Shell plc (LON:SHEL) has released its second quarter 2025 update, painting a complex picture of the energy giant's performance and triggering a drop in its shares. Shell's share price has fallen 2.7% through the morning session, not far from the intraday lows.

While some segments show signs of strength, particularly in refining margins, significant headwinds in production and chemical operations are raising concerns among investors. The company's scheduled release of final Q2 results on July 31st is highly anticipated, as analysts and shareholders alike seek clarity on the underlying drivers of these mixed signals.

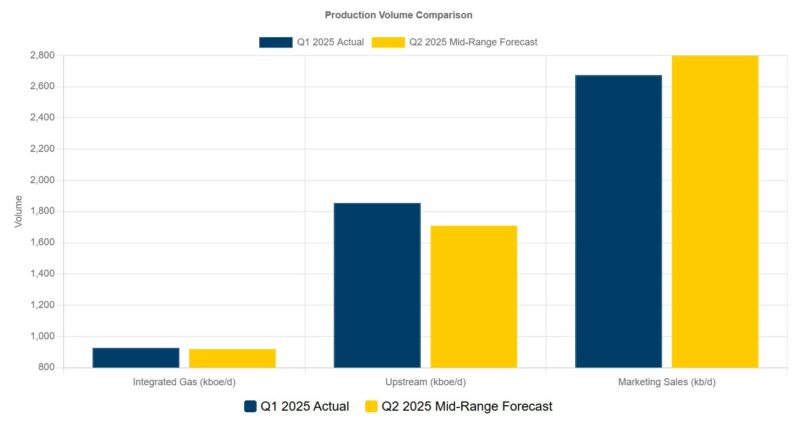

Production: Declines Across Key Segments

The update reveals anticipated declines in production across key segments. Integrated Gas is forecasting a slight dip in production, from 927 kboe/d in Q1 to a range of 900-940 kboe/d in Q2. LNG liquefaction volumes are also expected to see a marginal decrease.

However, the most significant impact is projected in the Upstream segment, where production is slated to fall from 1,855 kboe/d to between 1,660 and 1,760 kboe/d. Shell attributes this decline to scheduled maintenance and the completed sale of its Nigerian subsidiary, SPDC.

This divestment, while strategically aligned with Shell’s long-term goals, is clearly impacting near-term production figures. Furthermore, the company anticipates exploration well write-offs of approximately $0.2 billion, adding further pressure to the bottom line.

A potentially worrying aspect of the Q2 outlook is the projected performance of the Chemicals and Products segment.

Despite a substantial increase in indicative refining margins (IRM) from $6.2/bbl to $8.9/bbl and indicative chemicals margins (ICM) from $126/tonne to $166/tonne, the segment is expected to operate below break-even.

This counterintuitive outcome stems from a significant drop in chemicals utilization, projected to fall from 81% to between 68% and 72%. Shell cites unplanned maintenance at its Monaca facility as the primary cause for this decline, highlighting the vulnerability of its operations to unforeseen disruptions. Trading and Optimization within this segment is also expected to be significantly lower than Q1.

The Marketing segment offers a brighter spot, with sales volumes expected to remain robust at between 2,600 and 3,000 kb/d. More importantly, adjusted earnings for this segment are projected to be higher than in Q1, suggesting strong performance in downstream operations.

Renewables and Energy Solutions, a crucial area for Shell’s long-term strategy, is expected to deliver adjusted earnings ranging from a loss of $0.4 billion to a profit of $0.2 billion.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY