- The US-centric, but London listed construction sector operator releases its full-year earnings on Tuesday.

- In a week of significant news announcements UK services firm Ashtead Group Plc is still making itself heard.

- It will, more than most, be impacted by the statement of the Governor of the Bank of England on Thursday.

- The stock has been one of those able to rise from the depths of the coronavirus sell-off. It is tipped by many to continue to outperform but its busy news week is coming during a minor market shake-out.

- Appreciation of the week's news events and the firm's back-story could form an opportunity to buy the dips. This week it is as much about when to buy as what to buy.

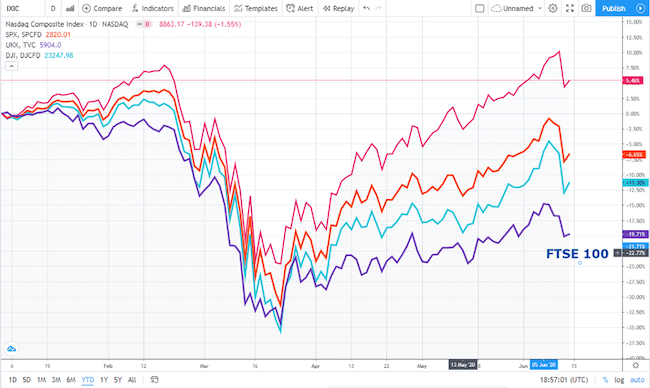

The seemingly never-ending Brexit saga and an economy comprised of firms designed for the pre-COVID rather than post-COVID environment has caused UK equities to underperform their US peers. The chart mapping the performance of the S&P500, Nasdaq, Dow Jones Industrial Average indices against the FTSE100 highlights the UK benchmark is made up of companies that are failing to catch the attention of investors.

It's not just COVID-19 related issues. The year to date chart shows the FTSE 100 since January has spent most of its time in fourth place in that particular race.

Year to date — FTSE 100 vs S&P 5000 vs DJIA vs Nasdaq Composite

Ashtead Group PLC is London listed but US orientated. As a result, the stock offers a different way to play different features of the equity and forex markets. The year to date price chart of the stock against the major UK and US stock indices shows lower lows and higher highs. A tempting prospect for those looking to capitalise on price volatility.

Despite the dramatic swings in the Ashtead share price, its business operations are relatively and literally down to earth. Ashtead is an international equipment rental company with national networks in the US, UK and Canada, trading under the name Sunbelt Rentals. It rents out a full range of construction and industrial equipment, from sump pumps to heavy plant across a wide variety of applications and a diverse customer base.

Year to date — Ashtead Group Plc vs FTSE 100 vs S&P 5000 vs DJIA

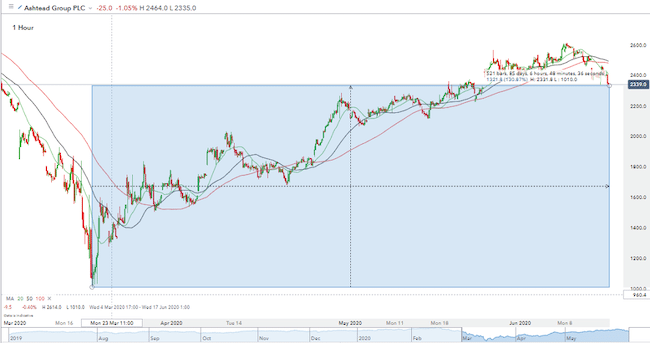

The Ashtead share price has had a fantastic run from the March lows. The firm's day-to-day operations may not be particularly glamorous but the 138% increase in share price from the 19th of March is a handsome return.

Ashtead Group PLC — Hourly candles — 5th March–12th June 2020

The firm is due to share to what extent such investor confidence is justified when it reveals its full-year earnings to the market on Tuesday.

From a fundamentals point of view, the Ashtead share price has benefited from the group's strategy of developing its business in North America. Operating under the trading name ‘Sunbelt Group' the firm holds the position as the fourth largest equipment rental company in the US. Guidance has to date suggested that US rental revenues are expected to fall by 15% year-on-year. That is less than some had feared and less than other firms in other sectors.

Any downturn in the construction industry, in the UK or the US, may well be counterbalanced by government spending to support the sector. Whether it's plans to build bridges or houses — construction spending is a particularly easy and popular lever for politicians to pull.

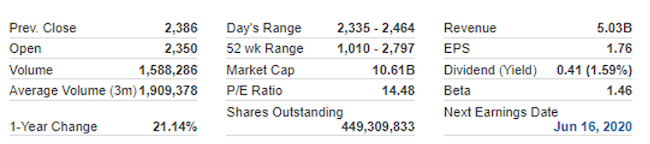

Ashtead Group Plc — Fundamentals

In the build-up to the earnings announcement analyst forecasts of final dividend currently sit at the 35.8p level. That is a number to watch out for when the firm releases its notes on Tuesday. Dividend yields are becoming harder for big institutional investors to find in 2020 and any number higher than that would bring the firm onto the radar of large investment funds. The company may reconfirm that previous plans for share buy-backs and merger activity have already been scaled back, but that news has already been shared, so it is mostly priced in.

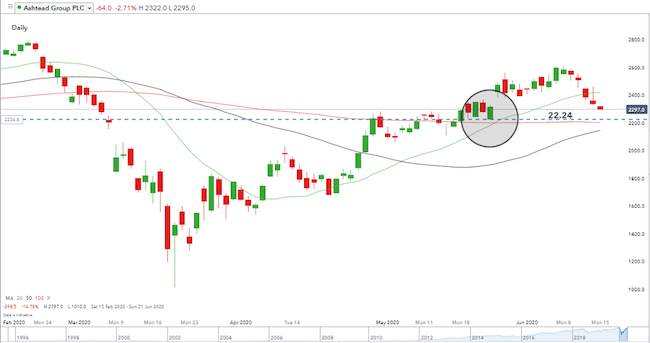

The technical analysis of the Ashtead share price suggests the time to buy could be approaching.

General market weakness through to the end of last week has continued into the current one. In line with the broad market sell-off, the Ashtead share price has dropped to touch its long-term price trend support level.

Ashtead Group PLC ± Hourly candles — 5th March–12th June 2020

The breach through to the downside could suggest weakness. Or the triggering of stop losses on positions held during the firm's stellar rise to £23.39. There's never anything wrong with banking some profits and those who bought in March may want to crystallise their gains. However, there are reasons to see this as an opportunity to buy a dip.

Any bounce off the trend support line could see upward momentum build. The Ashtead share price recently peaked at £26.14. A break of that resistance level leaves head-room for the price to move up to test the yearly highs of £27.97. Should the Ashtead share price get back to break even for the year it would equate to a 20.5% return from Monday's opening price.

With risk management in mind, a break of the £22.28 support level would denote price forming a ‘lower-low' bearish price pattern. It's never great to take a loss, but given the uncertainty in the general market, it is at least reassuring to have a logical stop-loss level to hand.

Ashtead Group PLC — Daily candles — 17th February–15th June 2020

A busy week ahead

Those monitoring the Ashtead share price and looking for a trade entry point will be braced for the earnings announcement on Tuesday. It won't be the only opportunity to rely on news events to open up the door to a trading position.

The week ahead is a busy one in terms of big UK data releases. Smarter investors realise such data offers an insight into the past rather than the future, but that still doesn't mean terrible coronavirus-related figures won't hurt or move share prices.

UK unemployment numbers are due on Tuesday and retail sales figures on Friday. Given that the central banks drove the recovery from the March lows, it is the update from the Bank of England, due on Thursday, that is likely to attract the most attention.

Central banks across the globe have taken it in turns to announce further expansion of their quantitative easing (QE) programs. Any deviation from this ‘follow my leader' approach would be a significant surprise. Analyst expectations are that the BoE will hold interest rates at current levels while announcing a further £100bn of QE.

That QE extension would allow the BoE to continue buying bonds at its current rate until August. That being the month when the Bank next meets to discuss policy. The possibility of it announcing further QE at that meeting means the UKs QE program is currently open-ended. With that money accruing zero returns in cash accounts and driving down bond yields, that liquidity needs to find a home. At the moment, the popular destination is the equity markets. As William Schomberg of Reuters wrote:

“The BoE is amassing gilts faster than the government is selling them in order to prevent the debt flood from pushing up borrowing costs.”

Source: Reuters

Any actions in terms of QE or other guidance given by the BoE would likely spur on the UK equity markets. With bonds also offering sluggish returns the phrase doing the rounds in the market and explaining the surge into equities is ‘Tina' — ‘There Is No Alternative'.

That assertion is hard to argue with, which means that the announcements could generate price volatility that translates as opportunities to buy any dips or to catch breakouts to the upside.

Factoring in forex

The Bank of England interest rate announcement due to be released that day is likely to jolt the forex markets into action; a crucial feature for Ashtead valuations.

The exposure to North America puts the firm very firmly in the group of UK listed stocks that generate profits in foreign currencies. The US operations account for 85% of the group's total revenue. Its Canadian network chips in 4%, leaving the UK operations accounting for 11% of the total.

Any devaluation of GBP in relation to USD or CAD will in accounting terms see profits from North America magnified by the forex move.

One trigger of such a move is the Bank of England announcement. It's unlikely the Governor will do anything to cause a ‘run on the pound', but he is in a difficult situation and could at least take some froth off the pound's recent rally. The proposed additional QE spending will ultimately need to be paid back at some point and uncertainty about plans for doing so could weaken sterling.

Some might question the recent strength of sterling. In reality, it has been more about dollar weakness rather than UK strength but a shift towards a weaker pound could have already started.

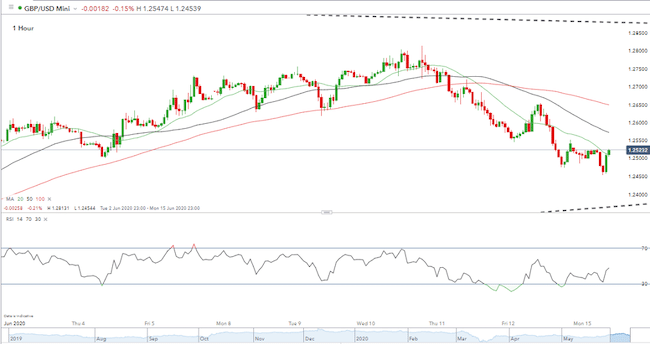

GBPUSD — 3rd June–15th June 2020

The hourly GBPUSD chart shows what little sterling strength is coming from the overselling easing off. The times when the RSI breaching 30 is being followed by a retracement rally but is failing to break out of the downward trend.

Brexit

There are other ways that the week's news could trigger an increase in the Ashtead share price. The earnings announcement and BoE meeting are diarised, but Brexit still casts a very long shadow over the economy. The news from UK/EU negotiations is much more ad hoc in nature. Brexit has ‘happened’, but the new trade agreement between the two trading blocs has most definitely not.

The UK and EU may disagree on the strength of each other's hand of cards, but mismanaging a simple trade-off between the two may not be the most significant risk facing the UK and the pound.

Harry Broadman, a former US trade negotiator and managing director at Berkeley Research Group, was speaking with Politico when he raised the prospect of a ‘trade triangle. One where the US and EU share notes and take turns to pick away at the UK. He said:

“It's hard to see at the aggregate level how London can use any substantial cross-sectoral agreement it might strike with Washington to tame Brussels. The probability of it striking a deal with Washington is frankly low in the first place.

“If anything, if I were a trade negotiator working on behalf of the UK my biggest fear is the EU and US would play off the UK between them.”

Source: Politico

Such an outcome would signal trouble for sterling and the UK economy but relative strength for the US and firms with exposure to that market such as Ashtead.

Buy the dips?

Even in a news-heavy week, the Ashtead full-year earnings announcement on Tuesday looks worth considering. It's not easy buying dips. Classic advice suggests scaling into a position can help traders avoid getting their fingers burnt. At the same time, a full-strength sell-off can be devastating for P&L.

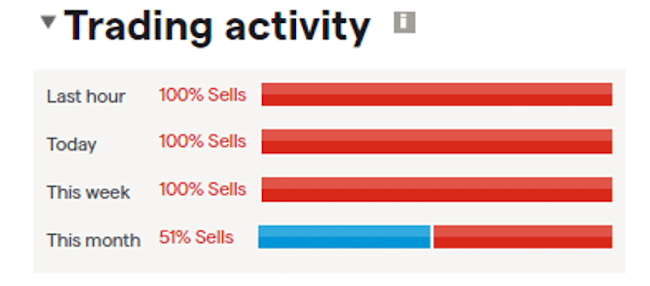

A glance at the IG sentiment indicator shows that in the first hours trading on Monday IG clients were bailing out of positions and possibly taking naked shorts.

IG Sentiment indicator — Ashtead Group PLC

The COVID-crisis means there will be times when things look very bearish for the Ashtead share price and the broader market. Those aware that ‘Tina' is still in the room and with an appreciation of upcoming events may want to keep Ashtead and its Northern American exposure in mind. A little preparation can turn market noise into a profit.