Marshalls (LON: MSLH) fell sharply on Wednesday after the company warned of continued pressure on profitability due to softening demand in its key end markets.

At the time of writing, the stock is down almost 19% at 214p, having dropped as low as 197.4p at the open. Marshalls closed Thursday at 264p a share. The stock is down over 30% this year.

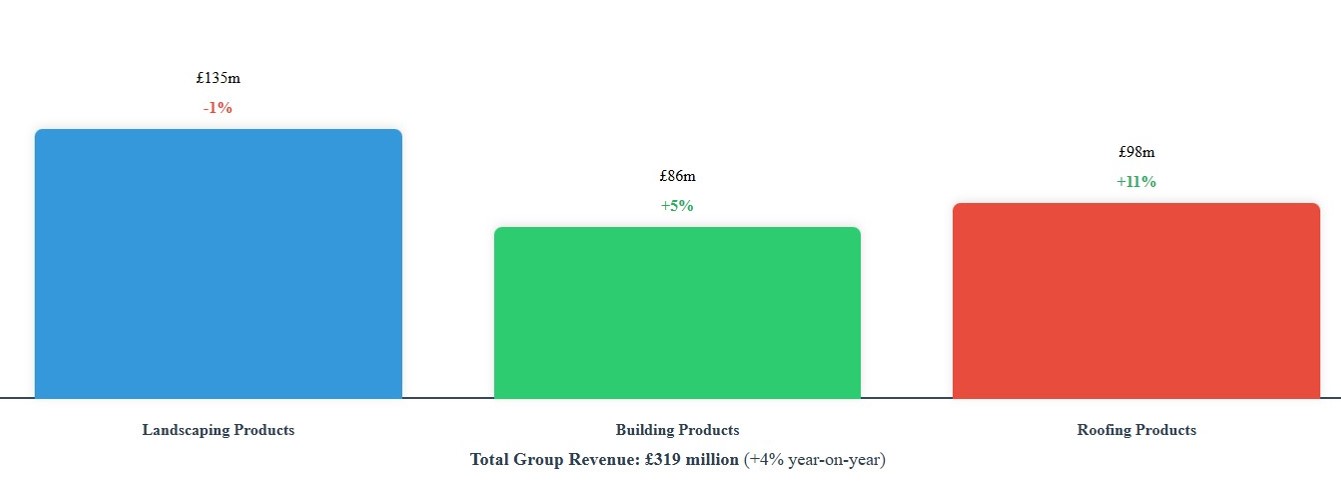

In a trading update for the six months to June 30, the landscaping and building products firm reported revenue of £319 million, up 4% year-on-year.

However, the increase was driven by volume growth and offset by weaker pricing and an unfavourable product mix.

The company said that market conditions deteriorated from the end of May and that it expects no near-term catalyst for improvement in activity levels for the rest of 2025.

Landscaping Products revenue fell 1% to £135 million. While this marked an improvement from a double-digit decline in the second half of 2024,

Marshalls flagged ongoing challenges, including structural overcapacity in the UK supply chain and a shift in demand toward lower-margin products.

Building Products revenue grew 5% to £86 million, while Roofing Products revenue increased by 11% to £98 million, sustaining its recent strong momentum.

“The softening of demand, a weaker product mix and targeted price investment have reduced our Group profit expectations for 2025,” said Chief Executive Matt Pullen.

Adjusted profit before tax is now expected to fall between £42 million and £46 million, down from previous forecasts. Marshalls is accelerating cost-cutting efforts and expects to deliver £9 million in annualised savings by year-end.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY