ON Semiconductor reports fiscal Q4 2025 results today after market close. The stock has rallied 38.6% over the past 12 months, and 15% since the start of this year, sitting above the $65 level ahead of the print.

The quarter provides a view on whether the company’s automotive and industrial end-markets have stabilized following a year-long inventory digestion, and whether AI data-center power demand can offset persistent weakness in Europe and China.

Consensus sits at $1.53B revenue and $0.62 adjusted EPS, essentially matching the midpoint of management’s prior guide, which eliminates room for an easy beat and shifts investor focus to gross margin execution and forward commentary on utilization rates.

$26.67B

89.3

$0.62

$1.53B

EPS of $0.62 represents a 34.7% decline year-over-year, yet the stock trades at 89.3x trailing earnings and 22.6x forward estimates, a valuation premium that assumes the trough is behind and margin recovery is imminent. The options market prices a 6-8% post-earnings move, above the historical average of 1.0% but below the 4.5% average reaction on prior beats, suggesting investors are positioned for volatility driven by guidance rather than the quarter’s arithmetic.

What matters is not whether ON meets the $0.62 EPS bar, but whether gross margin lands in the upper half of the 37-39% guided range and whether management signals that automotive SiC order patterns are stabilizing. The company beat Q3 estimates by 6.8% on EPS and topped revenue expectations, yet the stock fell 2.8% the next day as investors focused on the lack of margin expansion.

That pattern reinforces the current dynamic: execution alone is insufficient; the stock requires evidence that utilization is improving and that the path back to the company’s 53% long-term gross margin target is credible.

| Metric | Consensus Est. | Range | Prior Guidance | YoY Change |

|---|---|---|---|---|

| EPS (Adjusted) | $0.62 | $0.58 – $0.69 | $0.57 – $0.67 | -34.7% |

| Revenue | $1.53B | $1.51B – $1.53B | $1.48B – $1.58B | -11.0% |

| Gross Margin | 38.0% | 37.0% – 39.0% | 37.0% – 39.0% | -450 bps |

Analysts Covering: 30

Estimate Revisions (30d): 13 up / 0 down

Consensus expectations cluster tightly around management’s November guidance midpoint, with the LSEG mean of $0.62 EPS and $1.53B revenue sitting at the center of the $0.57-$0.67 EPS range and $1.48B-$1.58B revenue range. This alignment removes the buffer that typically allows for modest beats; a result at the guided midpoint will be interpreted as in-line rather than a positive surprise. The 30-day revision pattern shows 13 upward EPS adjustments with zero downward moves, but the magnitude of those revisions has been small, reflecting analyst caution rather than enthusiasm.

The gross margin estimate of 38.0% sits at the midpoint of the 37-39% guided range, a critical metric given the company’s long-term target of 53%. Every 50 basis points of margin outperformance translates to roughly $0.02 in EPS, meaning a print at 38.5% or higher would materially improve the earnings quality even if revenue lands in-line. The year-over-year margin compression of 450 basis points reflects flat capacity utilization as automotive demand digested inventory, and the path back to mid-40s margins depends on whether management can articulate improving factory loading in the first half of 2026.

Management Guidance and Commentary

“We are seeing stabilization in our core segments, automotive and industrial, following sequential growth of 7% in automotive revenues and 5% in industrial revenues in the third quarter of 2025.”

Management’s November guidance framed Q4 as a continuation of stabilization rather than a snapback, with revenue midpoint of $1.53B representing flat sequential growth and gross margin midpoint of 38% indicating no material improvement in factory utilization. The tone emphasized cautious customer behavior and ongoing inventory digestion in Europe and China, two regions that account for a significant portion of automotive silicon carbide demand. The company’s commentary on AI data-center power was more constructive, noting that the segment had reached material scale and would continue to contribute meaningfully to revenue mix.

The gap between guidance and consensus is minimal, with consensus EPS of $0.62 sitting 5 cents above the midpoint of the $0.57-$0.67 range. This tight alignment creates a scenario where the guidance range itself becomes the de facto bar; a result below $0.60 would be interpreted as a miss even if it falls within the guided range, while a result above $0.64 would be required to generate positive momentum.

Analyst Price Targets & Ratings

Wall Street sentiment remains cautious, with 50% of analysts rating shares a Hold and only 43% maintaining Buy or Strong Buy ratings. The consensus target of $63.50 implies 3% downside from current levels, reflecting uncertainty about the timing of margin recovery and automotive demand stabilization.

Sector & Peer Comparison

| Company | Ticker | Market Cap | P/E | Fwd P/E | Profit Margin |

|---|---|---|---|---|---|

|

ON Semiconductor Corporation

⭐ Focus |

ON | $26.7B | 89.3 | 22.6 | 5.2% |

|

NVIDIA Corporation

|

NVDA | $4,514.2B | 45.9 | 24.1 | 53.0% |

|

Taiwan Semiconductor Manufacturing

|

TSM | $1,809.3B | 33.3 | 25.3 | 45.1% |

|

Advanced Micro Devices Inc

|

AMD | $339.8B | 79.9 | 31.2 | 12.5% |

|

Intel Corporation

|

INTC | $252.7B | N/A | 105.3 | -0.5% |

|

Qualcomm Incorporated

|

QCOM | $146.7B | 27.7 | 11.8 | 12.0% |

ON Semiconductor trades at a forward P/E of 22.6x, a premium to Qualcomm (11.8x) and in-line with NVIDIA (24.1x) and Taiwan Semiconductor (25.3x), despite materially lower profit margins and negative earnings growth. The company’s 5.2% profit margin sits well below semiconductor industry leaders, reflecting the cyclical nature of its automotive and industrial exposure and the margin pressure from underutilized manufacturing capacity.

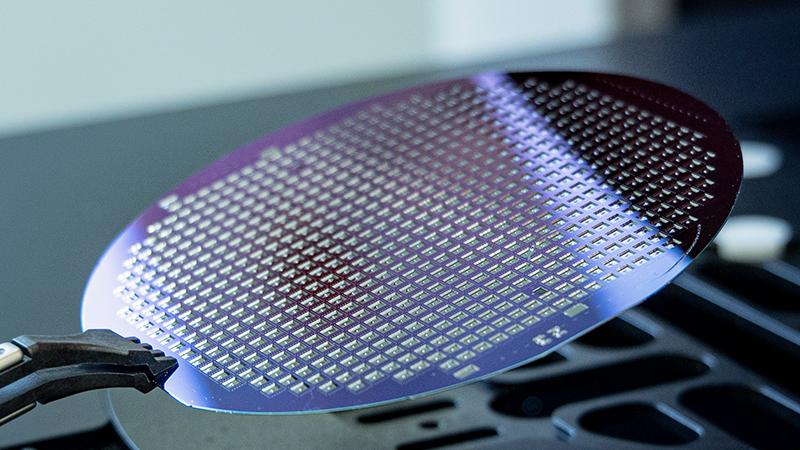

Silicon carbide wafer technology drives automotive power efficiency and performance

Earnings Track Record

| Quarter | EPS Actual | EPS Est. | Result | Surprise % |

|---|---|---|---|---|

| Q3 2025 | $0.63 | $0.59 | Beat | +6.8% |

| Q2 2025 | $0.53 | $0.53 | Met | 0.0% |

| Q1 2025 | $0.55 | $0.50 | Beat | +10.0% |

| Q4 2024 | $0.95 | $0.97 | Miss | -2.1% |

| Q3 2024 | $0.99 | $0.97 | Beat | +2.1% |

| Q2 2024 | $0.96 | $0.92 | Beat | +4.3% |

ON Semiconductor has beaten EPS estimates in 16 of the last 20 quarters, an 80% beat rate that establishes a pattern of conservative guidance and modest execution upside. The most recent quarter (Q3 2025) showed a 6.8% EPS beat, with $0.63 actual versus $0.59 estimated, yet the stock fell 2.8% the following day, reinforcing the pattern that guidance and margin commentary drive reactions more than headline beats.

Post-Earnings Price Movement History

| Date | Surprise | EPS vs Est. | Next Day Move | Price Change |

|---|---|---|---|---|

| Q3 2025 | +6.8% | $0.63 vs $0.59 | -2.8% | $49.76 → $48.35 |

| Q2 2025 | 0.0% | $0.53 vs $0.53 | +1.3% | $52.93 → $53.60 |

| Q1 2025 | +10.0% | $0.55 vs $0.50 | -1.8% | $40.94 → $40.20 |

| Q4 2024 | -2.1% | $0.95 vs $0.97 | -2.8% | $63.46 → $61.71 |

The historical price movement data reveals a counterintuitive pattern: ON Semiconductor’s stock has averaged a 3.0% decline on earnings beats and a 0.9% gain on misses over recent quarters. This inverted reaction function reflects investor focus on forward guidance and margin trajectory rather than backward-looking results.

Expected Move & Implied Volatility

45%

62%

38%

The options market prices a 7.0% post-earnings move in either direction, translating to a range of $60.91 to $70.07 based on the current stock price of $65.49. This implied move sits well above the historical average of 1.0% and the median of 2.3%, reflecting the uncertainty around whether Q4 results will demonstrate margin inflection or signal an extended trough.

AI data-center power applications represent fastest-growing segment for ON Semiconductor

Expert Predictions & What to Watch

Key Outlook: Guidance Will Drive the Trade

Key Metrics to Watch

The setup heading into this print centers on whether ON can demonstrate that the automotive inventory digestion is nearing completion and that capacity utilization is beginning to improve. A clean execution on gross margin combined with constructive Q1 guidance could support a modest rally, but the tight consensus alignment with prior guidance leaves little room for error. For investors considering exposure to semiconductor equities, understanding the difference between stocks and shares can help inform portfolio construction decisions.

The company’s position in the automotive semiconductor space makes it particularly sensitive to inventory cycles and capacity utilization metrics. Investors focused on trading vs investing approaches should note that ON’s quarterly volatility often stems from guidance revisions rather than backward-looking results. Those seeking to understand market dynamics should also consider what leverage means in trading, as semiconductor stocks can exhibit amplified moves during earnings periods.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY