GSK shares (LON:GSK) re-gained ground this week, adding 3.15% on the week, following the European Commission's approval of Blenrep (belantamab mafodotin) for relapsed or refractory multiple myeloma. The approval, however, arrives amid concerns stemming from a negative advisory vote in the United States that had seen the share price fall 5% in the prior week.

Taking a look at the chart of the past 10 trading days below highlights the shift well, with the various regional decisions showing up clearly in sentiment.

The EU approval covers Blenrep in combination with bortezomib plus dexamethasone (BVd) and pomalidomide plus dexamethasone (BPd), offering new treatment options for patients who have received at least one prior therapy. The decision was based on the DREAMM-7 and DREAMM-8 Phase III trials, showing statistically significant progression-free survival improvements compared to standard care. In DREAMM-7, an overall survival benefit versus a daratumumab-based triplet was also observed.

Hesham Abdullah, Senior Vice President, Global Head Oncology, R&D, GSK, hailed the approval as a “redefining moment” for EU patients, emphasizing Blenrep's potential to extend remission and survival, with administration possible in diverse clinical settings.

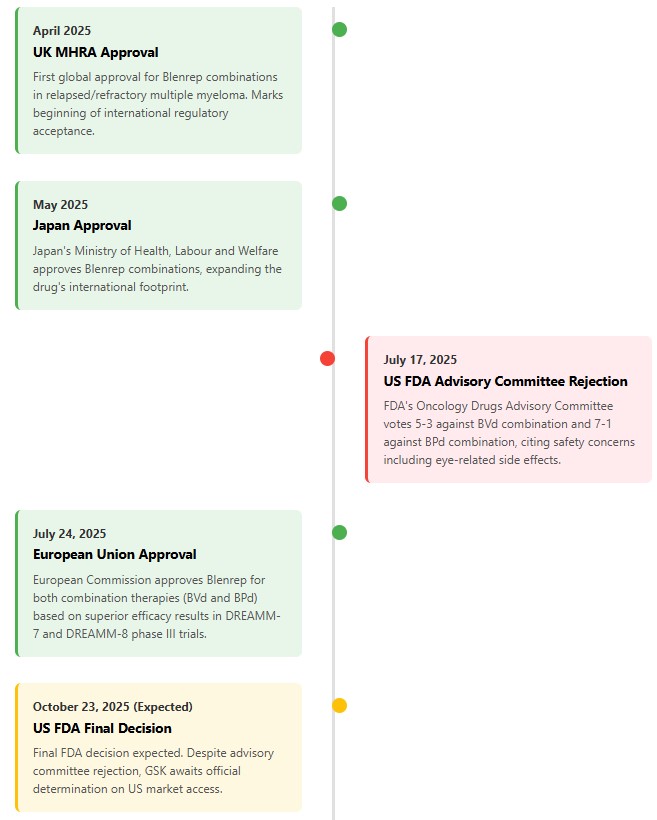

This positive development contrasts sharply with the situation in the US, where the FDA's Oncology Drugs Advisory Committee recently voted against approving Blenrep combinations. Concerns centered on the drug's safety profile, specifically eye-related side effects. The committee voted against its use with bortezomib and dexamethasone (5-3) and pomalidomide and dexamethasone (7-1). The FDA's final decision is due by October 23, 2025.

The US advisory vote triggered a 6% drop in GSK's share price on July 18, reflecting investor apprehension regarding the potential impact on future revenue. Analysts estimate a possible £1 billion hit to GSK's projected 2031 sales of £40 billion if the FDA rejects the drug.

Despite the US setback, Blenrep has secured approvals in other major markets, including the UK (April 2025) and Japan (May 2025). These approvals underscore the drug's potential as a valuable treatment option globally.

GSK is scheduled to report Q2 2025 earnings on July 30, 2025. Analysts anticipate continued revenue growth, particularly in vaccines and oncology, with consensus turnover for vaccines (excluding pandemic solutions) forecast at £11.5 billion for 2025.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- XTB UK regulated by the FCA – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY