Trading platform eToro has now amassed more than 20 million registered users. The popularity of the site can be partly put down to the user-friendly and cost-effective nature of trading on the platform, but the feature that continues to draw in new investors, particularly beginners, is the copy trading service that eToro has become famous for. But who are the most profitable eToro copy traders? We take a look the performances of the top eToro traders.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

Whether you are still learning the basics, or just don’t have time to follow the markets effectively, it’s possible to set up your account to take on the trading ideas of others. You still have control over your funds, but the research, decision-making and monitoring of live positions are performed by someone else. Copy trading is a convenient option for those looking to get low-maintenance exposure to the financial markets, and using the copy trading service comes at no extra cost.

Once you have gained a better understanding of how copy trading works, it’s necessary to establish the best copy traders to follow, why they are successful, and how following them could be the best approach towards investing.

Table of contents

Selecting the Best Copy Traders on eToro

Selecting the best eToro copy trader is similar to selecting the best asset, or strategy, and booking the trade yourself. The key difference is that you are putting a third party in charge of a lot of the decision-making process, so some care is needed.

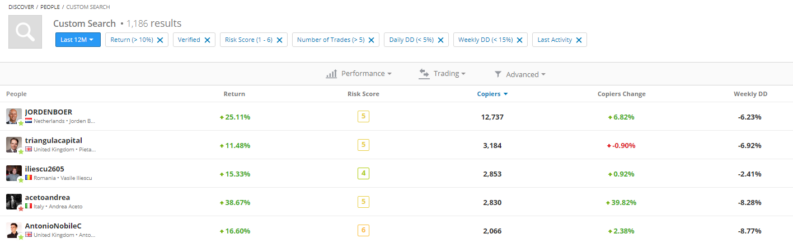

The good news is that the transparent nature of the eToro platform means that it is easy to research key criteria regarding the different traders who can be copied – and the even better news is that many of them have track records of generating positive returns for their followers. As the choice of traders can be somewhat overwhelming, we’ve identified the key factors to look out for.

Trading Style

One of the easiest filters to use is to identify potential traders who run strategies that tie in with your investment aims. On the eToro platform, traders are invited to give a summary of their approach, which allows copiers to understand what they are buying. Jorden Boer (@JORDENBOER), who has 12,700 copiers, explains his approach below:

“My trading strategy is to maintain a well-balanced portfolio trading the short, medium, and long-term simultaneously… No leverage, no hedging, no crypto and no adding funds… I trade using both technical and fundamental analysis with a medium risk score.”

Jorden Boer (@JORDENBOER)

With so many traders offering their services, there is a good fit for most people. If you want to gain exposure to a particular sector, such as commodities, crypto or bonds, or a region such as North America, Africa or Asia, then it is possible to focus your search one eToro copy traders who specialise in those areas.

Risk Score

The risk score mentioned in Boer’s profile refers to a neat feature of the eToro platform. It measures a portfolio’s maximum volatility and reports them as a range of percentages that are amalgamated into a single figure to give traders an idea of a portfolio’s change in gains or losses over time. A risk score of 1 denotes a low-volatility portfolio, whereas a risk score of 10 is allocated to a portfolio where portfolio volatility is in excess of 23.3%. Boer’s risk score is 5.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

Performance

Negative returns are obviously bad, but it’s also important to check the nature of the returns made by profitable traders. If you are looking to adopt a sensible approach to investing, and make realistic long-term gains, then you’ll want to copy a trader who has relatively low P&L volatility. This would reflect that the assets in the portfolio have been chosen to generate smoothed-out returns rather than catch the eye of potential copiers.

Number of Copiers and AUM

It’s important not to dismiss ‘emerging’ traders who might offer something new, but beginners in particular might take comfort from knowing that a trader is already being copied by a large number of other investors. Following the same line of thought, a trader can be considered more viable if they have, over time, built up a larger amount of assets under management (AUM).

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

Trading History

Past performance isn’t indicative of future returns, but a trader who has been running a strategy for months or years is likely to be running a well-thought-out strategy. Research the comments section of the trader’s page to check if there have been any major changes in approach, as there is nothing preventing a trader from changing their strategy at any time.

Portfolio Examination

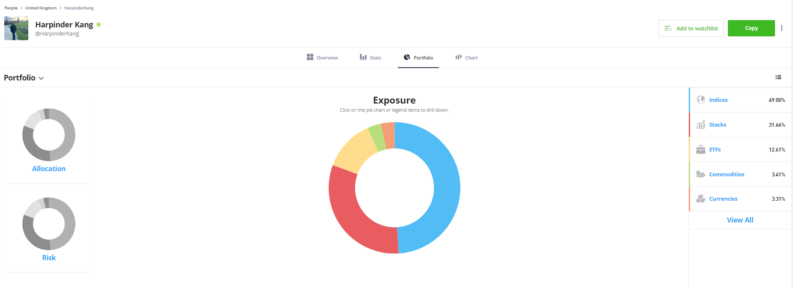

At eToro, it is possible to dig into the portfolio of other traders to a granular level. You can establish what their current holdings are and how they are performing, track their trade history, and consider to what extent the portfolio is diversified.

If the portfolio of a trader holds the kind of assets you would like to invest in, then copying them involves simply clicking ‘Copy’, which will set up your account to track their activity.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

Market Conditions

It is important that the trader and strategy you copy are appropriate for current market conditions. Some assets perform better in different types of markets. An uptick in geopolitical risk can make a usually low-volatility portfolio more volatile, and a normally high-volatility one too hot to handle. So, even if a trader has a fantastic recent track record, their approach might be due a downturn as a result of events outside their control, and vice versa.

