NatWest shares (LON:NWG) are moving higher today, adding 2% into the afternoon session, with recent earnings results boosting sentiment, and now a raised PT from Morgan Stanley adding further fuel to the fire.

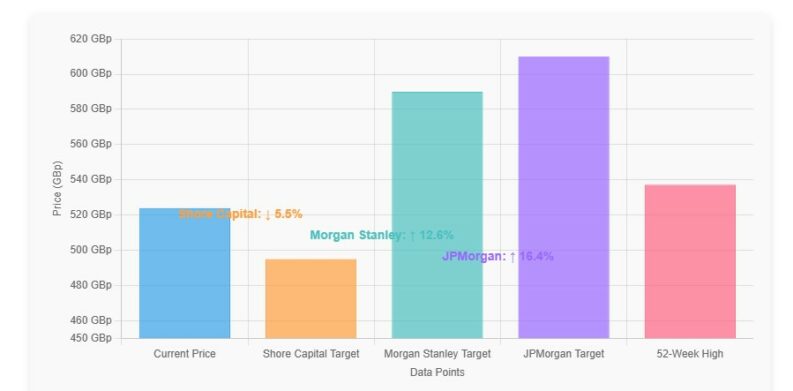

Morgan Stanley raised its price target on NatWest to 590p from 580p, maintaining an “Equal Weight” rating. This suggests that the firm anticipates NatWest's performance to align with the broader market, reflecting measured confidence in its potential for growth, at a level around 12% above where shares change hands today.

NatWest's shares have performed strongly in recent times, with almost all time-frames back to the 5 year (+360%) likely to put holders in the green..

The bank's 50-day moving average stands at 508.97, while the 200-day moving average is 469.89, both below the current price, indicating a positive trend.

JPMorgan Chase & Co. has also expressed confidence in NatWest, raising its target price to 610p with an “Overweight” rating. In contrast, Shore Capital maintains a “Hold” rating with a 495p target, presenting a more conservative view.

In the first half of 2025, NatWest delivered a beat and raise, reporting pre-tax profits of £3.6 billion, an 18% increase year-over-year. This performance exceeded analyst expectations and was fueled by growth in loans and deposits.

The bank subsequently announced a £750 million share buyback program and raised its annual return on tangible equity forecast to 16.5%, up from a previous estimate of up to 16%.

“These results demonstrate our ability to generate sustainable growth and returns for our shareholders,” NatWest during the announcement of the H1 results.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY