The United Arab Emirates has been a hub of trading activity for centuries. With the financial markets currently offering a wide range of investment opportunities, the best online trading platforms in the UAE are satisfying client demand by providing high quality, low-cost access to various asset classes. Things are rapidly changing with the various trading platforms, and we have conducted reviews of more than 100 different broker platforms to get to the answer as to who should still be listed amongst the top platforms in UAE.

Choosing the right platform can be complicated, so we created this page to help UAE readers to find trusted and low cost versions with the minimum of fuss. There are various platforms that are best suited to different types of trading activity, and different types of instruments. Those in the UAE who have opened an online trading account can access markets ranging from forex, real estate, exchange traded funds and shares listed on the Dubai Financial Market (DFM) stock exchange, depending on what the broker provides.

The Best Trading Platforms in UAE

#1Pepperstone

Our best rated forex trading platform in UAE

Our best rated forex trading platform in UAE

- Well regulated, including by DFSA

- Choice of four platforms

- Low-cost trading, raw spreads and low-latency

- Demo account

- Zero account inactivity fees

- Islamic account

- Negative balance protection

Pepperstone started out as a forex broker but has, due to popular demand, expanded into other markets. It now offers markets in a range of instruments including CFDs, stocks, indices, metals and energy commodities.

Despite the broker’s growth in size, it’s kept true to its core strengths. It provides low-cost, high-quality access to the international markets and is known for having award-winning levels of customer service.

Broker Fees

Part of the secret to being considered one of the best online trading platforms is keeping costs down. Low fees are crucial to making a profit from trading.

Execution spreads at Pepperstone are super-tight. The average spread for major forex pairs like EURUSD on the Razor Account is 0.17 pips. Spreads are variable, so as market liquidity improves, so do trading terms, and spreads in some currency pairs can be as tight as 0.0 pips.

The average spreads in gold markets are an impressive 0.13 points.

Trading Limit

There’s little chance of running out of space at Pepperstone. It’s possible to open up to 100 trading accounts.

Features

- CFD trading on FX, indices, gold, shares (US, AU, DE and UK) and more

- Super-fast execution — most orders are executed in less than 30ms

- A choice of two account types, Standard and Razor with NDD and STP trade processing options

- Scalping and hedging are permitted

Regulation

Pepperstone is also authorised and regulated by a range of top-grade global regulators. The Dubai Financial Services Authority (DFSA) is one regulator that monitors the activities of the brokers, others include well-regarded names such as FCA, CySEC, BAFIN, CMA, SCB and ASIC.

For this reason, Pepperstone can be considered one of the safest, as well as one of the best, trading platforms in the UAE.

Platform

Pepperstone offers its clients the choice of four market-leading platforms, MT4, MT5, cTrader and TradingView. These are all third-party services, which come with considerable reputations. MT4, for example, is the world’s most popular retail trading platform for forex. They are available in desktop, web-browser and mobile app format.

If you’re looking for copy trading, then you can access DupliTrade, myFXbook and MetaTrader Signals from your Pepperstone account. Those wanting to have more control over their decision-making can access a wide range of educational material and research tools.

The Pepperstone platform is designed to accommodate beginners, but also be able to take your trading to the next level.

Customer Support

The Pepperstone customer services team keeps on winning industry awards. The team’s reputation for being professional, prompt and informed spans the globe. This is important because there are possibly going to be times when live positions are at play and the quality of customer support can be the difference between making a profit or a loss.

#2HFM (HF Markets)

What We Liked:

What We Liked:

- Trade with leverage of up to 1:2000

- Swap-free / Islamic trading accounts

- Zero commissions in some markets

- Impressive research and analysis tools including Autochartist and Advanced Insight

- Multilingual customer support available 24/5 via phone, email, and Live Chat

- Choice of three high-quality and easy to use trading platforms

- Professional grade trade execution

- Low admin costs

Since its inception in 2010, the award-winning broker HFM has grown to gain more than 3.5m client accounts. Also known as HFM Markets, the broker’s success has been based on offering a user-friendly way of trading the markets using powerful software tools that give its clients an edge. HFM removes many of the traditional barriers to entry faced by traders; for example, three of the four available accounts have no minimum account balance requirement. Beginners also benefit from around-the-clock multilingual customer support. For more experienced traders, there is an opportunity to tap into a headline-grabbing maximum leverage rate of up to 1:2000.

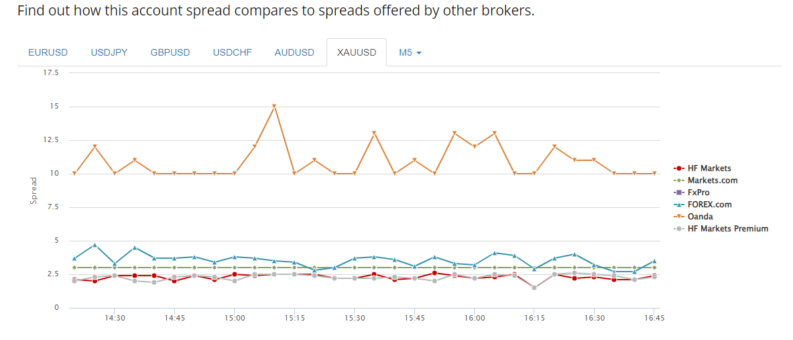

Broker Fees

HF Markets does not set out to be a budget operator, but the terms and conditions on offer ensure investors can enjoy cost-effective trading. Spreads on some currency pairs are as low as zero pips, and stock spreads start at 0.01 pips. These spreads are variable, and they do widen according to market conditions. The confidence the broker has in its fee structure is proven by the unique Spread Comparison tool that allows clients to cross-reference the rates offered by other brokers in key markets. In line with standard market practice, overnight financing fees apply on CFD positions, but no charges are applied on cash deposits and withdrawals.

Trading Limit

Trading terms are one area where HFM stands out, largely thanks to the maximum leverage rate being 1:2000. That is much higher than the industry standard and allows HFM clients to scale up on risk-return and gain greater exposure to the markets even if they make small deposits.

Features

The trader-focused approach of HFM includes a range of additional features designed to help clients identify trade entry and exit points. The well-regarded Autochartist is a third-party software package which scours the markets looking for trading opportunities. That’s backed up by the new and exclusive Advanced Insight tool, which uses AI to analyse millions of data points, calculating market volatility and sentiment. The tools can identify price trends in more than 1,000 markets, including forex, stocks, indices, commodities, bonds, ETFs, and cryptocurrencies.

HFM offers the option to use Islamic/swap-free accounts, which are Shariah-compliant.

Regulation

Security of funds is the number one priority when choosing a broker. Our HF Markets review established that HF Markets (SV) Ltd is registered in St. Vincent & the Grenadines as an International Business Company with the registration number 22747 IBC 2015. Other entities of the wider HF Markets Group operate under licence from other regulators, ensuring the broker offers a global service.

Platform

HFM clients can choose from one of three different trading platforms. During the testing stage of our HF Markets review, we found the in-house developed proprietary HFM Platform to have pleasing aesthetics that make site navigation and trading a user-friendly experience. Also available are the MetaTrader MT4 and MT5 trading platforms. They are packed full of trade indicators and remain the most popular trading platforms in the world.

Customer Support

Clients can contact HF Markets customer support on a 24/5 basis via phone, email, or Live Chat and in more than 27 languages. Having a range of ways to source assistance ensures clients get the help they need when they need it in a format which suits them.

#3FXTM

What We Liked

What We Liked

- One of the big global brokers.

- A reliable platform with more than 2 million existing clients.

- Islamic account, which is fully Shariah-compliant.

- Beginner-friendly and the ‘Cent’ account allows new traders to start trading in small size.

- $10 minimum opening balance (Cent account).

- Competitive pricing — spreads starting from 0 pips and no commissions on selected ECN accounts.

- Institution-grade infrastructure ensures reliable and fast trade execution.

- Islamic Account for Shariah-compliant trading.

- Winner of the World Finance, Best Trading Experience award, 2020.

- User-friendly mobile apps, perfect for those who want to trade on the move.

- 24-hour customer support available in 18 different languages.

- Free demo account.

- Lots of additional extras, including Trading Signals and FXTM Pivot Point Strategy

FXTM offers an extremely popular trading platform that is packed full of neat and innovative features specifically designed to make trading easy. Thanks to this approach, the broker continues to pick up industry awards and new clients.

It gives its users everything they need to trade, but it’s laid out in a easy to access way, which makes the platform ideal for beginners. A lot of the features are unique to FXTM and visiting the platform to try out its service is highly recommended.

Source: FXTM

Some of the upgrades such as the Cent Account appear no-brainers and raises the question why other brokers don’t offer them as well. With a low minimum deposit of $10, the Cent Account allows traders to take the step up from trading in a demo account and into live trading without the risk of burning through their entire cash pile.

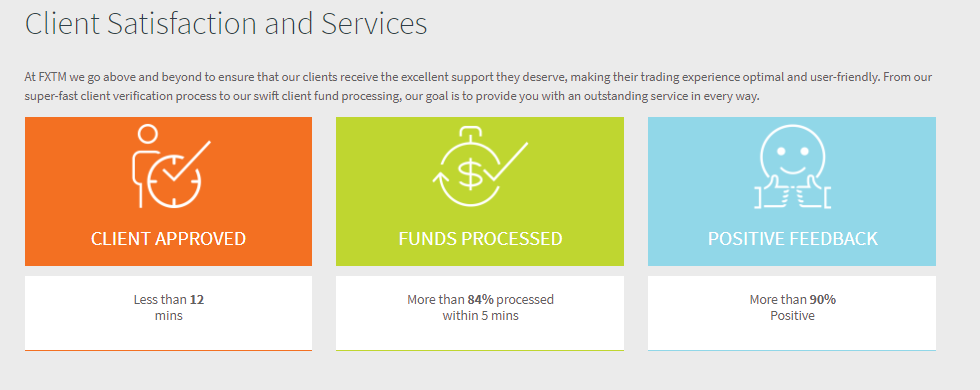

The firm is also one of the best in the sector in terms of the information it provides clients about the operational efficiency of the site. Transparent reporting is a sign of a confident broker and one that is aware that it is doing a good job of supporting its clients.

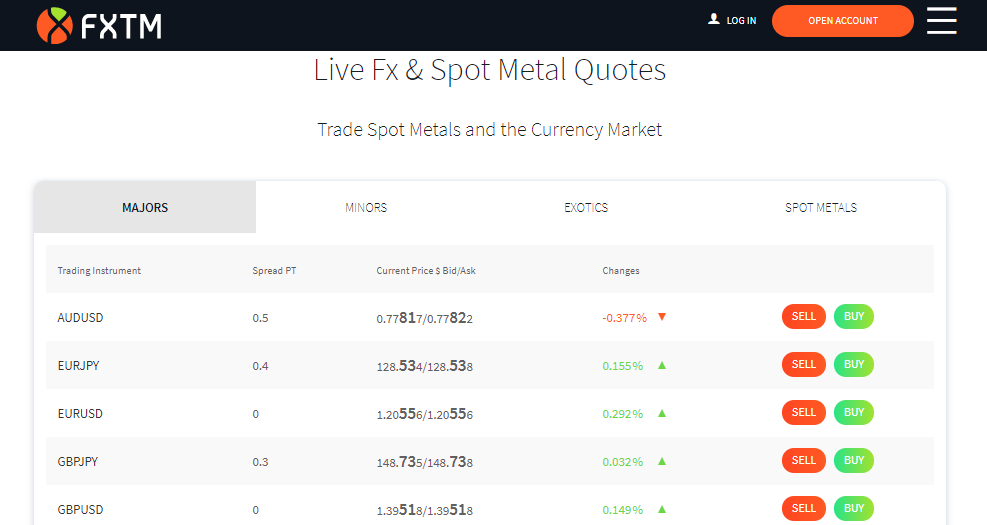

Broker Fees

FXTM offers three types of account types, Standard, Stock CFDs and Cent, so that clients can find a best fit. The T&Cs vary across the accounts, but all are very competitive.

- EURUSD as low as 0.1pips

- EURUSDStandard spread: 1.9 pips

- EURUSD Average RAW spread: Standard spread 0.6 pips

- GBPUSD Average RAW spread: Standard spread 0.5 pips

- Commissions USD: $2

Source: FXTM

Trading Limit

Leverage terms are flexible and can even be adjusted on a trade-by-trade basis. FXTM clients that open accounts are covered by the Mauritius regulator FSC and can access leverage up to 1:300.

- FXTM provides access to a range of asset groups: 120 currency pairs + 36 commodities + 58 indices + 7 cryptocurrencies + 77 ETFs and 4 bonds.

- The minimum initial deposit requirement at FXTM is $10 for the Cent account and $100 for the Standard, Stock and FXTM copy trading accounts.

- Maximum number of orders: 100.

Source: FXTM

Features

- A trusted broker with a refreshing approach to innovation.

- The Cent account is a great introduction level account with a $10 minimum balance requirement.

Regulation

As stated on FXTM’s website: “Exinity Limited is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License bearing license number C113012295”. (Source: FXTM)

Platform

FXTM offers its clients the world’s most popular retail trading platform, MetaTrader MT4 and its sister platform MT5. Both of the industry-leading dashboards are available in desktop, WebTrader and mobile app format. FXTM clients can take comfort from knowing they’ll never be too far from the markets.

MT4 has user-friendly functionality and is packed full of powerful charting and analytical tools. It’s an ideal platform for those starting out in trading and comes with an easy to use but professional-grade charting package. The MT4 / MQL5 online community a great place for beginners to seek out the ideas of other more experienced traders. Some of them are even willing to share their trading signals.

The second platform on offer is the second-generation MetaTrader5 product, which has more indicators and time-frame settings than its predecessor. MT5 offers a slightly different way of doing things, and as both are high-spec, selection often comes down to which platforms functionality you prefer.

