- Facebook, Amazon, Apple, Netflix and Alphabet (formerly known as Google) have thrown considerable profits the way of traders looking to catch a ride on the Q2 equity market rally.

- At current price levels, the share prices of the firms can be seen to throw off signals about the state of the broader market.

- There may also be a need to revisit which strategy is best if traders are to continue to take profits from the price moves of the US tech-giants.

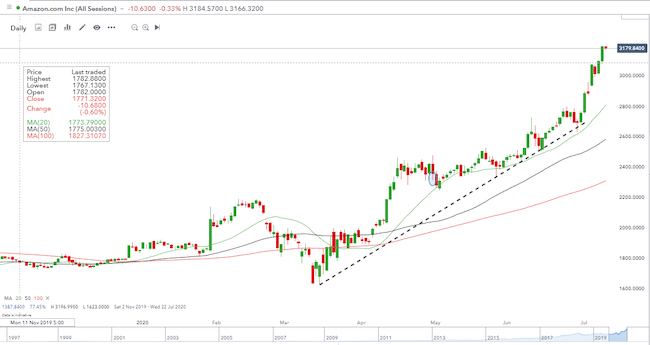

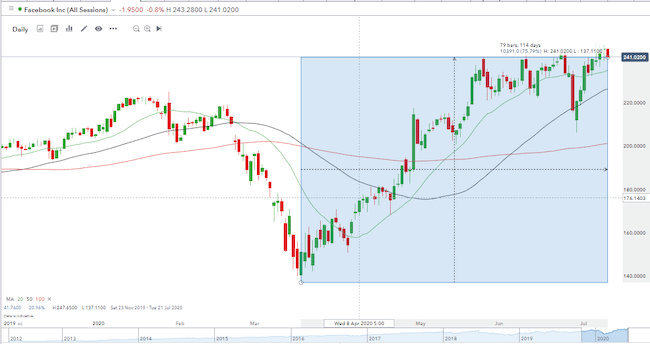

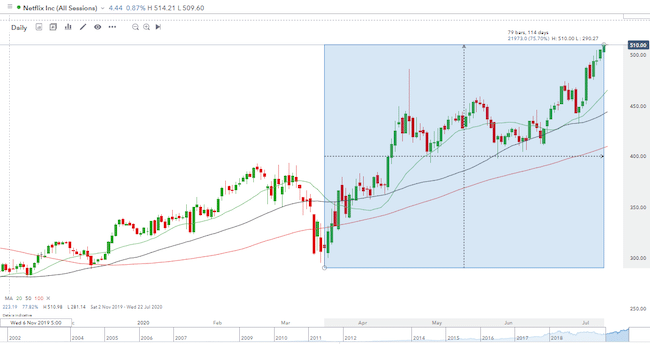

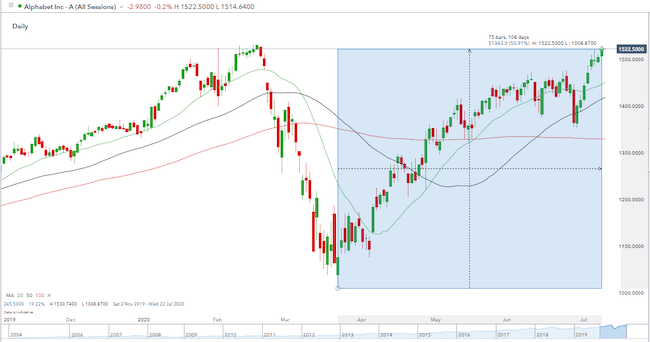

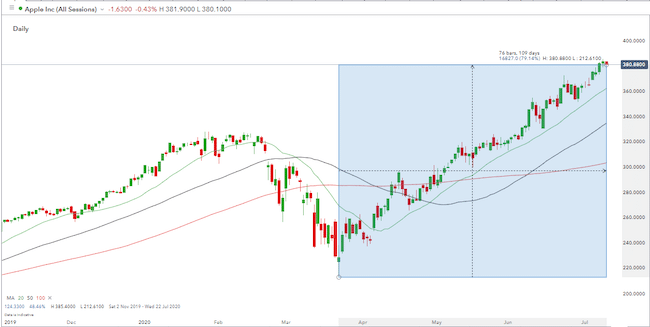

Tech stocks have been a popular and profitably target for investors as the markets have pulled away from the COVID crash. Since the March lows, the Amazon share price is up 95.92%. Also leading the charge has been the Facebook share price, which is up 75.79%, Netflix (+75.70%) and Apple (+79.14%). In line, but just behind in terms of share price performance is Google posting a 50.91% share price rise since it’s March low.

Amazon share price 26th Nov 2019–10th July 2020

Facebook share price 26th Nov 2019–10th July 2020

Netflix share price 26th Nov 2019–10th July 2020

Google share price 26th Nov 2019–10th July 2020

Apple share price 26th Nov 2019–10th July 2020

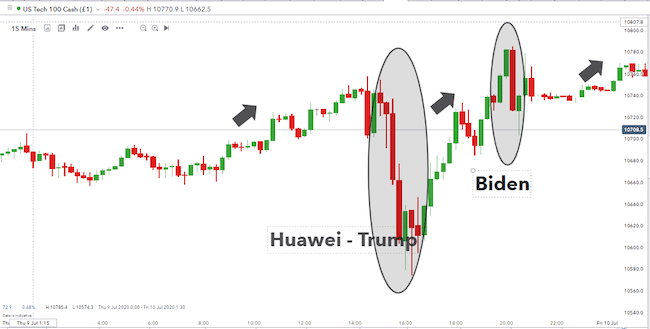

Those wondering if the rally will continue will note the trading events of Thursday, which packed all the factors that are playing on the market into one session. The price action of the Nasdaq index offers a condensed version of what’s driving prices and where they might go next. They also offer an insight into the type of trading strategies which might be profitable.

Shorting into that tidal wave of buying pressure could have blown up trading accounts. Shorting at current levels could also lead to traders being carried out of the ring, but there is at least technical data to imply this could be a turning point.

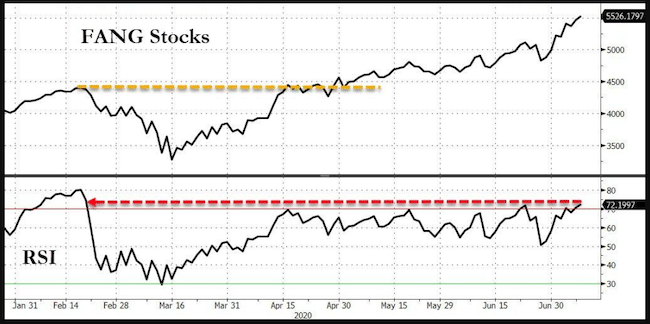

The Bloomberg chart shows FAANG stock prices. The data illustrates how the RSI is back at the peak level it touched prior to the March sell-off.

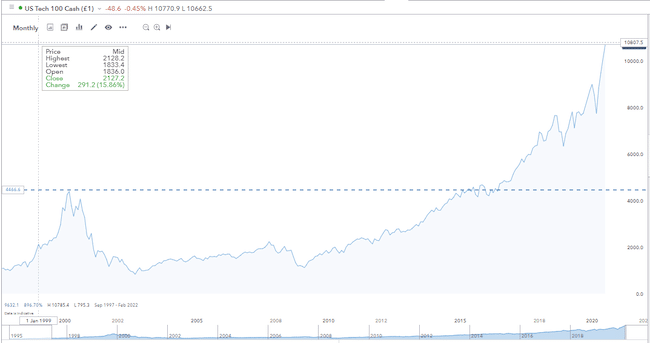

Nasdaq index – 1995-2020

The chart of Nasdaq 100 / S&P 500 also offers flash-backs to the tech crash of 2000.

Leading or lagging?

The question is whether the Nasdaq is the leading or lagging indicator of the state of the markets. During the rally that followed the crash of 2009, it was the Banks which came into focus. Increased hopes that the sector wouldn’t implode led to a good day for the bank share prices. As finance sector indices moved upwards, the rest of the market followed. Since March is has been the Nasdaq index rather than banks which has led the way. To the surprise of many, the COVID pandemic has so far at least failed to become a financial crisis. It is only when the fiscal and monetary life-support is turned off that the extent of corporate default and unemployment will be revealed.

This time the onus is firmly on the tech stocks. The argument to support the Amazon share price move, for example, is that changes to consumer behaviour — which were forecast to take several years — were rushed through in months. The ‘new normal’ is favouring firms that operate, and in instances dominate, their part of the digital economy.

Taking a view on that would influence what strategy to adopt to try to squeeze more profits out of the long Nasdaq trade.

At current price levels, the FAANG share prices are bumping into severe resistance. This is causing momentary pull-backs and then further buying pressure as traders ‘buy the dips’.

Nasdaq Index – Intraday – Thursday 9th July

A year in a day

Thursday’s trading pattern in the Nasdaq revealed all the same features that are also operating over a longer time frame. First, there was the period where FAANG share prices ticked up but only gradually — some traders built positions and those late to the party were getting over their FOMO to join the tech revolution. It is, after all, the long-term natural state of equity markets to creep upwards.

After such a dramatic bull run, there is a sense that the air could be getting thin and the old adage that taking a profit is never a bad thing doesn’t take long to come into play.

The first dip of the day came following an announcement on Huawei, which reminded the markets of the trade war still raging between the US and China. Regulations are being finalised, which will restrict the US government from buying goods or services from any company that uses products from five Chinese companies, including Huawei.

“The danger our nation faces from foreign adversaries like China looking to infiltrate our systems is great,” said acting director of the White House office of management and budget, Russ Vought. He continued: “The Trump Administration is keeping our government strong against nefarious networks like Huawei by fully implementing the ban on Federal procurement”.

Source: Reuters

European markets closed with Asian markets yet to open the US exchanges, which hold so many of the tech giants that rose in price again. The bad data turned into a chance to buy in at lower levels.

Then came geo-political risk. The US election and the potential for a COVID-19 second wave have cemented their position as the key news items for trading the second half of the year.

Joe Biden, Democrat nominee for the White House, spoke at a manufacturing plant in Dunmore, Pennsylvania. He said:

“It’s time that corporate American pays their fair share of taxes… The days of Amazon paying nothing in federal income tax are over. Let’s make sure workers have power and a voice. It’s way past time to put an end to the era of shareholder capitalism – the idea that the only responsibility a corporation has is to its shareholders. That’s simply not true and it’s an absolute farce. They have a responsibility to their workers, to their country. That isn’t a new or radical notion.”

Source: The Hill

Such speeches are carefully thought out, so political analysts must have established there is a sector of the voting public that finds such messages appealing. It isn’t Wall Street as the share price corrections show.

Operating on a more relaxed time schedule, news of a spike in US cases of coronavirus infections dripped into the market. The noise from this has caused prices to bump around resistance levels but has ultimately failed to topple the FAANG stocks off their position at or near record highs.

The Dow was down on the day and Nasdaq was heading in the other direction. Is the Nasdaq the leading indicator or the last to suffer from being over-bought as harsh economic reality comes to light? Those looking to put on long-term positions in FAANG stocks might be waiting for confirmatory signals for that trade. The short-term traders, buying into the dips and offloading at resistance levels can point to two geo-political flashpoints failing to take them out of their positions.

Analysis of buying the dips on a longer time horizon can be found here.