Dotdigital shares (LON:DOTD) have moved 3.5% higher this morning, as the company released its trading update for the year ended June 30, 2025, with a period of steady growth under it's belt.

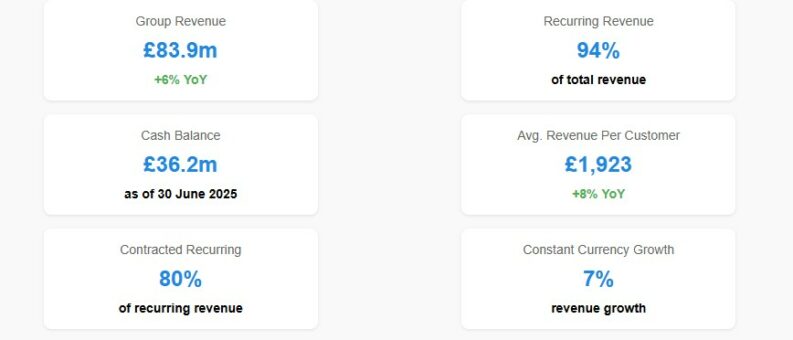

The company reported group revenue of £83.9 million, a 6% increase year-over-year on an actual currency basis and 7% on a constant currency basis. This performance underscores Dotdigital's resilience in navigating what CEO Milan Patel describes as “uncertain market conditions.”

The update highlights the company's continued focus on recurring revenue streams, a key strength for SaaS businesses, with 94% of revenue classified as recurring or repeating, of which 80% is contractually recurring. The average revenue per customer (ARPC) also saw a healthy increase of 8% on a constant currency and normalized basis, reaching £1,923 per month.

The company's cash balance stood at £36.2 million as of June 30, 2025, reflecting a decrease from £45.7 million at the end of December 2024, primarily due to a $20 million cash payment for the strategic acquisition of Social Snowball.

Despite this expenditure, the company's ability to maintain a substantial cash reserve demonstrates its strong cash-generating capabilities.

Furthermore, Dotdigital intends to increase its final dividend, subject to board approval, signaling confidence in its financial performance and commitment to shareholder returns.

The acquisition of Social Snowball, a US-based influencer marketing platform, represents a significant strategic move for Dotdigital. This acquisition is expected to substantially increase the company's presence in the crucial North American market, enhance its cross-channel marketing automation capabilities, and provide access to the rapidly growing influencer marketing segment.

The $35 million acquisition, funded through cash reserves and the issuance of new ordinary shares, reflects the company's efforts to expand its product offerings and market reach, and could provide further upside in periods to come.

While the trading update paints a positive picture, the stock's recent performance has been somewhat volatile. Dotdigital's shares have pulled back 12.5% since the start of the year, with last week's break below 70p support seeing a ~25% drawdown from the high in May. A break from the recent pullback will be welcome news to bulls.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY