Pepperstone is one of the world’s largest trading brokers and is praised for its excellent customer service and wide range of third-party platforms. The research offering better than industry standard, but one minor negative is the relatively lower number of tradeable products compared to other brokers. Pepperstone was founded in 2010 in Melbourne, Australia and is not a publicly listed company.

But is Pepperstone the correct broker for you? In our Pepperstone review, we will look at regulation, account types and fees, trading platforms on offer, plus much more.

Account options

Forex

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Good | 1:30 | Low |

As with most brokers, Pepperstone offers a wide variety of Forex pairs, including majors, minors, and emerging markets. Pepperstone gives investors access to 60+ currency pairs and also 3 currency index CFDs. This offering of currency indices is notable, as although many brokers offer a US Dollar Index, there are few that offer a Euro Index and Japanese Yen Index.

With the Razor account (see below), the spread can be as narrow as 0.0 pips on Forex markets, although there is a commission to pay of 3.50 USD.

CFD

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Mid | 1:30 | Low |

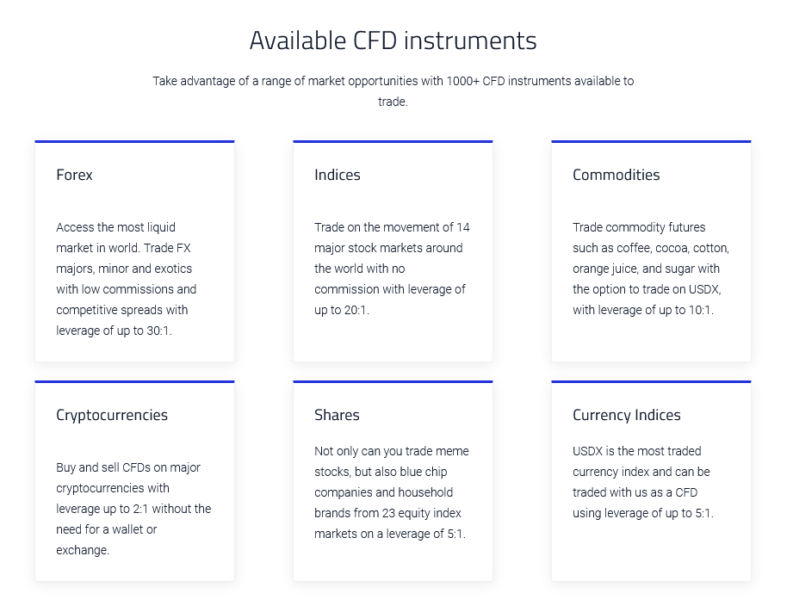

You can trade CFDs on stock averages (indices), individual shares, Forex pairs and Forex indices (as outlined above), cryptocurrencies (as outlined below) and CFDs on commodities with Pepperstone.

For the major stock markets there are over 20 global index CFDs on from around the world. In addition, there are also “thematic” indices, including the VIX volatility index, various sector indices and also three cryptocurrency indices.

In the commodities space Pepperstone gives clients a fairly wide offering. In the precious and base metals space, there is the ability to trade gold against five different currencies, which is a generous offering. Also, there is silver priced in US Dollars and Euros, plus platinum, palladium and copper. On the agricultural/ softs side there are eight commodities to choose from, and also three energy commodities (two oil, one gas). The leverage is up to 20:1.

Stocks

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Good | 1:5 | Low |

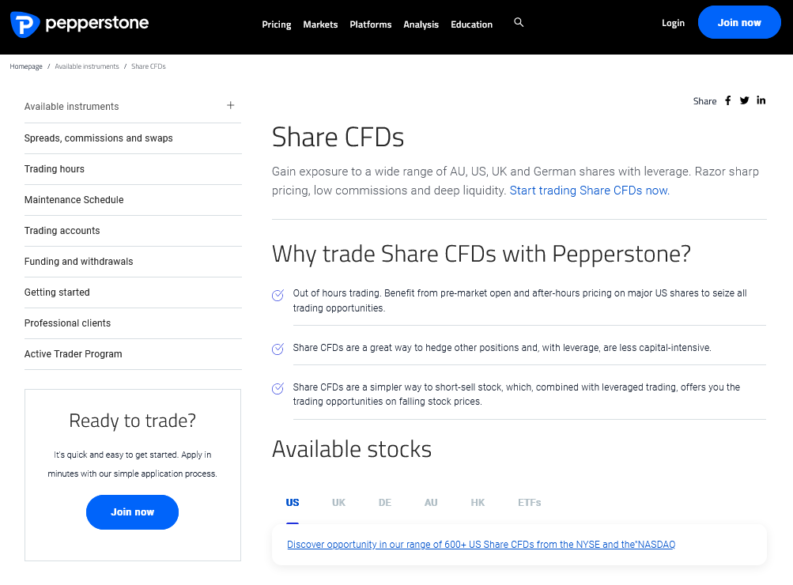

Although Pepperstone do not offer direct investment into stocks, they do offer individual share CFDs. Alongside over 20 global share index CFDs and also the various sector averages, Pepperstone also offers access to trade or invest in 600+ share CFDs from US markets only. Leverage for these share CFDs is at 5:1.

Furthermore, Pepperstone is amongst a handful of brokers that allow clients to trade these individual US equities in extended market hours. This can be extremely useful for traders to take positions early or reduce risk.

Social Trading

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Good | 1:30 | Low |

Pepperstone has partnered with numerous third-party services to offer the social and copy approaches to trading. Traders can use MetaTrader Trading Signals, myFXbook and DupliTrade with Pepperstone. This allows for seamless social trading that allows you to copy the trading strategies and signals of successful traders in real time.

Crypto

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Many | 1:2 | Low |

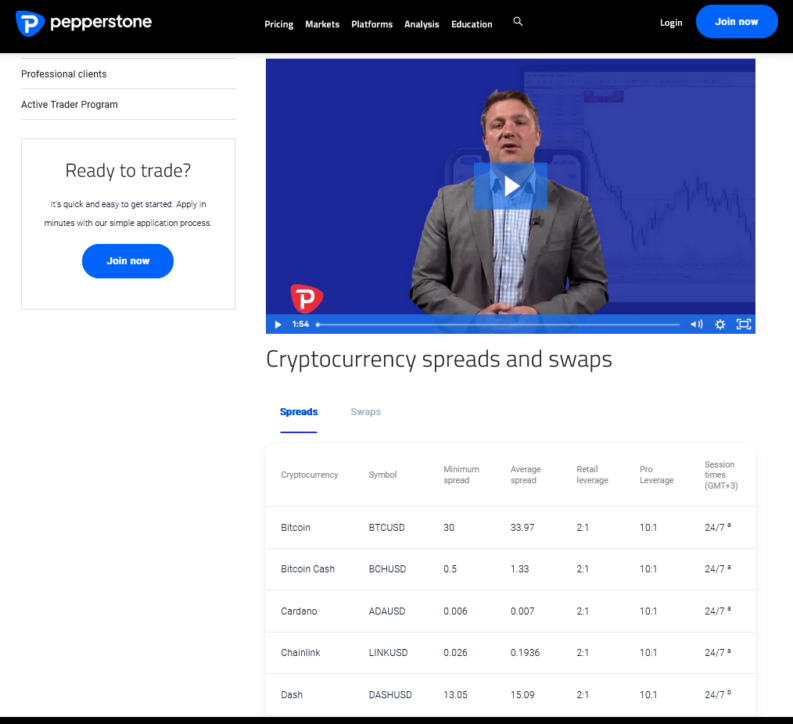

Pepperstone offers 20 crypto CFDs. Leverage is up to 1:2 for retail customers and 1:10 for professional customers. It should be noted that these investments are in the form of CFDs, not direct investment in the actual cryptocurrency itself. There are also three cryptocurrency indices that are on offer to trade.

In UK, crypto trading is only offered to professional traders.

Spread Betting (* only under FCA)

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £200 | Good | 1:30 | Low |

Spread betting is available through Pepperstone to traders who are residents of the UK and Ireland. The spread betting accounts are very similar to the CFD accounts, but with no stamp duty or capital gains tax payable.

WHAT DID OUR TRADERS THINK AFTER REVIEWING THE KEY CRITERIA?

Trust and Regulation

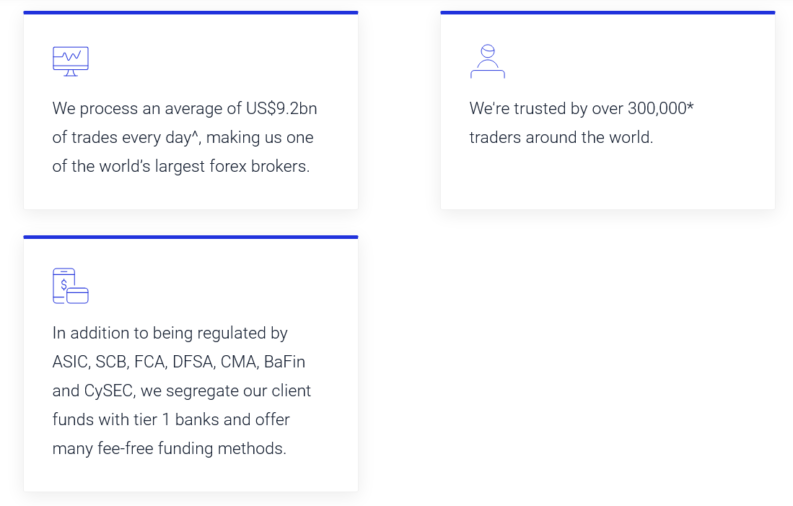

Pepperstone is regulated and licensed by two high tier regulators, the Financial Conduct Authority (FCA) in the United Kingdom and the Australian Securities and Investment Commission (ASIC) in Australia. In addition, they are also regulated by the Dubai Financial Services Authority (DFSA) and by four other lower tier regulatory bodies.

These regulators require Pepperstone to follow strict capital requirements, fully segregate traders’ accounts from company funds, comply with ‘know your client’ procedures and adhere to strict anti-money laundering requirements, as well as a plethora of other stringent measures designed to protect traders.

Overall, Pepperstone should be considered a safe and secure broker for spread betting, CFDs and Forex trading.

| Trust and regulation | Pepperstone |

| Regulated in how many countries | 7 |

| Year established | 2010 |

| Publicly traded | No |

Offering of Tradeable Products

When opening an account with Pepperstone, you will notice two main choices: Standard Account and Razor Account.

Certain features are available across all accounts, including:

- Leverage available up to 500:1 for professional clients

- Scalping, hedging & expert advisors are all permitted

- No dealing desk execution

- Maximum 100 lots trading size

- Minimum 0.01 lots trading size

- Minimum account opening balance of AUD$200

| Standard | Razor | |

| Institutional grade spreads | Yes | Yes |

| Average EURUSD spread | 0.6 – 1.3 pips | 0.0 – 0.3 pips |

| Commission | $0 | From AUD$7 round turn 100k traded |

| Rollover swaps | Market rates available on trading platform | Market rates available on trading platform |

All retail clients have minimum trade sizes of 0.01 lots, maximum trade sizes of 100 lots, and leverage of up to 30:1. The minimum balance to open the account is always $200, and base currencies can be GBP, EUR, USD, or CHF. Both Pepperstone account types also allow scalping, hedging, and expert advisors. Neither has dealing desk execution and both offer news trading.

Standard accounts have institutional grade spreads with an average EUR/USD spread of 0.6 to 1.3 pips. This account type has no commission and is ideal for new traders.

Razor accounts have institutional grade spreads without markups and average EUR/USD spreads between 0.0 and 0.3 pips. This Pepperstone review suggests this type of account for algorithmic traders and scalpers, as that is who Pepperstone designed it for. Commissions start at GBP 4.50 round turns for every 100,000 traded.

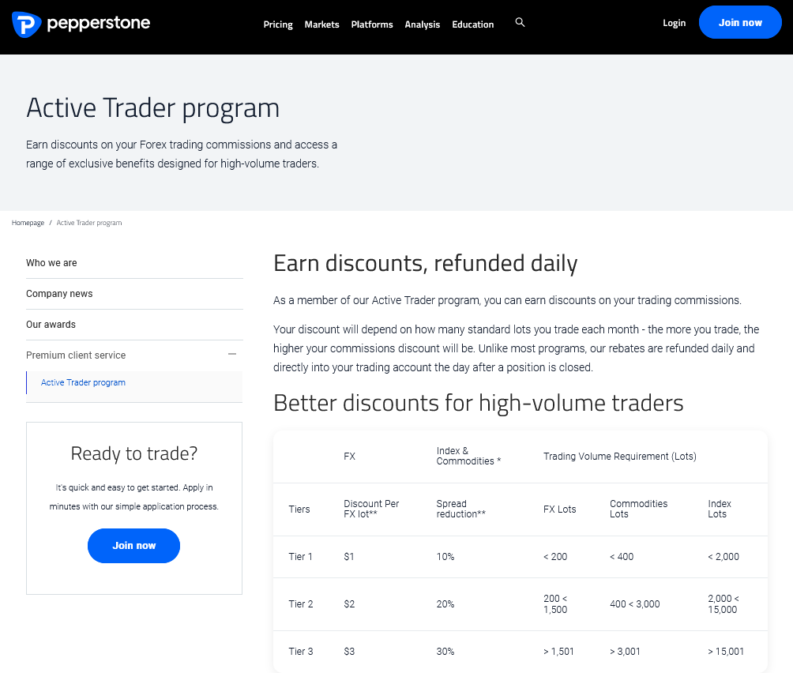

Professional clients can apply to get exclusive features and higher leverage, but they will lose negative balance protection. Professional accounts include access to exclusive events, a relationship manager, access to the Active Trader program, credit facilities, and leverage of up to 1:200 for indices with up to 1:500 for forex.

Those who qualify for the Active Trader program receive rebates for forex trades completed on Razor accounts, with the rebates depending on the volume of trades completed.

Additionally, you can review Pepperstone yourself without any commitment via a demo account.

Platforms

Overall, we would view the offering of tradeable products from Pepperstone as fairly narrow, given the status of the broker. The Forex offering is robust and in line with market leaders, with the added bonus of three currency indices; the US Dollar Index as offered elsewhere but a bonus with a Euro Index and Japanese Yen Index.

The stock indices and commodity offerings are also in line with the industry standard, as we outline above in the CFD section. Though there are extra offerings of the “thematic” indices, which include various stock sector indices, the VIX volatility index, plus three cryptocurrency indices.

The individual share CFD offering is of 600+ share CFDs and only from US markets.

Pepperstone offers 20 cryptocurrency CFDs (plus those three cryptocurrency indices).

So, a mixed offering on the whole, with some bright points amongst a broadly average presentation of tradeable products.

| Product offering | Pepperstone |

| How many Forex Pairs offered | 60+ |

| How many Stock Indices offered | 20+ |

| How many Individual stocks offered | 1000+ |

| How many Bonds offered | 0 |

| How many Commodities offered | 17+ |

| How many Crypto pairs offered | 20+ |

Fees/Commissions

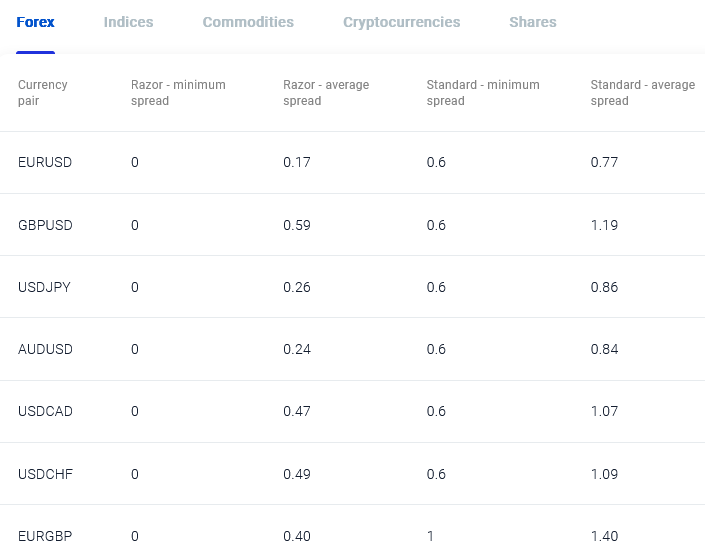

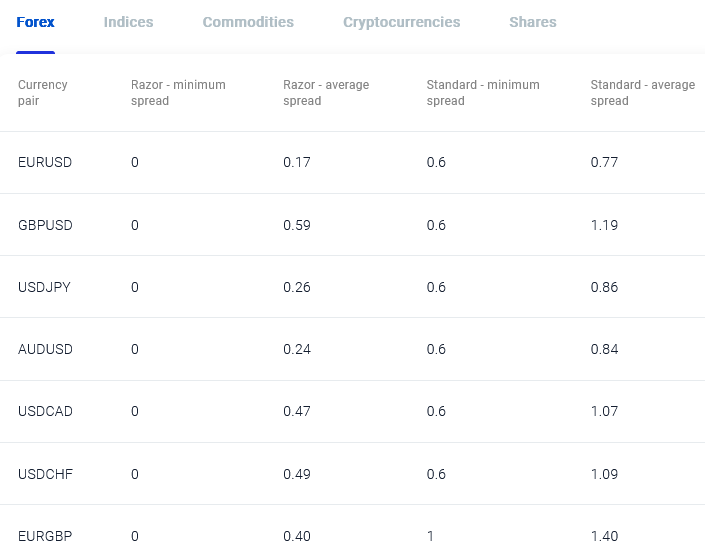

Unlike the majority of brokers today, Pepperstone has two pricing models, which include commissions and the spread, the difference between the bid and ask prices. Pepperstone prides itself on offering competitive pricing and low spreads due to deep liquidity. We will look at the spreads available on the different account options below, but these spreads are variable, as Pepperstone reviews prices from multiple sources and providers to offer competitive rates to traders.

There are two main choices when opening an account with Pepperstone, the Standard Account and Razor Account.

Standard accounts do not have particularly narrow spreads, for example an average spread for EUR/USD of 0.7 to 0.8 pips. This account type has no commission.

Razor accounts, however, have far narrower spreads, with an average EUR/USD spread of between 0.0 and 0.17 pips. This type of account would be ideal for algorithmic traders and scalpers, and it is designed it for these types of accounts in mind. Commissions start at GBP £4.50 round turns for every 100,000 traded (1 lot).

Also, those who qualify for the Active Trader program receive rebates for trades completed on Razor accounts, with the rebates dependent on the volume of trades completed.

The minimum balance to open an account is $200 ot the equivalent with base currencies can be GBP, EUR, USD, or CHF. As with most brokers a demo account is available with Pepperstone, but as with other brokers with access for only 30 days.

In addition, professional clients can apply to get exclusive features and higher leverage, but they will lose negative balance protection. Professional accounts include access to exclusive events, a relationship manager, access to the Active Trader program and credit facilities.

| Fees/ Commissions | Pepperstone |

| EUR/USD average spread | 0.77 pips |

| EUR/USD minimum spread | 0.6 pips |

| Minimum account opening deposit | $200 equivalent |

| Withdrawal Fee | $20 equivalent |

| Inactivity Fee | No |

Trading Platform

The first factor to note with respect to reviewing Pepperstone’s trading platforms is that they do not have their own bespoke platform. We will go on to discuss the merits of what they do have on offer from a third party presentive, but we believe that in today’s trading world, top brokers should offer their own trading platform.

That being said, Pepperstone do make cTrader and cAlgo, plus MetaTrader 4 and MetaTrader 5 (desktop and web based) available to their clients, with various add on functionality. The Razor and Standard accounts can be used with any of these platforms.

You can also gain access to TradingView’s advanced charting tools by means of a Pepperstone Razor account.

The cTrader trading platform offers an intuitive design that appeals to beginning traders and experts alike. You can also use advanced features of Trader Automate lets you back test and optimise trading strategies, by building automated trading robots and custom indicators.

MetaTrader 4 and MetaTrader 5 are probably the most popular trading platforms in the world. Pepperstone offers Smart Trader Tools for these platforms, which includes access to 28 expert advisors (EAs) and indicators. You can also create your own EAs (with MQL4). Autochartist an automated technical analysis plug in is also available for identifying potential trades.

On the copy trading side, as we have highlighted above Pepperstone offers numerous copy and social trading options on the MetaTrader trading platforms.

Although, Pepperstone do not offer their own trading platform, the ability to use MT4, MT5, TradingView or cTrader, plus the wealth on add ins available via Pepperstone on these platforms makes for a solid platform offering.

| Platform feature | Pepperstone |

| Own platform | No |

| Demo account offered | Yes |

| MT4 | Yes |

| MT5 | Yes |

| TradingView | Yes |

| cTrader | Yes |

| Chart Indicators | 53 |

| Chart drawing tools | 33 |

Mobile Offering

There are multiple options for mobile trading at Pepperstone. As with the trading platform, traders with Pepperstone can choose from the MetaTrader 4 (MT4), MetaTrader 5 (MT5) or cTrader mobile apps. Again, as with the trading platform the breadth of apps on offer is a positive, but once more as with the trading platform we would prefer to see Pepperstone offering their own mobile trading app.

| Mobile feature | Pepperstone |

| Own Apple app | Yes |

| Own Android app | Yes |

| Third party app (MT4/MT5/other) | Yes |

Education

At the time of writing Pepperstone has 24 broad “trading guides” on their site, which are organized by experience level; beginner, intermediate and advanced. In addition, there are further articles specifically on Forex and CFD education, a decent number of which also include videos. The video education is also available on the Pepperstone You Tube channel and is of good quality, above the average for the industry.

Despite this solid education offering, Pepperstone still falls somewhat behind the leading education provided by competitor brokers at the upper end of educational providers.

| Education feature | Pepperstone |

| Webinars | Yes |

| Videos | Yes |

| Community Forums | No |

| Education Organized by Experience Level | Yes |

| Education Organized by Topic | Yes |

| Education Organized by Type | Yes |

| Has Education – Forex | Yes |

| Has Education – Stock Indices | Yes |

| Has Education – Individual Stocks | Yes |

| Has Education – Bonds | No |

| Has Education – Commodities | Yes |

| Has Education – Crypto | Yes |

| Investor Dictionary/ Glossary | No |

Research

The in-house research and commentary from Pepperstone is of good quality and covers a wide range of approaches. This would include macroeconomic / fundamental views, technical analysis, plus strategy and risk management guidance. Content includes the “Chart of the Day” and “Daily Fix”, which are all extremely useful for traders across a range of abilities. However, we would state that there are only a few articles and videos per week, averaging less than one a day. In order to truly compete with the leaders in the retail/ professional broking industry, Pepperstone would need to produce more research content.

As we looked at in the platform section above, Pepperstone do offer a wide variety of third-party research tools. These include copy/social trading platforms and options, the numerous expert advisors (EAs) and indicators on MT4/ MT5, plus the AutoChartist technical analysis tool.

| Research feature | Pepperstone |

| Research Organized by Experience Level | Yes |

| Research Organized by Topic | Yes |

| Research Organized by Type | No |

| Has Research – Forex | Yes |

| Has Research – Stock Indices | Yes |

| Has Research – Individual Stocks | Yes |

| Has Research – Bonds | No |

| Has Research – Commodities | Yes |

| Has Research – Crypto | Yes |

Customer Support

Pepperstone is as an award-winning broker for customer service, which is reinforced by various support features. There are a number of trading and support resources to take advantage of, including: 24/5 multilingual support across live chat, email and phone. A floating live chat button for easy contact, plus personalised support from a dedicated account manager

The support section of the website is helpful and includes a FAQ section where there are answers to the most common questions. However, many brokers do have a more extensive FAQ section than that offered by Pepperstone.

| Customer support | Pepperstone |

| Customer call support Mon-Fri over 8 hours | Yes |

| Customer call support Mon-Fri 24 hours | Yes |

| Customer call support Saturday all day | No |

| Customer call support Saturday part day | Yes |

| Customer call support Sunday all day | No |

| Customer call support Sunday part day | Yes |

| Web Chat | Yes |

Overview

Pepperstone is one of the world’s largest trading brokers and does offer excellent customer service and some great add ins to the wide range of third-party platforms that are on offer. However, they do not have their own platform, whilst the number of products that can be traded outside of Forex is somewhat limited. That being said, the Razor account offers competitive spreads, whilst the research and education offering are better than industry standard. So why not give Pepperstone a go?!