Key points:

- JD Sports will report interim results on Thursday

- How has inflation impacted the business?

- Shares are down almost 45% in 2022, investors may be eyeing a bounce

JD Sports (LON: JD) is set to report its interim results for the 26-week period to July 30, 2022, on Thursday, September 22.

It is the first set of results since Régis Schultz was appointed CEO. Although he only took over in September, with the company's shares down almost 45% in 2022 (-2.55% at the time of writing on Tuesday), he will be hoping for a boost.

However, with inflation soaring throughout the reporting period, the UK-based retail company is expected to report a slight decline in profit as consumers relax spending. But are those expectations correct? Here's what demand trends show:

Web Traffic

According to Semrush, during the period, traffic to JD Sports's UK website fell from approximately 8.1 million visitors to 7.1 million. Meanwhile, its US website saw traffic dip to around 1.12 million in July from around 1.17 million in February, in line with the current expectations that inflation impacted sales during the period.

Google Trends

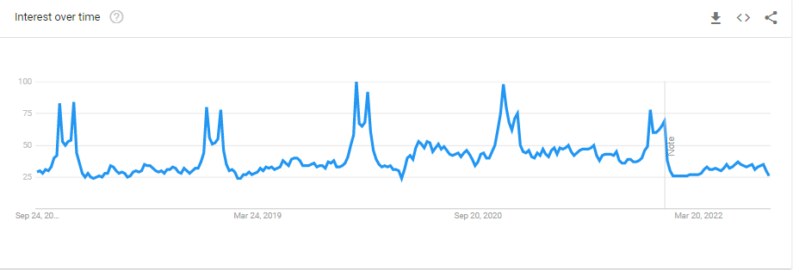

Furthermore, Google Trends data reveals search interest for JD Sports is currently around its lowest level since pre-pandemic, again reaffirming the current expectations for this week's report.

However, in the US, JD Sports has been growing, with search interest steadily increasing, although it has dipped since its high before Christmas 2021.

High Street Footfall

While we don't have access to data for the whole period, an article from Talking Retail reveals that RSM UK analysis shows high street footfall fell 25% in May 2022 from the previous month.

Meanwhile, they state that footfall is still 48% below pre-pandemic levels, while London's Oxford Street, an important shopping location, is the worst hit high street in the UK, down 52% from pre-pandemic levels. The decline is said to be due to hybrid working and less commuting than in previous years. However, there was a slight rise month-on-month in April.

Bottom Line

I will be surprised if JD Sports hasn't been impacted by inflation with pressure on costs and sales.

However, while that is the nature of the current economic environment, the company has a strong balance sheet, and investors may be looking to snap up shares on the cheap following its year-to-date decline. As a result, a rise following the report would not surprise us, as the company is potentially viewed as a good long-term hold.

Analysts see JD Sports posting a pre-tax profit of around £380 million for the period, compared to £440 million during the same period the previous year.