BP shares (LON:BP) have moved back above 400p today, up 1.3% at 403.86p, boosted by a significant oil and gas discovery at the Bumerangue prospect in deepwater offshore Brazil.

While the find represents BP's largest discovery in 25 years, the market's muted reaction reflects the downward pressure on oil prices, with benchmark WTI, and Brent down more than 1.5% today.

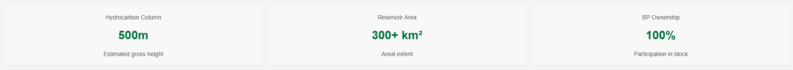

The Bumerangue well, designated 1-BP-13-SPS, was drilled in the Santos Basin, approximately 404 kilometers off the coast of Rio de Janeiro, reaching a total depth of 5,855 meters in 2,372 meters of water. The well intersected a 500-meter gross hydrocarbon column within a high-quality pre-salt carbonate reservoir spanning over 300 square kilometers.

Rig-site analysis has indicated elevated levels of carbon dioxide, necessitating further laboratory analysis to fully characterize the reservoir and fluids. BP secured 100% participation in the block under favorable commercial terms in December 2022. Subsequent appraisal activities are planned, pending regulatory approval.

According to Gordon Birrell, BP's executive vice president for Production & Operations, this discovery underscores BP's commitment to upstream growth and its ambition to create a substantial production hub in Brazil. “We are excited to announce this significant discovery at Bumerangue, BP's largest in 25 years,” Birrell stated, highlighting the importance of Brazil within BP's global strategy.

BP aims to increase its global upstream production to 2.3-2.5 million barrels of oil equivalent per day by 2030, with potential for further increases to 2035. The Bumerangue discovery aligns with these goals, providing a potentially significant boost to BP's production capacity.

The company also has a long-standing presence in Brazil, spanning over 50 years, with interests in eight offshore blocks across three basins, operating four of them. An appraisal well for the Alto de Cabo Frio Central discovery, in which BP holds a 50% interest alongside Petrobras, has recently commenced drilling. Additionally, an exploration well is planned for the Tupinambá block in 2026.

Whilst today's announcement is undeniably a positive, the underlying sentiment in markets due to oil price pressures, and the OPEC+ increased output is applying downward pressure on the sector. Whilst peers such as Shell are trading negative on the day, down 0.7%, the upwards move at BP on the news has helped drive sector outperformance.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY