NatWest shares (LON: NWG) are moving higher this morning, as the bank delivered a strong performance for the first half of 2025, both exceeding expectations and raising their outlook.

The bank's H1 results, released today, highlight 28% in profit growth, with a raised guide, and a share buyback. The market has responded positively, with Natwest's share price up 1% early.

Chief Executive Paul Thwaite expressed confidence in the bank's trajectory, stating, “NatWest Group's strong performance in the first half of the year reflects our consistent support for our customers and, in turn, delivery for our shareholders.”

This sentiment is backed by upgraded income and returns guidance for 2025, a substantial 9.5p interim dividend, and the announcement of a £750 million share buyback program.

Thwaite emphasized the bank's commitment to its 20 million customers, highlighting increases in lending, deposits, and assets under management. The focus on simplification, enhanced technology, and AI capabilities further positions NatWest for future success in a rapidly evolving financial landscape.

The headline figures, with profit of £2.5 billion, and earnings per share 30.9p both reflecting a 28% growth rate Y/Y.

The bank's Return on Tangible Equity (RoTE) reached an impressive 18.1%, a key indicator of profitability and efficiency.

A key driver of NatWest's growth in H1 2025 was its disciplined approach to capital deployment and strategic acquisitions.

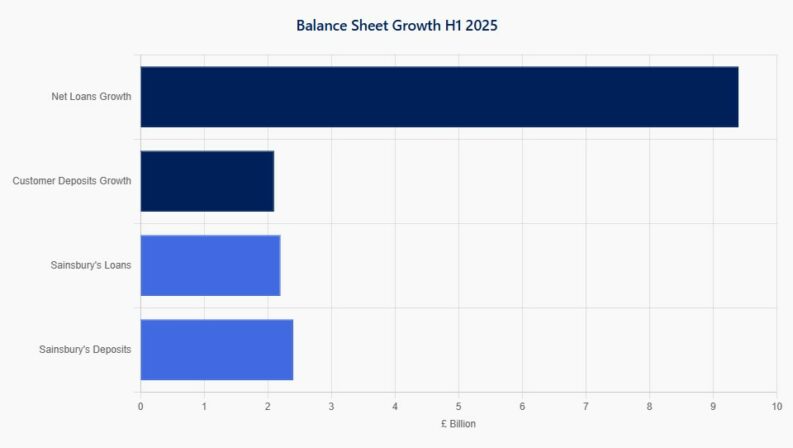

The bank added 1.1 million new customers, a significant portion of which resulted from the successful acquisition of Sainsbury's Bank on May 1, 2025. This transaction added scale to NatWest's unsecured business, with net loans increasing by £11.6 billion, including £2.2 billion from Sainsbury's Bank. Customer deposits also saw a substantial increase of £4.5 billion, including £2.4 billion from the acquired entity.

Beyond acquisitions, NatWest is making significant strides in simplifying its operations and enhancing its digital capabilities. The 6.7 percentage point improvement in the cost-to-income ratio demonstrates the tangible benefits of these efforts. The bank is actively digitizing customer journeys and deploying AI to improve productivity and customer experience, reflected in improved Net Promoter Scores (NPS) across all three business divisions. Notably, NatWest has forged new collaborations with industry giants like OpenAI, AWS, and Accenture to accelerate data simplification and enable greater personalization for customers. This commitment to technological innovation is crucial for maintaining a competitive edge in the long term.

Looking ahead, NatWest has strengthened its guidance for 2025, reflecting confidence in its continued performance.

The bank now expects to achieve a Return on Tangible Equity of greater than 16.5%. Revenue is now guided above £16 billion, with the previous mid-point suggesting ~£15.5billion. Group operating costs, excluding litigation and conduct costs, are projected to be around £8.1 billion.

The successful return to full private ownership in Q2 2025 marks a significant milestone for NatWest, providing greater strategic flexibility and autonomy.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY