Stellantis' stock price (NYSE: STLA) failed at the latest attempt to hold $10, with a 7.72% in last week looking to be get worse in pre-market trading after the automotive giant released preliminary figures projecting a net loss of €2.3 billion ($2.68 billion) for the first half of 2025.

The announcement, which also included a significant drop in revenue and shipments, has seen the stock fall a further 1.4% to $9.07. Tariff burdens, restructuring costs, and a weakened North American market are all playing on sentiment, with STLA having already fallen 55.5% in the past 12 months.

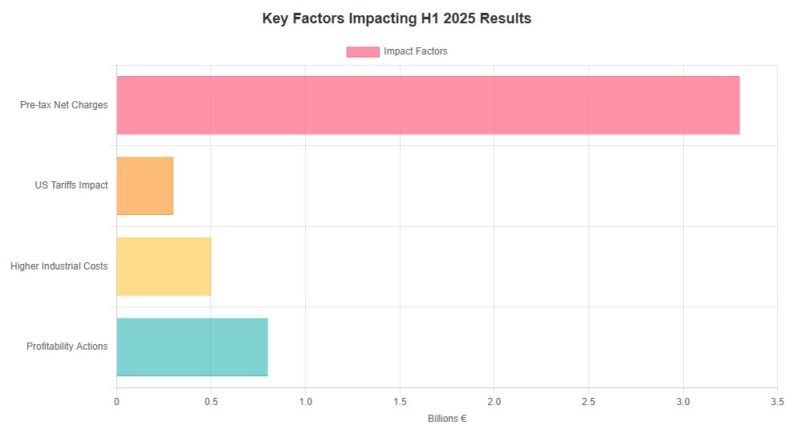

The preliminary figures, released ahead of the full earnings report scheduled for July 29, paint a grim picture for the owner of iconic brands like Jeep, Dodge, Fiat, Chrysler, and Peugeot. Stellantis attributes the substantial loss to several key factors, including approximately €3.3 billion in pre-tax net charges related to early-stage actions aimed at improving profitability.

These actions, while intended to streamline operations and boost long-term performance, are clearly taking a significant toll on the company's short-term financial health.

Adding to the woes are adverse impacts on adjusted operating income stemming from higher industrial costs, unfavorable foreign exchange rate fluctuations, and, most notably, the initial effects of U.S. tariffs. The company anticipates a €300 million hit in its first-half results directly attributable to these tariffs, coupled with planned production losses implemented as part of its response strategy.

This suggests that Stellantis is actively scaling back production in certain areas to mitigate the financial damage caused by the tariffs, a move that, while potentially prudent in the long run, is exacerbating the current revenue shortfall.

First-half net revenue is estimated at €74.3 billion, a considerable decline from the €85 billion reported during the same period last year. This drop reflects a broader slowdown in sales, particularly in North America, where second-quarter shipments are expected to decline by roughly 109,000 units, representing a staggering 25% year-over-year decrease. Stellantis attributes this decline to reduced manufacturing and shipment of imported vehicles, which are most heavily impacted by the tariffs, as well as a decrease in fleet channel sales. Overall second-quarter shipments fell to an estimated 1.4 million vehicles, down 6% year-on-year.

The upcoming earnings report on July 29 will be a crucial moment for Stellantis. The company's ability to articulate a clear and credible plan for addressing the challenges it faces will be critical in restoring investor confidence and preventing further erosion of value.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY