- One week after the assassination of Iranian general Qasem Soleimani, the US and Iran have formed an uneasy and unofficial truce.

- The sides have a long track record of firing insults at each other but the attacks, which involved firing actual missiles, ratcheted up the tension in the area.

- The opaque world of Middle Eastern politics makes it hard to draw any firm conclusions, but the rollercoaster ride of the last few days does offer insights into how the markets are reacting to events.

In the last week, US and Iranian military forces have both taken a free hit against each other. Each has suffered collateral damage, each as carried out a show of strength. The suggestion being made is that both sides can now argue they have achieved a face-saving ‘victory’ over the other. This view is being shared by many in the equity markets as global indices have rallied back to be near the levels they were at before the first shorts were fired.

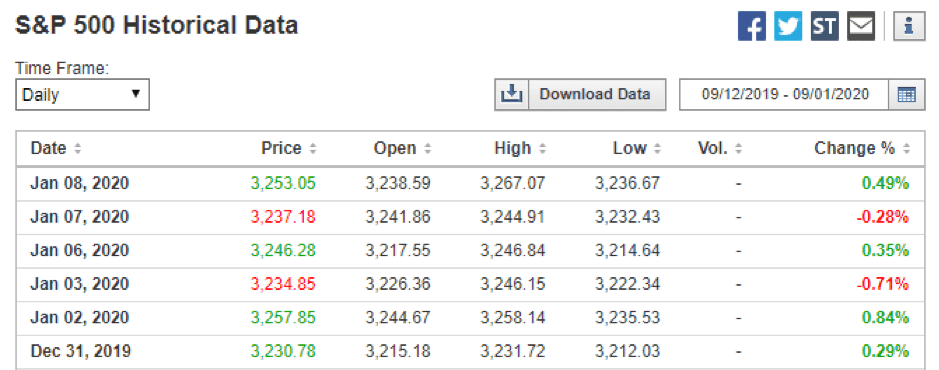

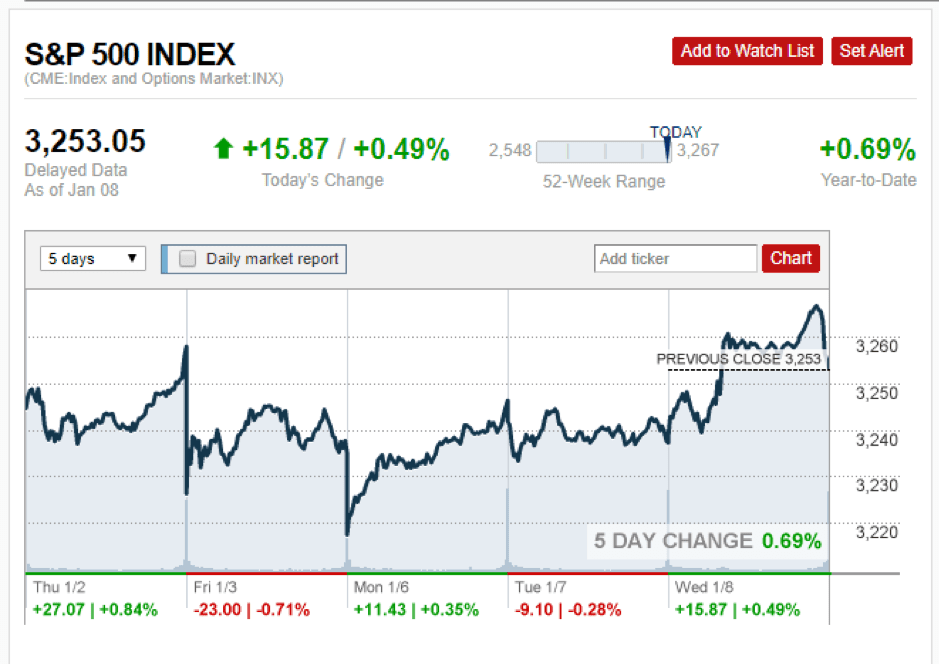

The US missile attack that killed Iranian general Qasem Soleimani caused oil prices to spike (Brent gained 4% intraday and closed 3.55% up) and the S&P500 to fall 0.71%. Swift Iranian retaliation, which followed on Wednesday 8th January doubled up the pressure. Oil rose again and the S&P500 fell a further 0.28%. Those who had put on positions in anticipation of the situation blowing over were disappointed and prices picked up momentum as they pushed through the stop losses of those looking for immediate retracement.

The bullish mood in the equity markets is illustrated by the daily returns chart, which shows the only two red days were those when the US and Iran fired missiles. In the intervening days, the equity markets dedicated themselves to ‘business as usual’.

Winners and losers

The shake-up in the first week of 2020 trading has highlighted some traditional fault-lines in the market.