Top eToro copy traders and Their Strategies

eToro has been offering copy trading since 2010, and unsurprisingly, some traders have outperformed others over that time. There are thousands to choose from, but below are some of those eToro copy traders who have developed strong reputations in the investment community.

@Triangulacapital – Pietari Laurila

This account is managed by an investor with more than 18 years’ experience of investing in the stock market. It has been running since December 2020, and now has more than $5m in copy assets. 3,188 eToro clients are currently copying the portfolio, which uses fundamental analysis to identify and buy undervalued stocks. Value investing is a strategy that can take some time to come good, but the stock picks have so far performed well. In 2021, the total percentage return was 37.42%; in 2022, it was 1.57%; and the year-to-date return for 2023 is currently 9.88%.

@Wise_woman – Veronika Tykhonova

The Wise_woman account at eToro has a risk score of 6, which reflects positions in more volatile assets such as currencies and commodities as well as stocks and ETFs. The trader takes a ‘macro’ view and aims to capture upside from long-term trends. In 2021, 2022 and 2023, returns were 8.48%, 1.36% and 10.34%, respectively.

@VIXGold – Catalina Norena

The @VIXGold account aims to capture macro moves in the global economy. It invests in ETFs and indices, which guarantees that a degree of diversification is built into the strategy. The account manager, Catalina Norena, has an advanced master’s degree in financial economics, and experience of working at the big multinational firms in which she now invests. There is some rotation between the major stock indices, but a consistent weighting to the S&P 500. Copying this trader is a way to track the performance of big US stocks, but with somebody keeping an eye on the portfolio to try to squeeze out additional returns.

@HarpinderKang – Harpinder Kang

It is worth noting that not all copy traders invest their own capital in their strategy. When they do, it is a sign that the trader’s interests are aligned with those of their followers. In the case of @HarpinderKang, the trader reassuringly states: “Having invested a considerable amount of my own money in my portfolio, I feel it is necessary to preserve capital first and foremost.”

The account aims to outperform S&P 500 while keeping portfolio volatility to a minimum. Meeting his own targets, and those of his followers, Harpinder Kang posted an annual return of 42.68% in 2021, and in 2022 annual returns were 60.93%.

@Isiahjames – Isiah Pila

With a risk score of 4 and a target rate of return of 15%, the @Isiahjames account at eToro offers low to moderate risk-return for those who follow it, even though it does sometimes hold positions in cryptocurrencies. Strategies used include swing trading, and capital allocation is typically weighted heavily towards US stocks. There is no leverage applied, and the use of short positions, as part of long-short strategies, demonstrates how elements of market risk are hedged. This account started accepting copy traders in March 2022 and in that year posted a return of 34.2%.

At eToro, copy trades and self-booked trades are carried out from the same account. Tracking your different positions is also done using the same monitor. This convenient blend of self-booked and copied trades offers beginner investors more structure when they start to trade. When you factor in that there are no additional fees for using the copy trading service, it’s clear to see why the eToro platform is so popular.

Recent Success Stories and Scale of Returns

One of the benefits of copy trading is that someone else is tasked with spotting new trends and rebalancing the portfolio to turn them into monetary gains.

The Harpinder Kang portfolio is an interesting example of how this works. Current positions in the account include S&P 500 ETFs and AI (artificial intelligence) stocks such as NVIDIA. The ETF position means that the strategy tracks the performance of the underlying index, and the NVIDIA position offers an opportunity to beat the index. This turned out to be the right call, with NVIDIA stock in Q1 2023 almost doubling in value.

There are, of course, instances where a trader picks stocks that underperform the broader index or even lose money. However, for many, that risk is worth taking based on the fact that the trader who is being copied is actively watching the markets to an extent that they wouldn’t be able to.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

Copy Trading Best Practices

An inherent risk of trading is that the assets you buy might fall in value, but the nature of copy trading means that investors need to adopt additional best practices in order to optimise returns.

Research and due diligence are crucial. There is great value to be gained from understanding the strategy and behaviour of a trader, and spotting if there is ever any divergence by what they state is their aim, and what trades are actually booked.

Using the chat room-style feature on a trader’s homepage is a neat way of getting to know more about the approach of the individual managing the account. These are often populated with investor updates or FAQs, and those thinking of copying are invited to ask any questions they have about how the strategy works.

One question that a potential investor might ask is whether a trader encourages new investors to ‘copy all trades’ or ‘copy new trades only’. This reflects that the portfolios usually have existing positions that have been built up over time.

Different strategies require different approaches in terms of how best to start copying a trader. At eToro, information concerning whether to ‘copy new trades only’ or recommended minimum investment size is usually supplied in the profile summary.

The summary statements and performance figures offer the best idea of what the trader aims to achieve, but those who are carrying out more stringent analysis might also want to consider other data. The win-loss ratio and maximum draw-down numbers will give an indication as to whether the trader holds onto losing positions until they come good or blows up the account, with the better approach being a disciplined approach where losses are cut to protect overall returns.

The two best pieces of advice for anyone considering copy trading are to embrace diversification, and make sure that you monitor your account. Both of these help manage risk. Either the assets invested in, or your copy trader themselves, can suffer an unexpected downturn in fortunes, and while copy trading can be low maintenance, it isn’t risk-free.

If you’re still considering the pros and cons of copy trading and whether it is for you, one way to find out more is to try doing it using a Demo account. That way, you can get used to the processes involved and what it feels like to copy another trader.

Summary

Copy trading isn’t for everyone. Some investors prefer to keep direct control of their trading decisions; for others, it can form an easier way to gain access to the markets; and there is a third group who take advantage of both options and run self-trade and copy trading positions simultaneously.

The approach is now well established, and as links to a trader can be broken at any time, there is minimal operational risk involved. Market risk remains, but sometimes managing that is best done by taking on the ideas of others.