The electric vehicle (EV) revolution is driving unprecedented demand for battery metals, placing nickel firmly in the spotlight. As a crucial component in EV batteries, particularly those offering higher energy density and longer ranges, nickel's strategic importance is only set to grow. Investing in nickel stocks, therefore, presents an opportunity to capitalize on this burgeoning market.

However, understanding the nuances of the nickel industry, including the major players, their operational strengths and weaknesses, and the prevailing market dynamics, is paramount for informed investment decisions. This guide provides an in-depth look at three prominent companies in the nickel sector: Vale S.A. (VALE), BHP Group (BHP), and Rio Tinto (RIO), offering a comparative analysis to help investors navigate this complex landscape.

Vale S.A.: Global Nickel Leader with Growth Ambitions

Vale S.A., a Brazilian multinational, stands out as the world's largest producer of both iron ore and nickel. Its extensive nickel mining operations span across Brazil, Canada, Indonesia, and New Caledonia. The Sorowako mine in Indonesia, boasting substantial proven and probable reserves, exemplifies Vale's significant presence in the nickel market.

This mine alone contains an estimated 1.81 million tonnes of nickel metal, underscoring Vale's capacity to meet future demand. Further solidifying its position, Vale has secured a long-term agreement to supply low-carbon Class 1 nickel to Tesla, a key player in the EV market. This strategic partnership highlights Vale's commitment to the EV battery supply chain and positions it favorably to benefit from the increasing demand for sustainable nickel.

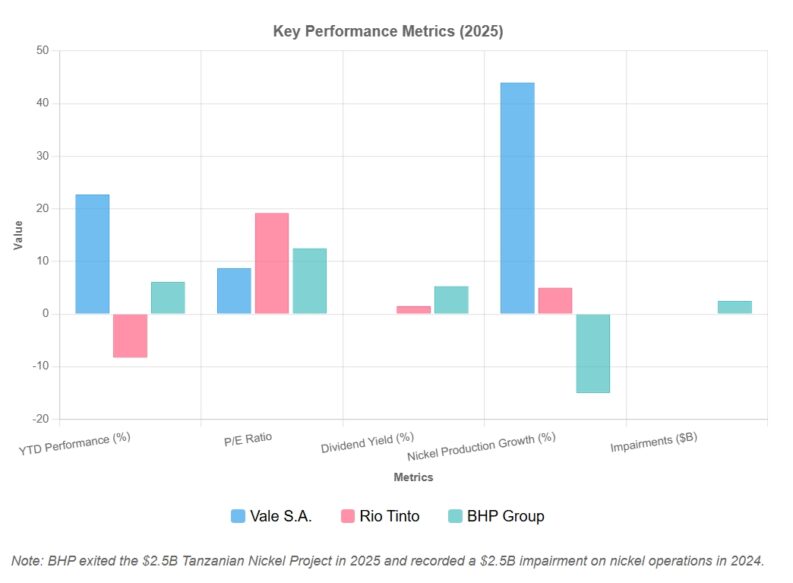

Furthermore, the Long Harbour Nickel Processing Plant in Canada processes nickel concentrate from the Voisey's Bay mine, adding another layer to Vale's integrated nickel operations. Recent news underscores Vale's operational efficiency, with a reported 44% year-over-year increase in nickel production during the second quarter of 2025, driven by improvements in Canada and Brazil. The company's aggressive expansion plans, including a $3.3 billion investment to boost copper and nickel output over the next four years, signal a strong commitment to growth and capturing a larger share of the market.

However, Vale has faced environmental and legal challenges, including a lawsuit alleging heavy metal contamination linked to its Onça-Puma site, highlighting the importance of ESG (Environmental, Social, and Governance) considerations when evaluating this stock. Despite these challenges, improved relations with the Brazilian government after a period of criticism could pave the way for smoother operations and future growth.

Financially, Vale presents an intriguing picture. While the provided stock analysis uses “VAL” for Valaris Limited, a completely different company, the general concept of using metrics like P/E ratio, dividend yield, and market cap remains crucial. Investors should seek out current, accurate financial data for Vale S.A. (likely under the ticker VALE) to assess its valuation and profitability in light of these recent developments.

BHP Group: Diversification with a Cautious Nickel Approach

BHP Group, an Australian multinational mining giant, offers a diversified portfolio with a significant nickel component through its Nickel West division in Western Australia. The Mount Keith Mine, a large open-pit operation, produced approximately 80,000 tonnes of nickel in the 2022-23 financial year, demonstrating BHP's substantial nickel output.

