement rather than challenge each other. Many across the globe stick with using MT4 as it is still the benchmark other platforms measure themselves by. Other traders, however, opt for the greater flexibility of the MT5 platform. The good news is that both are available at FXTM and trying them out, even in demo format, will give you a taste of how they compare.

After your trade has been booked, it needs to be sent to the market and this is where FXTM’s free VPS hosting service scores highly. By hosting its servers close to the exchanges, FXTM ensures your trades get filled as fast as possible and at the best price.

There’s nothing more frustrating than picking a good trade entry point to later find market price moved, and you weren’t ‘filled’ on your order. Having great trading ideas is one thing, but being able to carry them out is something else and that is why choosing a high-quality and reliable broker is so important.

A third platform on offer at FXTM is the FXTM Invest Copy Trading service. This offers another way to get exposure to the financial markets and make your money work a bit harder. It is popular with beginners and those who don’t have the time to develop their own strategies. There are more than 5,000 traders to copy, the minimum opening balance is only $100 and you only pay commissions on winning trades.

Customer Support

FXTM is the real deal and it’s worth visiting its site just to see how good the trading experience can be. In terms of industry awards, FXTM was awarded Best Trading Experience and Best Trading Condition awards at the World Finance Awards in 2020.

There are times when traders need some guidance and FXTM customer support is available in 18 languages, 24 hours a day. There are also dedicated account managers to help you get the most from trading and it’s possible to contact them via email, telephone and live chat.

#4Vantage FX

- User-friendly platform — ideal for beginners.

- Trade a wide range of asset groups, including forex, commodities, crypto, shares and indices.

- Free demo account.

- Islamic Account for Shariah-compliant trading.

- Super-tight spreads including 0.0 pips trading on RAW ECN accounts.

- Impressive execution infrastructure to ensure you get the best price.

- Exclusive FX promotions.

Vantage FX has been operating for more than 10 years and has recently been building considerable momentum. The broker offers a neat blend of user-friendly functionality and high-level trading tools, which enable its clients to trade the markets with ease and to be supported by a range of tools designed to help them be successful.

The many industry awards the broker has won are proof of its progress and there is a real buzz about the broker in the trading community. It does the simple things well but also offers a range of services to help newbies take their trading to the next level.

Setting up a free demo account can be done in a matter of seconds and allows you to try trading with a broker at the cutting edge of the industry.

Broker Fees

Vantage FX’s aggressive approach to pricing starts with its RAW ECN account, which has spreads as low as 0.0 pips. It continues across the other accounts, which also offer highly competitive T&Cs. Vantage FX has recognised that traders want a cost-effective way to trade the markets and successfully set about satisfying that need.

Trading Limit

Vantage FX’s standard Forex leverage starts at 100:1, which is as much leverage as most traders need. If you meet certain conditions, you can scale this up to a maximum leverage rate as high as 500:1

Features

- Ideal for beginners but packed with features to take your trading to the next level.

- Fast and reliable trade execution to help you get the best prices.

Regulation

Vantage Global Limited is authorised and regulated by the VFSC under Section 4 of the Financial Dealers Licensing Act [CAP 70] (Reg. No. 700271) and is registered at iCount Building, Kumul Highway, Port Vila, Vanuatu.

Clients’ funds are held in a segregated account with Australia’s AA rated National Australia Bank (NAB).

Platform

The industry-leading MetaTrader4 and MetaTrader5 platforms can be accessed via PC, Mac, iOS and Android devices. They are available as downloadable platforms or in a WebTrader format, which ensures clients have a range of different ways to stay on top of their trading.

There are three more platforms on offer, ZuluTrade, DupliTrade and MyFXBook Autotrade. Each offer their own take on social trading and copy trading and provide ways for Vantage FX clients to trade the markets using the ideas of others.

Customer Support

The award-winning Vantage FX customer support team can be contacted by phone, live chat and email. Its customer support provisions are multi-lingual and available to clients on a 24/5 basis.