Source: FXTM

The free VPS hosting service is a big plus point and having your trading servers near to the global exchanges means better pricing and more reliable execution. There’s nothing more frustrating than picking a good trade entry point but finding market price moves before you have a chance to get into it.

FXTM Invest is a copy trading service that offers another way to get exposure to the financial markets. This is popular among beginners and those who don’t have the experience or time to develop their own strategies. There are more than 5,000 traders offering their ideas to be copied and the minimum opening balance is only $100.

The Copy Trading service provides another example of FXTM’s client-friendly approach — you only pay copy trading fees on profitable trades.

Customer Support

FXTM was awarded Best Trading Experience at the World Finance Awards in 2020. Customer support is available in 18 languages and the easy to reach dedicated account managers are also multilingual.

FXTM customer services can be contacted via email, telephone and live chat and are available around the clock.

#4eToro

What We Liked

What We Liked

- CySEC, ASIC and FCA Regulated

- Copy trading and self-trading in one place

- Wide range of instruments including crypto

- User-friendly platform, ideal for beginners

- Free demo account

- Islamic account

The fact that eToro supports 13 million clients speaks for itself. The broker has combined having a global outlook with developing a unique user experience for the traders that use it.

For some time, eToro has been widely regarded as providing one of the best trading platforms for beginners. This hasn’t stopped it improving its service or introducing a range of neat, innovative features, which make accessing the financial markets a user-friendly experience.

The registration process for opening a live trading account at eToro takes minutes to complete. If you want to try out its free demo account before-hand then opening that account takes moments. Setting up a demo account requires little more than an email address, but you can then trade virtual funds and find out why so many make eToro their broker of choice.

Broker Fees

eToro supports trading in stocks, ETFs, commodities, forex, crypto and indices. Clients can buy assets outright or take advantage of leverage using CFDs.

There are no trading commissions charged at eToro. Instead, the firm makes its money from the bid-offer spread.

Trading Limit

The maximum number of open trades is 2,000. Leverage terms are set according to investor domicile. Being a regulated broker, eToro ensures the T&Cs it offers clients are in line with local rules and regulations.

Features

- Copy Trading — choose to copy from a list of thousands of traders

- Provides one of the most user-friendly stock trading experiences in UAE

- Try social trading by engaging with the other traders on the site

Regulation

eToro is regulated by the Cyprus Securities & Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC) and also the Financial Conduct Authority (FCA), which makes the platform safe to trade by those in the UAE.

Platform

The eToro platform was designed and developed by the firm to be an ideal entry-level service for those looking to trade online. It offers user-friendly access to the global markets. For example, if you want to tap into opportunities in US tech stocks, you can do that via online trading from Dubai.

Support services include daily research notes, in-depth analysis reports and online tutorials and seminars covering the basics of online trading.

Customer Support

The intuitive functionality of the eToro platform means that most users can get up and running very easily. If you do have any further questions, the customer service team are ready to help and can be contacted via phone or email.

#5XTB

What We Liked

What We Liked

- Low-cost trading

- Innovative tech features

- Wide range of markets to trade including stocks, ETFs and crypto

- Micro-lot trading — great for beginners

- Top-tier proprietary platform — xStation 5

- Islamic accounts

XTB is so confident about its trading spreads (which go as low as 0.1 pips) that it offers a live-data table of what they are.

The broker provides cost-effective online share trading in Dubai with spreads on US stocks as low as 1 cent.

Active traders can receive improved T&Cs and up to 30% discount on fees.

Trading Limit

Maximum leverage for international clients is 1:500.

Features

- Micro-lot trading and low minimum account balance — ideal for beginners looking to trade in small size

- More than 4,000 markets in a wide range of asset groups

- Zero fees on account management and administration

- Negative balance protection

- Six types of accounts to choose from — Pro, Demo, Standard, Islamic, Micro and Mini

Regulation

XTB is regulated by the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and Belize International Financial Services Commission (IFSC).

The broker has more than 200,000 clients and has been in operation for 15 around years. This makes it a broker that can be categorised as safe.

Platform

The XTB platform, xStation5, is a proprietary product, meaning the only way get to use it is to open an account with XTB. If you want to know quite how good a trading platform can be, we recommend trying out the XTB demo account by taking a few moments to register here.

It is an intriguing blend of simplicity and super-powerful software. Beginners will find it easy to jump on and get a good understanding of the markets. Intermediate and advanced traders will find a range of professional-grade tools, which are capable of supporting even the most complex strategies.

The XTB platform supports a wide range of trading strategies, including scalping and hedging. It is compatible with desktop, tablet and mobile devices.

Customer Support

Customer service can be contacted by live chat or phone. Support is available in Arabic language.

Email: [email protected]

Account Opening: +357 257 25356

24/5 – Customer Service Ogrodowa 58, 00-876 Warszawa, Poland: +44 2036953086