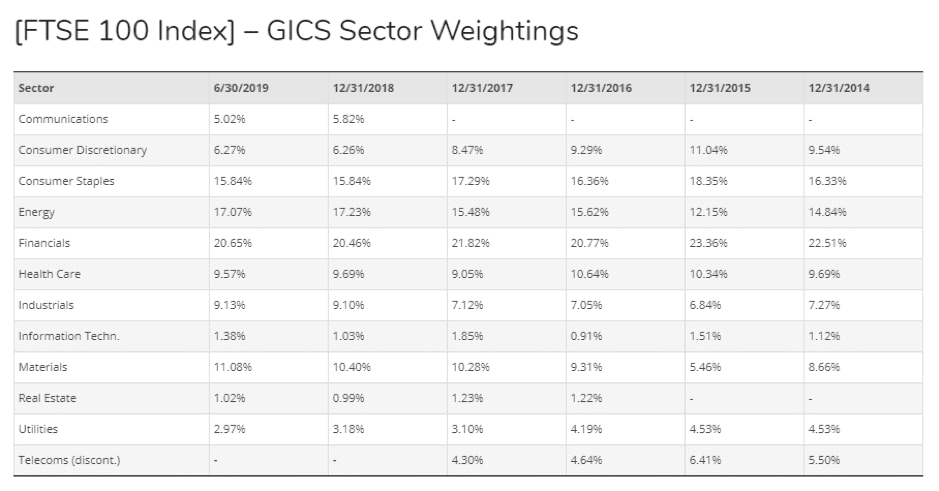

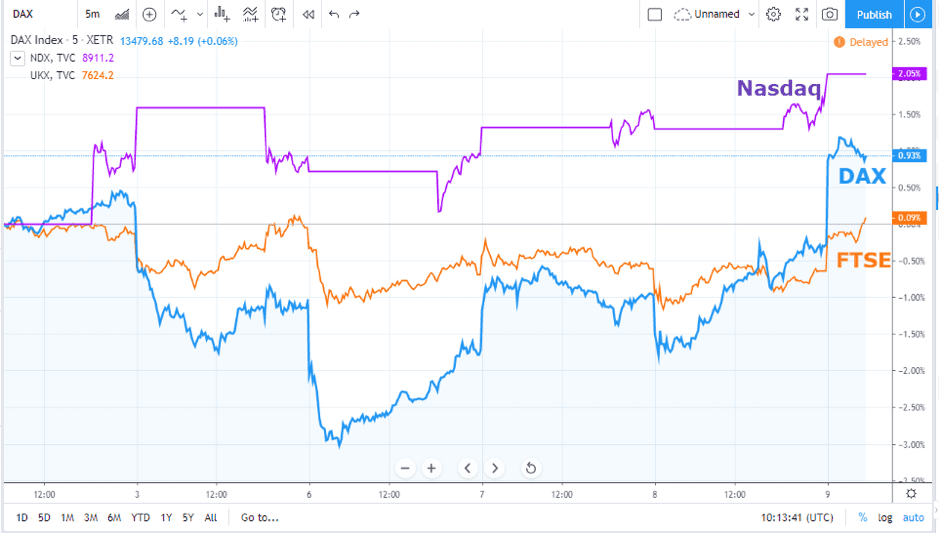

Comparing the Dax, Nasdaq and FTSE100 indices shows that the German index has been the most sensitive to events in the Gulf. There appears no reason to challenge the established consensus that firms that actually manufacture and export goods will struggle if a large-scale war broke out. In contrast, the FTSE100 has a long-term weighting towards energy stocks. Over the last 12 months the energy sector has made up at least 17% of the total value of the FTSE100 and the price spikes in oil and gas have bumped up the valuations of the likes of BP plc (LON:BP) and Royal Dutch (LON:RDSB).

The Nasdaq provides a sideways look at the situation. Investors take the view that innovation, invention and intellectual property offer better insurance against geopolitical risk. Of the three indices, the Nasdaq is the one that has performed best over the last five days.

Dax, FTSE100, Nasdaq — index comparison — Five-day chart:

The interesting feature of the comparison is that the DAX relief rally actually took it higher than the FTSE100. While the oil stocks in the UK index insulated it against some of the initial fall in prices, it has failed to recover with the same strength as the Dax. The US-Iran debate is not the sole driver of prices. However, it has been the lead for the last week and might support some who are looking to take long positions ready for long-term gains in German stocks. One assumption possibly being made is that US President Donald Trump would be more willing to sign off on a US-China trade deal rather than fight China and Iran on two fronts.

Uneasy peace

With the two attacks now logged, the conflict appears to have been temporarily reverted to political rhetoric. Two schools of thought are developing — one pointing to escalation and one to a stalemate.

The response from Iran was possibly more rapid than some had expected. Many pointed towards the threat of tanker attacks, attacks on opponent oil infrastructure or a scaling up of tension in the shipping lanes of the Gulf of Hormuz. The actual response was a series of rocket attacks on a variety of US bases in Iraq.

Alex Vatanka, senior fellow at the Middle East Institute, told CNBC’s Squawk Box Asia that:

“In many ways, we were expecting an Iranian retaliation. I, for one, did not think it will come so fast and so furious but that’s what happened.”

Source: CNBC

The ability of the markets to bounce back from each attack is being put down to the Iranian response being restrained. It is certainly a demonstration of intent but is not necessarily likely to bring about a further reaction. As Vatanka said: “look, Iran has made its point”.

Wednesday’s comments from Donald Trump were viewed as conciliatory. His tweets over the weekend suggested any military response by Tehran would result in the US bombing Iranian sites of cultural interest, but by Wednesday the president was tweeting: “all is well!” (source: Twitter). Indeed, as Wired.com has put it — “Did Twitter Help Stop War With Iran?” (source: Wired).

The buying activity suggests that many sided with Jens Nordvig, CEO of Exante Data, who said:

“I think the lesson from the last couple of years is it’s quite dangerous to get trapped in these risk-aversion news cycles because they don’t tend to last very long.”

Source: CNBC

And the winner is…

Market prices currently point towards the ‘stalemate’ scenario. According to ING Think, the playbook for 2020 was to include: “benign conditions, a trade truce and more money printing in G3 economies” (source: ING).

For many, tensions in the Gulf have formed a buying opportunity.

The current political approach appears to confirm buyer actions, but with global equity indices up on a YTD basis, there must be some concern that peace is already priced in.