While BHP reported a 26% decline in annual profit for the year ending June 30, 2025, primarily due to weaker iron ore prices, the company remains optimistic about the long-term demand for commodities like nickel. This optimism is supported by an $11 billion commitment to growth and exploration over the next two years, indicating a strategic focus on expanding its resource base.

However, recent news reveals a more nuanced situation. BHP's decision to exit its 17% stake in the Kabanga Nickel Project in Tanzania reflects a strategic shift in response to an oversupply of nickel from Indonesia and a weakened market outlook. This move suggests a more cautious approach to nickel investments compared to Vale's aggressive expansion plans. Furthermore, BHP flagged a substantial impairment charge for its Western Australia nickel business, citing the deteriorating nickel market outlook. This impairment highlights the challenges faced by BHP in maintaining profitability within its nickel operations, particularly in the face of increased supply from Indonesia.

Looking at the comparative stock analysis, the provided data for “BHP Group Limited” is relevant to the company, but should be verified with current data. The low debt-to-equity ratio suggests strong financial management. The dividend yield of 5.3% is attractive to income-seeking investors. The analyst target price, while subject to change, indicates potential upside.

Rio Tinto: Diversified Strength, More Limited Nickel Exposure

Rio Tinto, another British-Australian multinational mining corporation, boasts a diversified portfolio that includes aluminum, copper, diamonds, and iron ore. While nickel is not Rio Tinto's primary focus, its diversified operations and strong financial position make it a noteworthy player in the mining sector.

Rio Tinto's Pilbara iron ore operations, ranking among the lowest-cost producers globally, underpin strong margins even during price dips. The company's expansion into growth metals such as copper, lithium, and aluminum, with increased copper production and upcoming Simandou shipments, further bolsters its volume growth prospects.

While specific nickel-related news for Rio Tinto is less prominent compared to Vale and BHP, its overall financial strength and diversified portfolio provide a buffer against volatility in any single commodity market.

This diversification makes Rio Tinto a potentially less risky investment option for those seeking exposure to the mining sector without being solely reliant on nickel prices. Unfortunately, the provided stock analysis does not contain any information on Rio Tinto (RIO), so a comparison cannot be made.

Comparative Analysis

When comparing these three companies, several key factors emerge. Vale is aggressively pursuing nickel expansion, driven by the anticipated surge in demand from the EV battery market. However, it faces environmental and legal challenges that could impact its operations and profitability.

BHP, while optimistic about the long-term prospects of nickel, is taking a more cautious approach, as evidenced by its exit from the Kabanga project and impairment charges. Rio Tinto, with its diversified portfolio, offers a more stable investment option, albeit with less direct exposure to the nickel market.

What To Know About Trading or Investing in Nickel

Nickel became a hot commodity in recent years, due primarily to geopolitical tensions related to the crisis in Ukraine. Prices went asymptotic in early 2022, reaching as high as $100,000, as detailed below, but soon fell back to a steady, predictable slope. There could be more to come, and if the global economy is entering a commodity super-cycle, then this could be the start of a multi-year trend. That would be an ideal opportunity for those trading momentum strategies, but short-term noise in prices would also open the door to short-term strategies.

One way to trade the nickel market is to buy the metal itself. Trading commodity futures, exchange-traded funds (ETFs) and contracts for difference (CFDs) can involve additional financing fees and charges that rack up over time. These all eat into profits, especially if positions are held for some time. An alternative approach is to identify and buy nickel mining stocks and other nickel stocks that give exposure to various parts of the metal’s sector. This means that investors can still benefit from the booming nickel market, but do so by holding a position in stocks that are an easier-to-manage and more cost-effective asset group.

Conservative investors, who rely upon the favourable projections for nickel demand over the next five years, may choose to invest solely in a nickel ETF. For those investors who would prefer potentially higher returns, investing directly in individual nickel-related stocks may be the way to go. If the firms have a pipeline of proven reserves or a backlog in orders, then their share prices may be more stable than more developmental-oriented firms.

Investing in mining stocks can be exciting, but they pose a higher risk factor. A company’s fortunes can abruptly change with the wind, especially when testing reports prove to be negative. There is also a long timeframe between discovery, mining, and then selling on the open market. With long timeframes, performance risk becomes overriding, even when fundamentals and technical data would seem to suggest a stable course.

In conclusion, investing in nickel stocks offers exposure to a crucial component of the EV revolution. Vale, BHP, and Rio Tinto each offer unique investment profiles, with varying levels of risk and reward. By carefully evaluating each company's operational strengths and weaknesses, financial performance, and ESG considerations, investors can make informed decisions that align with their individual investment goals and risk tolerance. The nickel market is dynamic and subject to volatility, so staying informed about recent developments and market trends is essential for successful investing in this sector.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY