BHP's shares (LON:BHP) are holding firm at 2,000p on the London Stock Exchange, edging 0.6% higher on the day. This upside move comes despite the world's largest mining company seeing JPMorgan analyst Dominic O'Kane lower the firm's price target on the stock to 2,130p from 2,260p, maintaining a Neutral rating.

This adjustment reflects a complex interplay of record production in key commodities, setbacks in major projects like the Jansen potash mine, and strategic shifts towards sustainable practices.

O'Kane's revised price target, while still above the current market price, signals a tempered outlook for BHP. The adjustment comes in the wake of BHP's announcement of a delay and substantial cost overrun at its Jansen potash project in Canada.

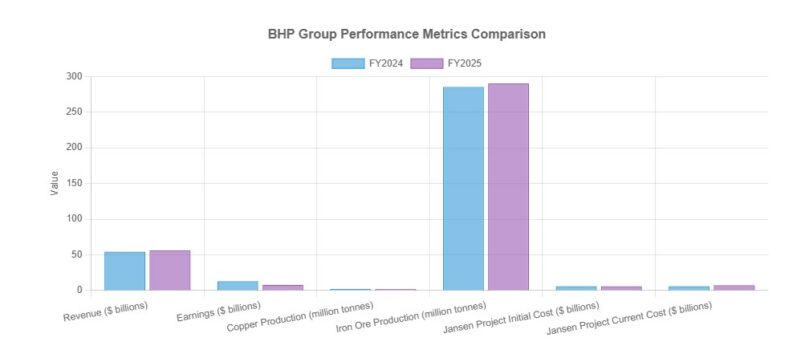

The first-stage expenditure for the project is now projected to range between $7.0 billion and $7.4 billion, a significant increase from the initial estimate of $5.7 billion. This surge in costs is attributed to a confluence of factors, including higher input costs, design modifications, and reduced productivity.

Consequently, the initial production timeline has been pushed back to mid-2027, and the company is contemplating extending the second-stage output target by two years to fiscal 2031, citing potential additional potash supply in the medium term.

However, the picture isn't entirely bleak. BHP reported record production levels in key commodities, demonstrating the strength of its diversified portfolio

BHP reported record annual copper production of 2.02 million metric tonnes for fiscal 2025, hitting the upper end of its guidance range. Iron ore output also reached an all-time high of 290 million tonnes, buoyed by a robust final quarter. For fiscal 2026, the company guides for lower copper output between 1.8–2.0 million tonnes, citing declining ore grades at the Escondida mine in Chile.

The major headwind for BHP comes from its Jansen potash project in Canada. The company announced a cost increase of up to $1.7 billion, raising total capital expenditure to between $7.0–$7.4 billion. First production is now expected in mid-2027, a delay from the original late-2026 target. Further, the project’s second stage may be delayed by two years to a 2031 completion.

This setback is a blow to CEO Mike Henry’s aim to diversify BHP beyond coal and iron ore. Potash is intended to expand the group’s exposure to agricultural commodities, which are seen as more sustainable than traditional mining products.

BHP is also reviewing its Western Australia Nickel assets amid ongoing balance sheet strain. Options reportedly include suspension, restart, or permanent closure—reflecting a possible refocus on core commodities.

“These partnerships aim to explore battery technology and the electrification of mining operations, reflecting BHP's commitment to reducing its carbon footprint and enhancing operational efficiency,” said a company spokesperson regarding its MOUs with CATL and FinDreams Battery Co.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY