Key points:

- Helium One shares aren't reacting to the latest announcement

- Things are going fine, well enough

- It's the drilling results which might make HE1 soar

Helium One (LON: HE1) shares are largely unmoved this morning on their latest announcement about their drilling activities in Tanzania. The announcement itself is essentially that things progress and work continues. Which may well be why this specific announcement hasn't moved Helium One shares. We tend to think that – hope that perhaps – management will continue to do the necessary even when they're not revealing information to the market.

There are details of minor import here though, it's not entirely “we continue”. The Tai prospect has an untested closure, there's been subsurface helium detected and both of those raise the chances of there being an interesting deposit.

At which point we need to think about the technical details of what is being done here. As we've pointed out before Helium One is prospecting for helium. The world needs more helium now that the US stockpile (and major global source) is being run down. Helium itself is a product of the radioactive breakdown of uranium and thorium – it's a “daughter product”. In fact, of the elements we use which are not, in themselves, radioactive it's the only one that is being continually generated upon Earth. Rocks which are high in U and Th will give off measurable amounts of He – just like they do Radon gas, it's the same process.

Also Read: Helium One Global Ltd Stock Forecast

When that helium escapes to the atmosphere it's pretty difficult – and very expensive indeed – to capture it. So, helium mining is a process of looking for natural gas reservoirs in high U and Th rocks. For the helium generated by the radioactive breakdown might well get trapped with the natural gas.

Helium One is prospecting in an area of Tanzania that has that high U and Th in the rock. They've shown that there is helium coming up into the atmosphere in measurable quantities. There are gas pockets around. This idea of an “untested closure” is that the helium is indeed being trapped with the natural gas, but that this is something that needs to be tested.

Everything does look good for that basic proposition – natural gas in certain Tanzanian rocks may be high in helium. But so far it's still only “looks good”. Which is what largely explains this:

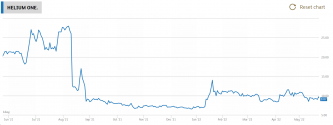

Yes, there was a certain excitement when Helium One first came to market. Since then there's been a certain amount of competition as well – there's a “helium belt” extending across Saskatchewan and certain of the northern US states which is also being explored. It's become obvious that the spread of LNG is aiding the extraction of previously marginal helium contents from other gas fields. But also we've not had definitive proof of Helium One's base contention – there's helium in them thar' hills. Which is a pretty important for a miner, the proof that there is something worth mining.

What is likely to perk up HE1, therefore, is proof from drilling results. Not just indicative evidence showing that there's no disproof of the base contention, but positive proof that yes, there's high helium natural gas in economic quantity.

We want the drilling results, not the announcement of drilling that is. All the evidence so far shows that it could indeed work, there's nothing we've got as yet that says it won't. But we do want the proof before Helium One shares might soar as if, umm, lifted by a helium balloon.