There is the potential offered by the new blockchain technology protocols, the possibility that Bitcoin might ‘democratise’ and revolutionise the financial markets, and of course, the chance to make or lose money big time. But is Bitcoin legal in Singapore?

Not surprisingly, regulatory authorities and governments across the world have been forced to take a view on to what extent to allow Bitcoin to become part of their financial system. Singapore stands out in this respect as developments through 2021 have seen the Monetary Authority of Singapore (MAS) introduce measures that make it stand out from the crowd. The question of whether Bitcoin is legal in Singapore can only be answered by considering a series of ever-changing variables, but this is what the situation looks like right now.

Law and Regulation of Bitcoin Trading in Singapore

The first aspect to note about Bitcoin is that authorities around the world, not just in Singapore, are playing catch-up. The flagship cryptocurrency has only been in existence since 2009 and already has a market capitalisation in the region of $871bn.

Part of the appeal is that one of its core features is that blockchain technology provides account holders with a degree of anonymity. Then factor in that cross-border transactions are as easy as domestic ones and incur no additional conversion costs, and it becomes clear that regulators would struggle to directly control the market, even if they wanted to. On the other hand, it would be a risky move for any nation to allow Bitcoin to operate completely free from control.

The approach of Singapore authorities has been to adopt an innovative and relatively relaxed approach, which is intended to make the most of the situation.

Is Bitcoin Legal Tender in Singapore?

Only one country in the world, El Salvador, accepts BTC as legal tender. This doesn’t mean it’s not worth anything. In Singapore, as in the rest of the world, if users of the Bitcoin system decide to accept the coin as a form of payment, then it has value. They can buy and sell BTC online using crypto exchanges, broker platforms, or even trade it in person.

It’s technically possible for two individuals to meet up and exchange SGD for a piece of paper with the blockchain code, which denotes ownership of Bitcoin.

Taking an opinion on whether Bitcoin will one day become the global currency and replace fiat currencies will help you determine whether you think Bitcoin is currently over or under-priced.

What Elements of Bitcoin Trading are Not Regulated in Singapore?

Bitcoin and other cryptocurrencies are not regulated by the MAS, and there is no legislative protection for individuals or firms that buy, sell, or hold Bitcoin. If you are a victim of fraud, or if you suspect a third party is acting fraudulently, then you are expected to report the matter to the police immediately. Just don’t expect the regulator to try to help you reclaim your funds or offer any sort of compensation.

There are no regulatory laws relating to how Bitcoin accounts and payments are processed, and the MAS is not mandated to protect your crypto assets in any way.

Is Singapore Becoming More Bitcoin-Friendly?

So, any individual investor looking to buy Bitcoin must do so remembering this is very much a ‘buyer beware’ situation. There are ways to buy and sell Bitcoin that are accepted as being relatively low risk, but there is no official protection on offer.

It certainly gets interesting when you factor in that Singapore authorities have introduced some laws to monitor and actually grow the market. These protect the interests of the financial system rather than the interests of individuals and this could be good news for the Singapore market.

Law And Regulation On Bitcoin Investments in Singapore

The Payment Services Act 2019 – Bitcoin and other cryptocurrencies that are purchased or sold, or individuals that facilitate the exchange of cryptocurrencies, would be regulated under the Payment Services Act 2019. The rules and regulations relating to that act are designed to prevent money laundering and the financing of terrorism.

Securities and Futures Act – MAS is officially recognised as the authority responsible for monitoring securities and exchanges. While there are no specific crypto laws in Singapore, operators such as brokers and crypto exchanges provide services that cross over into activities that come under those laws. As such, those exchanges and brokers must ensure they are in compliance with the Securities and Futures Act (SFA) where applicable. The duties include:

- To notify MAS of any changes to the primary information relating to how it operates.

- Efficient risk management.

- To keep a record of transactions.

- To report to MAS on a regular basis. Note, this reporting does not mean they are regulated, they are just sharing information as requested by the authorities.

- To assist the Authority when requested to do so.

- To ensure user information and employee information is kept confidential, unless MAS or a court order states otherwise.

More Crypto Friendly Legislation in 2020 – While the rest of the world has been clamping down on cryptocurrencies such as Bitcoin, Singapore has been passing further laws that open the doors to international crypto firms wishing to set up and operate in clear view of the authorities.

The city-state has even become the home of the CEO of crypto platform Binance. Changpeng Zhao relocated to the country several years ago. The thinking behind the move is that Singapore can enhance its reputation as a major financial hub if it accepts the inevitability of crypto trading becoming mainstream. It’s just that enough rules need to be put in place to ensure the country doesn’t effectively become a base for lawless crypto activity.

Bitcoin and Taxation in Singapore

In comparison to its global peer group, taxes in Singapore are considered mild and this extends to proceeds derived from investing in Bitcoin. If you receive revenue in the form of cryptocurrency, this is liable to income tax in the same way that cash payments are. The income tax rate varies from 0% for incomes below $20,000 per annum and goes up to 22% for those with incomes over $320,000 per annum.

Losses and capital gains are not subject to tax. As such, trading and investments over a long-term are treated differently when it comes to taxation. If cryptocurrencies are purchased and held onto for long enough, no taxes are due. On the other hand, if you trade Bitcoin on a regular basis, then tax must be paid.

How to trade Bitcoin in Singapore

With the risks associated with trading Bitcoin in Singapore outlined, it’s time to look at the ways to get involved.

There are a variety of platforms that facilitate Bitcoin trading, and each has their own pros and cons. One important fact to keep in mind is that even if the broker or platform you select is regulated by MAS, it will only be for activity in regulated instruments such as equities. If your broker is regulated and something goes wrong with your Bitcoin trade, then your interests still fall out of the scope of the regulator.

Trading Bitcoin in Singapore Using CFDs

One of the easiest ways to buy Bitcoin in Singapore is to set up an account with an online broker. Trading cryptocurrencies using CFDs through a broker such as IG offers a convenient way to gain exposure to Bitcoin. Contracts for Difference are an agreement between account holders and a broker platform – you don’t actually own the crypto itself.

There’s no need for specialist wallets, but the fundamental rules of any financial market apply. You win or lose money depending on which direction the Bitcoin price moves and the client and broker exchange cash when the trade is closed out. If you open a long position and the cryptocurrency does go up in value, you’ll make a profit, but if it falls in price, you’ll make a loss. It’s also possible to set up a ‘short’ position and in that case, you will make a profit if the price you close your position out at is lower than the entry-level price.

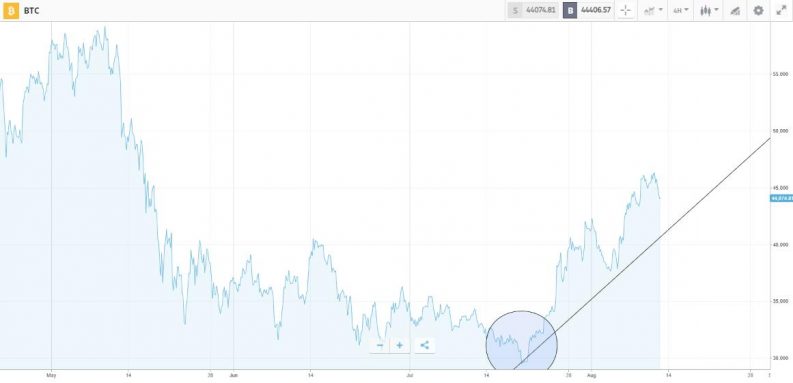

Source: eToro

Setting up an account with an online broker can be done online and requires providing some personal details and wiring funds to your new account. Once registered, you’ll be able to buy and sell Bitcoin using desktop devices or mobile phone apps.

Trading Bitcoin in Singapore Using a Crypto Exchange

An alternative method is to trade using a crypto exchange. While some brokers are regulated, crypto exchanges are unregulated. They also tend to only offer crypto markets, so if you’re looking to use your account to trade Bitcoin and other asset groups, an exchange might not be the best option for you.

Setting up with a crypto exchange requires providing the below information.

- Personal ID documents.

- Payment account or method of payment – including fund transfers and credit cards.

- Secure internet connection.

- A mobile to enable two-factor authentication.

- A crypto exchange account.

- Crypto wallet to store your cryptocurrency.

One way of buying Bitcoin through an exchange is to have the coins sent to your online account. There are risks associated with this. If the exchange is hacked or goes bust, you’ll likely lose out and remember the exchange and asset group are unregulated so none of the MAS protection measures kick in.

It’s widely considered safer to set up a personal cryptocurrency wallet. This is a digital account that can be held online (hot wallet) or offline (cold wallet). The hot wallet is also open to the risk of hacking, which makes using a cold wallet the safest method, at least as long as you don’t lose it.

How to Protect Yourself When Trading Bitcoin in Singapore

There are other risks to look out for. Some of these aren’t specific to Bitcoin but can be applied to trading in general and all deserve some attention.

Avoid investment schemes promising high returns.

As Bitcoin is unregulated, it’s a popular market for scammers. There is less likelihood of MAS getting involved in individual cases so it’s important to be wary. The price of Bitcoin is highly volatile and that allows some unscrupulous agents to promise exaggerated returns. Even bona fide schemes often come with high fees and commissions, which increase operational costs and eat into any promised returns.

Wiring cash to a third-party account is about the biggest no-no there is, as once funds have left your account you have no control over them. If setting up at a broker or exchange, be sure to double-check the process involves setting up an account in your name and that only you have access to it, and sole control overpayments.

Consider money-laundering and terrorist financing risk.

It’s not only fraudsters who are attracted to the crypto markets. The anonymity that comes as part of the Bitcoin trading package and the ease with which funds can be transferred across borders makes crypto a favoured means of payment for various groups of criminals. It’s possible your exchange could come under scrutiny from the authorities, which suspect payments are being made relating to organised crime or terrorism and that puts your assets at risk.

Remember, the fact that Bitcoin is unregulated doesn’t mean the authorities don’t monitor the markets. It’s just that they do so to protect their own interests, not yours. If your exchange is offering ridiculously attractive terms and conditions, it could be that it’s trying to attract enough retail clients to provide a smokescreen for criminal activity.

Trading Bitcoin through a broker platform using CFDs is one of the ways to mitigate the risk that your BTC holding might be lost or stolen. If you use an exchange, you do hold the rights to the underlying asset, but with that come some extra risks and responsibilities. If you hold your Bitcoin online at an exchange or in a hot wallet, then hackers can feasibly gain access to it. If you hold it offline, then it can be lost or stolen as easily as anything else held in physical form. There is also the risk of your device suffering a technical malfunction.

Consider how quickly you want to start trading Bitcoin

The many steps involved in setting up an account at an exchange do put some people off that option. If it is one you go for, then plan ahead as, due to the popularity of crypto trading and the relatively new nature of some exchanges, some operate waiting lists.

Conclusion

Trading Bitcoin in Singapore is legal. The market risk — the chance that price might dramatically move against you — is unavoidable but the operational risk, that you set up to trade the right way is completely under your control. A bit of research into the options available can pay off in the long term, especially as there is the very real risk of falling for a scam and losing all your funds.

Despite Singapore’s move towards becoming a good place to do business in Bitcoin, there is no regulatory protection on trades and positions held in cryptocurrencies. The new measures such as the Payment Services Act have been introduced to monitor and control the crypto eco-system as much as is possible. They are not intended to protect the interests of individual traders, so if you’re looking to buy Bitcoin in Singapore, make sure you go in with your eyes wide open.